Get the free Foreign Currency Account Terms and Conditions

Show details

This document outlines the terms and conditions related to Westpac's Foreign Currency Accounts, detailing their features, fees, key benefits, associated risks, and operational guidelines for individuals

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign foreign currency account terms

Edit your foreign currency account terms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your foreign currency account terms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

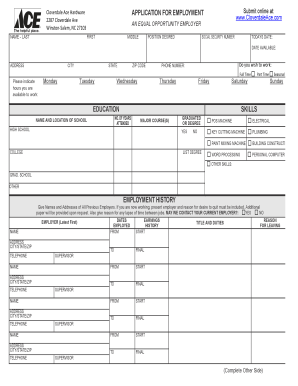

Editing foreign currency account terms online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit foreign currency account terms. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

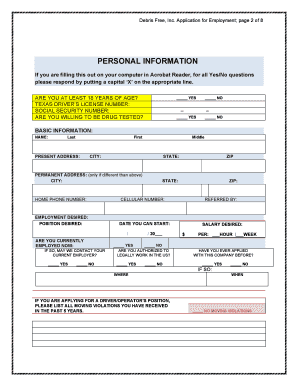

How to fill out foreign currency account terms

How to fill out Foreign Currency Account Terms and Conditions

01

Read the Foreign Currency Account Terms and Conditions document carefully.

02

Identify the section for filling out personal information, such as your name, address, and contact details.

03

Fill in the required details accurately in the designated fields.

04

Review the sections outlining fees, interest rates, and currency options available.

05

Initial next to any important terms that require your acknowledgment.

06

Provide information regarding your financial information as requested.

07

Read and acknowledge any legal disclaimers or agreements included.

08

Review your entire application for accuracy before submission.

09

Submit the completed document to your financial institution as instructed.

Who needs Foreign Currency Account Terms and Conditions?

01

Individuals looking to hold funds in foreign currencies.

02

Businesses engaged in international trade and transactions.

03

Travelers planning to maintain a currency account for ease in foreign spending.

04

Investors seeking to diversify their assets in multiple currencies.

Fill

form

: Try Risk Free

People Also Ask about

What is the ASC for foreign currency?

ASC 830, Foreign Currency Matters summarizes the accounting guidance for transactions denominated in a foreign currency as well as financial reporting requirements for operations occurring outside the primary economic environment of an entity.

How do you account for foreign currency?

When a foreign currency transaction is recorded, it needs to use the exchange rate in effect on the date of the transaction. For example, a U.S. company sells a widget for 100K GBP. To record the sale, the company needs to first record the transaction in GBP.

What is the accounting standard for foreign currency?

IAS 21 The Effects of Changes in Foreign Exchange Rates requires companies to convert foreign transactions into their functional currency and to translate foreign operations into a presentation currency by using spot exchange rates.

How do foreign currency accounts work?

Hold and manage multiple currencies: You can manage several currencies through a single account. It's also possible to send and receive money directly in these currencies. Low currency exchange rates: Multi-currency accounts usually offer a lower conversion rate than standard bank accounts.

Who is eligible for RFC account?

If you are an Indian citizen who has been living abroad and are now returning to India, you may be eligible for an RFC account if you are over the age of 18 and can provide proof of your non-resident status.

What is the accounting treatment for foreign exchange?

Foreign Exchange Accounting covers the accounting of the transactions which are carried by a business in different currencies (Foreign currency) other than functional currency, and records such transactions in the functional currency of the reporting entity, based on the exchange rate in effect on the date of

What is the accounting standard for foreign currency transaction?

IAS 21 — The Effects of Changes in Foreign Exchange Rates. IAS 21 outlines how to account for foreign currency transactions and operations in financial statements, and also how to translate financial statements into a presentation currency.

What are the rules for foreign exchange?

Main regulatory requirements This regulation requires that all deposits be maintained separately from the broker's bank accounts. Reporting and disclosure - These rules insure the broker's clients are well informed of the status of their account and the risks associated with FOREX products.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Foreign Currency Account Terms and Conditions?

Foreign Currency Account Terms and Conditions are the rules and guidelines governing the operation and management of accounts that hold foreign currencies. They outline the rights and responsibilities of account holders and the financial institution.

Who is required to file Foreign Currency Account Terms and Conditions?

Individuals and businesses who wish to open a foreign currency account are typically required to file the Foreign Currency Account Terms and Conditions with the bank or financial institution where they intend to open the account.

How to fill out Foreign Currency Account Terms and Conditions?

To fill out the Foreign Currency Account Terms and Conditions, applicants should provide accurate personal or business information, including identification details, intended use of the account, and any other required documentation as specified by the financial institution.

What is the purpose of Foreign Currency Account Terms and Conditions?

The purpose of the Foreign Currency Account Terms and Conditions is to establish a clear framework for account operations, protect both the account holder and the financial institution, and ensure compliance with legal and regulatory requirements.

What information must be reported on Foreign Currency Account Terms and Conditions?

The information that must be reported typically includes account holder details (name, address, identification), details about the foreign currency transactions, intended use of the account, and any associated fees or charges.

Fill out your foreign currency account terms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Foreign Currency Account Terms is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.