Get the free Overpayment Adjustment Form - ohsu

Show details

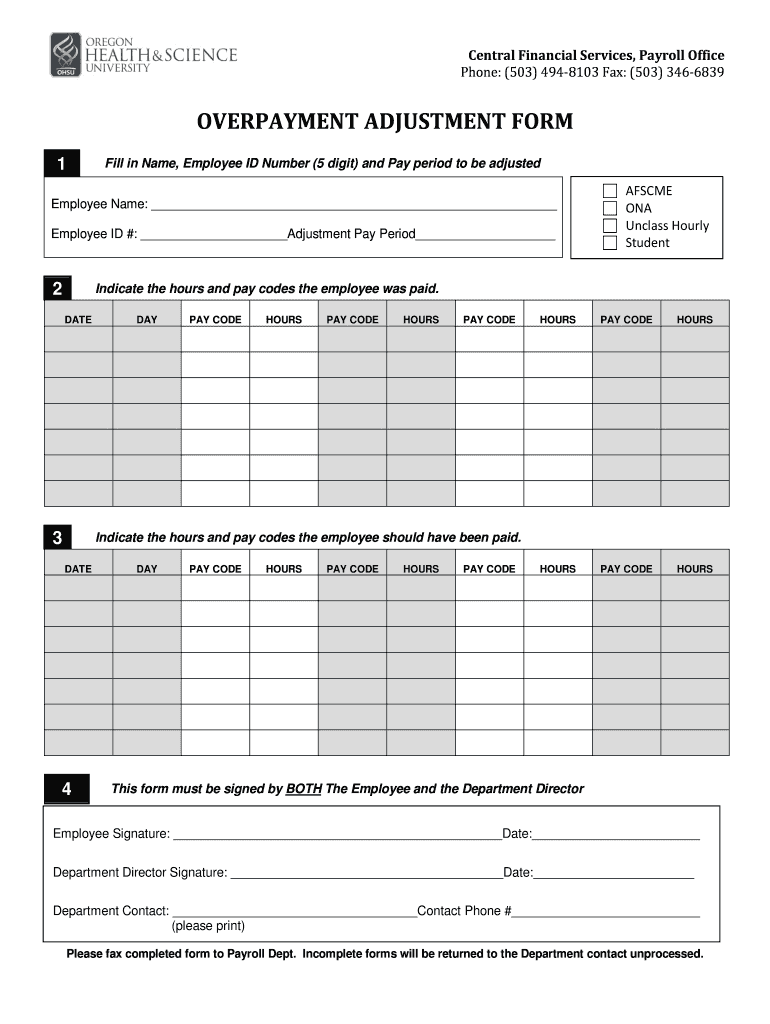

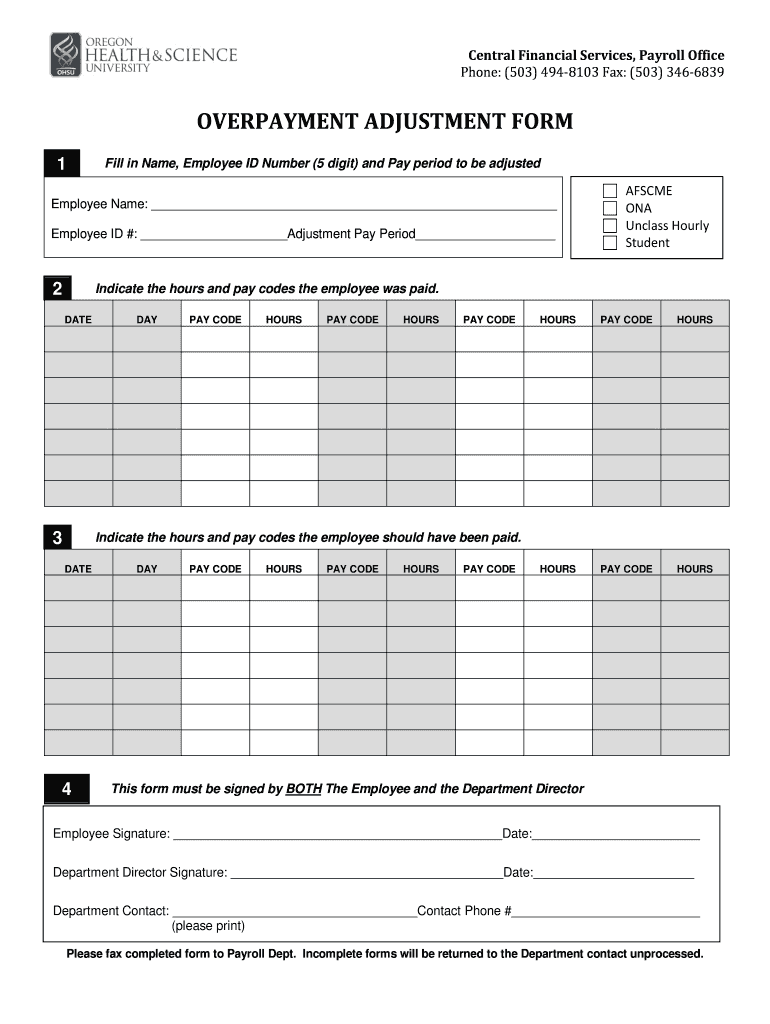

This form is used to adjust payroll overpayments for employees, including required signatures from both the employee and the department director.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign overpayment adjustment form

Edit your overpayment adjustment form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your overpayment adjustment form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing overpayment adjustment form online

Follow the steps below to take advantage of the professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit overpayment adjustment form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out overpayment adjustment form

How to fill out Overpayment Adjustment Form

01

Obtain the Overpayment Adjustment Form from the relevant agency's website or office.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Provide details about the overpayment, including the amount and the period it covers.

04

Attach any supporting documentation, such as payment stubs or prior correspondence related to the overpayment.

05

Review the form for accuracy and completeness.

06

Sign and date the form.

07

Submit the form to the appropriate agency, either by mail or electronically, as instructed.

Who needs Overpayment Adjustment Form?

01

Individuals who have received an overpayment of benefits or funds from a government agency.

02

People seeking to correct or adjust their financial records with the relevant agency.

03

Taxpayers who have overpaid and need to reclaim their funds.

Fill

form

: Try Risk Free

People Also Ask about

What is an overpayment adjustment?

If you do not think you owe the money, you can ask SSA to reconsider the overpayment by filing a Request for Reconsideration Form (SSA561-U2). You can also call your local Social Security office and ask them to take your appeal over the telephone.

Is overpayment the same as refund?

You get an overpayment credit when your tax payments exceed what you owe. You'll automatically receive a refund of the credit. However, you can ask us to apply the credit as an advance payment towards next year's taxes instead of sending it to you as a refund.

How can I get out of paying back an overpayment of Social Security?

Form SSA-3105 (Important Information About Your Appeal and Waiver Rights) is included with each overpayment notice. The SSA-3105 further explains the pre-recoupment review process and contains a tear-off form which the individual may complete and return to SSA if he/she wants reconsideration and/or waiver.

