NC IC Form MSC4 2011 free printable template

Show details

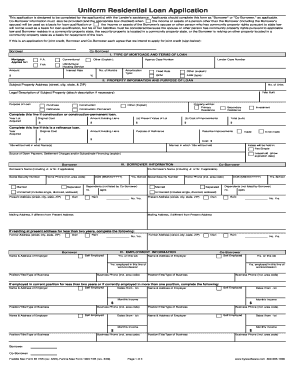

IC Form MSC4 rev. 4/11 NORTH CAROLINA INDUSTRIAL COMMISSION N.C. Industrial Commission Mediation Section I. C. File No s. Carrier No* County 4342 Mail Service Center Raleigh NC 27699-4342 Plaintiff v* DESIGNATION OF MEDIATOR Defendant Carrier Appearances Plaintiff sAttorneyTelephone AddressFax Defendant s AttorneyTelephone THIS FORM IS TO BE COMPLETED BY EITHER THE PLAINTIFF OR THE DEFENDANT WITHIN THE TIME SPECIFIED IN THE COMMISSION S ORDERS AND THE ICMSC RULES* Pursuant to the Order...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NC IC Form MSC4

Edit your NC IC Form MSC4 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NC IC Form MSC4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NC IC Form MSC4 online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NC IC Form MSC4. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC IC Form MSC4 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NC IC Form MSC4

How to fill out NC IC Form MSC4

01

Obtain the NC IC Form MSC4 from the official website or local government office.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal details, including name, address, and contact information.

04

Provide the necessary identification information, such as driver's license number or social security number.

05

Complete the sections related to your qualification and experience.

06

Attach any required supporting documents as specified in the form's instructions.

07

Review the completed form for accuracy and completeness.

08

Submit the form either online or via mail, as per the instructions provided.

Who needs NC IC Form MSC4?

01

Individuals applying for a specific identification card in North Carolina.

02

Residents seeking benefits that require identification verification.

03

Business owners needing to register or verify identity for licensing purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NC IC Form MSC4 from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like NC IC Form MSC4, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit NC IC Form MSC4 in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your NC IC Form MSC4, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit NC IC Form MSC4 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign NC IC Form MSC4 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is NC IC Form MSC4?

NC IC Form MSC4 is a legal form used to report information related to specific interactions with the North Carolina Industrial Commission.

Who is required to file NC IC Form MSC4?

Employers, insurance carriers, and third-party administrators involved in workers' compensation claims in North Carolina are required to file NC IC Form MSC4.

How to fill out NC IC Form MSC4?

To fill out NC IC Form MSC4, individuals need to provide details such as the claimant's information, the nature of the claim, and any relevant dates or descriptions pertinent to the case.

What is the purpose of NC IC Form MSC4?

The purpose of NC IC Form MSC4 is to provide the North Carolina Industrial Commission with necessary data regarding workers' compensation claims, ensuring compliance with state regulations.

What information must be reported on NC IC Form MSC4?

On NC IC Form MSC4, individuals must report information such as the claimant's name, claim number, date of injury, the type of benefits claimed, and any other necessary documentation or details related to the injury.

Fill out your NC IC Form MSC4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NC IC Form msc4 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.