NY PT-350-I 2011 free printable template

Show details

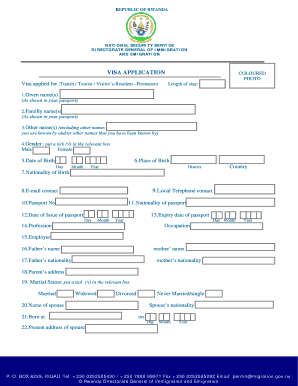

New York State Department of Taxation and Finance Instructions for Form PT-350 PT-350-I 1/13 Petroleum Business Tax Return for Fuel Consumption Commercial Vessels Who must file Operators of commercial vessels tugboats towboats etc. using motor fuel gasoline or diesel motor fuel in their vessels for consumption in New York State NYS territorial waters must file this return as required under Tax Law Article 13-A. Commercial fishermen should not co...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY PT-350-I

Edit your NY PT-350-I form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY PT-350-I form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY PT-350-I online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NY PT-350-I. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY PT-350-I Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY PT-350-I

How to fill out NY PT-350-I

01

Download the NY PT-350-I form from the New York State Department of Taxation and Finance website.

02

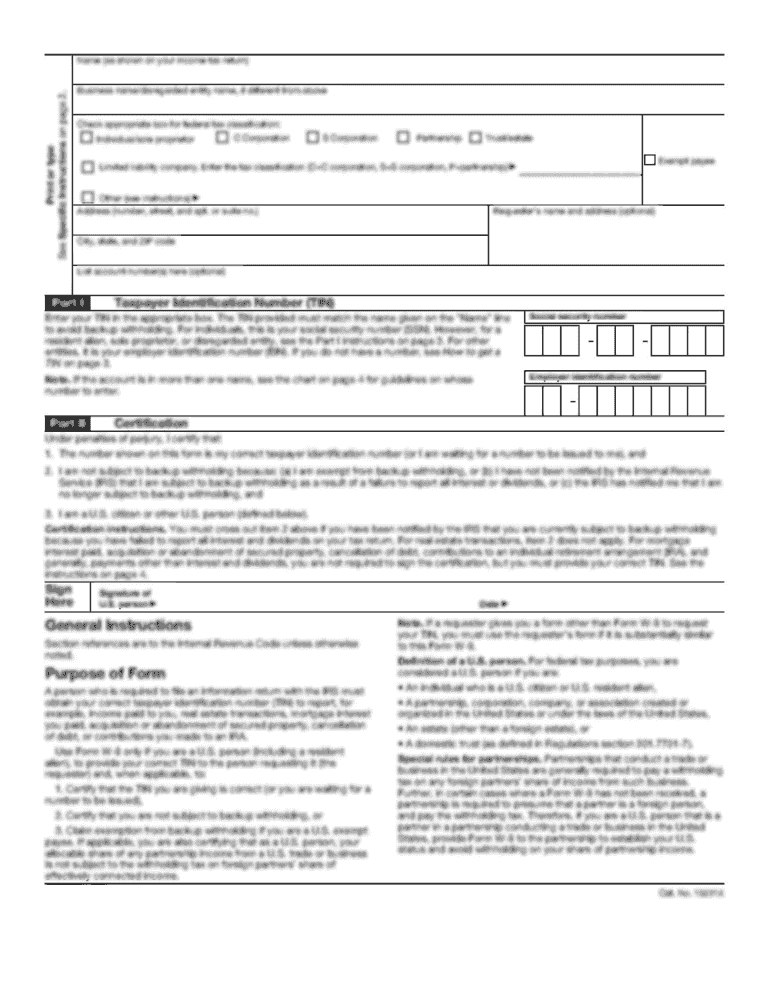

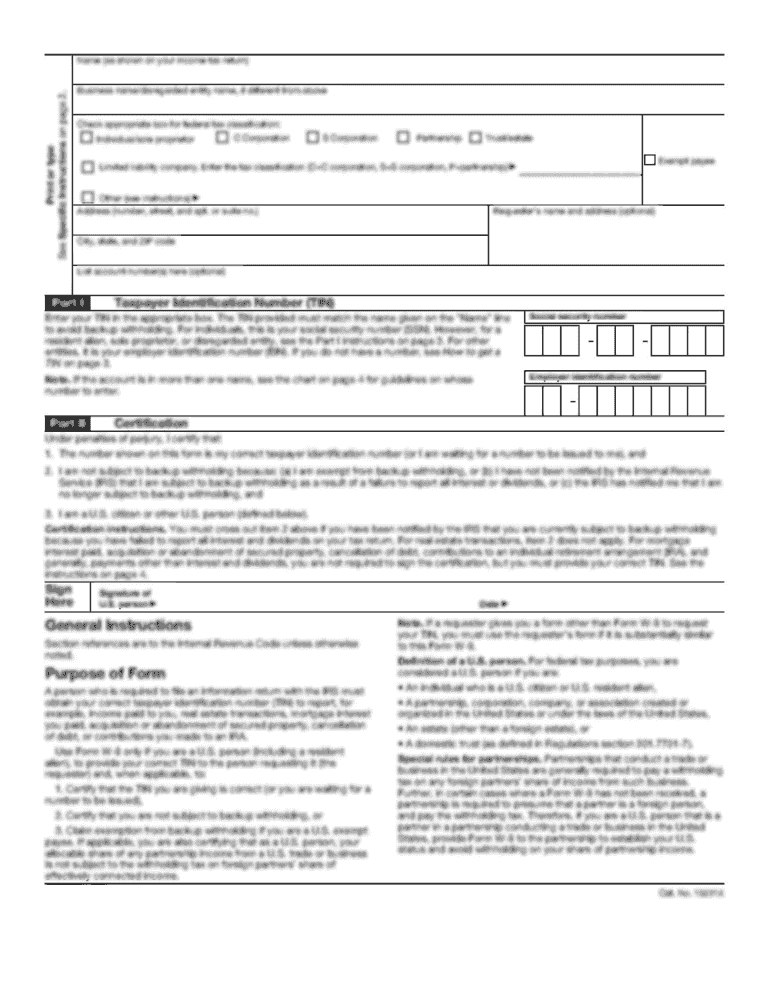

Fill out your personal information in the 'Taxpayer Information' section, including your name, address, and Social Security number.

03

Indicate the tax year you are filing for in the designated area.

04

Provide information about the property in question, including the address and type of property.

05

Include the reason for the claim, specifying any relevant details or circumstances.

06

If applicable, provide supporting documentation to substantiate your claim.

07

Review all information for accuracy.

08

Sign and date the form at the bottom.

09

Submit the completed form to the appropriate local assessor's office as instructed on the form.

Who needs NY PT-350-I?

01

Property owners in New York State who are seeking a tax exemption or reduction for their property taxes may need to fill out NY PT-350-I.

