Get the free Credit Card Agreement

Show details

Este documento constitui o acordo completo para sua conta conosco. Ele substitui quaisquer termos anteriores fornecidos a você para sua conta. O uso da sua conta é regido por este acordo, que é

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit card agreement

Edit your credit card agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit card agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit card agreement online

Follow the steps down below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credit card agreement. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

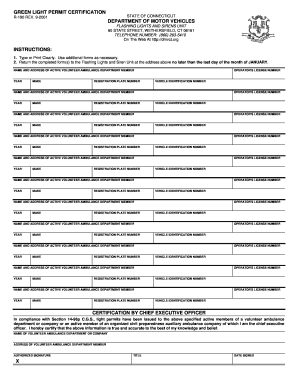

How to fill out credit card agreement

How to fill out Credit Card Agreement

01

Obtain the Credit Card Agreement form from your bank or credit card issuer.

02

Read the terms and conditions outlined in the agreement carefully.

03

Fill in your personal information, such as your name, address, and Social Security number.

04

Provide your financial information, including your income and employment details.

05

Review the interest rates, fees, and rewards programs listed in the agreement.

06

Sign and date the agreement to acknowledge your acceptance of the terms.

07

Submit the completed agreement to your bank or credit card issuer, either online or via mail.

Who needs Credit Card Agreement?

01

Individuals who wish to apply for a credit card to make purchases.

02

Consumers looking to establish or build their credit history.

03

Anyone needing access to short-term financing options.

04

People interested in earning rewards or benefits through credit card use.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a promissory note and an agreement?

Key takeaways A loan agreement is a contract between a borrower and a lender that specifies what each party has agreed to. A promissory note is where one party promises, in writing, to pay a set amount to the other ing to their agreement.

Is a credit card a promissory note?

Some types of loans don't have promissory notes, especially those that don't have a set amount of money to be borrowed or a set monthly payment amount. Credit cards are the main example, as you'll typically have a document known as a cardholder agreement that lists details of the relationship.

Is a credit card agreement a promissory note?

Some types of loans don't have promissory notes, especially those that don't have a set amount of money to be borrowed or a set monthly payment amount. Credit cards are the main example, as you'll typically have a document known as a cardholder agreement that lists details of the relationship.

Is a credit agreement the same as a promissory note?

Unlike a promissory note, a loan agreement imposes obligations on both parties, which is why both the borrower and lender must sign the agreement. A loan agreement should state what purpose the loan is used for, and whether the borrower must provide compensation if the lender suffers loss.

What is written permission to use credit card?

A letter of authorization for credit card use is a digital or physical form permitting businesses to charge a payment method. The document says the cardholder agrees to the merchant's terms for the specified products or services. Customers must sign the credit card authorization form electronically or physically.

Is a credit note a promissory note?

One example of a promissory note is a corporate credit promissory note. For this type of promissory note, a company will typically be seeking a short-term loan.

Where can I get a credit card responsibility agreement?

Under federal law, your credit card issuer is required to provide a copy of your agreement upon request. Look on the back of the credit card or on your latest monthly statement to find the name of the issuer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Credit Card Agreement?

A Credit Card Agreement is a legal document that outlines the terms and conditions between a credit card issuer and the cardholder, including payment obligations, interest rates, fees, and other important information regarding the use of the credit card.

Who is required to file Credit Card Agreement?

Credit card issuers, such as banks and financial institutions, are required to file Credit Card Agreements with the appropriate regulatory bodies to ensure compliance with consumer protection laws and regulations.

How to fill out Credit Card Agreement?

Filling out a Credit Card Agreement typically involves providing personal information such as name, address, Social Security number, income details, and any other required information as stipulated by the credit card issuer.

What is the purpose of Credit Card Agreement?

The purpose of a Credit Card Agreement is to provide transparency and clear communication between the credit card issuer and the cardholder, detailing the rights and responsibilities of both parties and helping to prevent disputes.

What information must be reported on Credit Card Agreement?

Information that must be reported on a Credit Card Agreement includes the cardholder's name and address, credit limit, interest rates, fees, payment due dates, and terms regarding rewards, penalties, and other relevant terms and conditions.

Fill out your credit card agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Card Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.