What does it mean when it says you have an overpayment?

overpayment Business English the act of paying more than is necessary or more than the value of something, or the amount by which someone has paid too much: Any overpayment will be treated as a payment of tax in advance.

What is an example of an overpayment?

Example: Employee A was paid $500 on their check for the 1/31 pay period. Employee A should have been paid $400. This results in a gross overpayment of $100.

How do I request for reconsideration of overpayment?

Fax or mail us a request to waive overpaid benefits Fill out Request for Waiver of Overpayment Recovery (PDF). Then, find the Social Security office closest to your home and fax or mail us the completed form.

Do I have to pay back an overpayment?

In most circumstances an employer has the right to claim back money if they've overpaid someone. They should contact the employee as soon as they're aware of the mistake.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Overpayment Adjustment Form?

The Overpayment Adjustment Form is a document used to correct any overpayments made in a financial transaction or benefit program, allowing for adjustments to be recorded and managed.

Who is required to file Overpayment Adjustment Form?

Individuals or entities that have received an overpayment from a government agency or other organization are required to file the Overpayment Adjustment Form to rectify the financial discrepancy.

How to fill out Overpayment Adjustment Form?

To fill out the Overpayment Adjustment Form, a filer must provide personal details, specify the amount of overpayment, attach relevant documentation, and sign the form to ensure accuracy and compliance.

What is the purpose of Overpayment Adjustment Form?

The purpose of the Overpayment Adjustment Form is to formally request corrections for overpayments, ensuring that accurate records are maintained and appropriate refunds or adjustments are processed.

What information must be reported on Overpayment Adjustment Form?

The Overpayment Adjustment Form must report information such as claimant details, overpayment amount, reasons for the overpayment, and any relevant transaction identifiers to facilitate adjustment processing.

Fill out your overpayment adjustment form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Overpayment Adjustment Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.