02

Individuals who have experienced significant changes in their property value or circumstances affecting their eligibility for tax exemptions should also consider this form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my NY PT-350-I directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your NY PT-350-I along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send NY PT-350-I for eSignature?

When your NY PT-350-I is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit NY PT-350-I on an iOS device?

You certainly can. You can quickly edit, distribute, and sign NY PT-350-I on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is NY PT-350-I?

NY PT-350-I is a form used in New York State for reporting and calculating the estate tax for estates of decedents who died on or after January 1, 2014.

Who is required to file NY PT-350-I?

The executor or administrator of an estate that is required to file an estate tax return in New York must file the NY PT-350-I if the estate exceeds the filing threshold.

How to fill out NY PT-350-I?

To fill out the NY PT-350-I, you need to provide information about the decedent, the estate, and any taxable gifts as well as calculate the estate tax liability based on the current legislation.

What is the purpose of NY PT-350-I?

The purpose of NY PT-350-I is to report detailed information to the New York State Department of Taxation and Finance for the purpose of calculating and paying the estate tax.

What information must be reported on NY PT-350-I?

The information that must be reported on NY PT-350-I includes details about the decedent, a summary of assets and liabilities of the estate, applicable deductions, taxable gifts, and calculations of the estate tax due.

Fill out your NY PT-350-I online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY PT-350-I is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.