Get the free Perkins Loan Cancellation Application - ucmo

Show details

This document is used by borrowers to apply for the cancellation of a portion of their Federal Perkins loan after completing eligible employment, specifically for teachers in low-income schools.

We are not affiliated with any brand or entity on this form

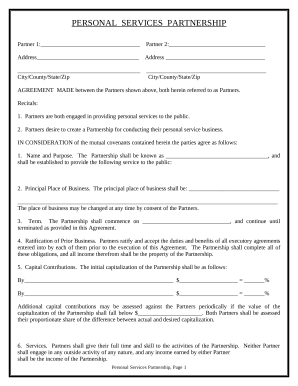

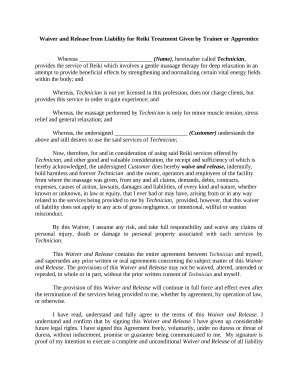

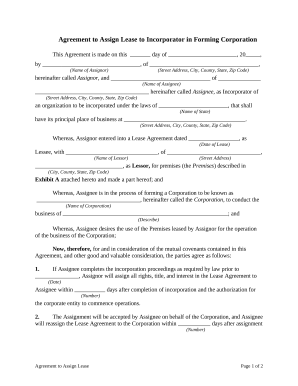

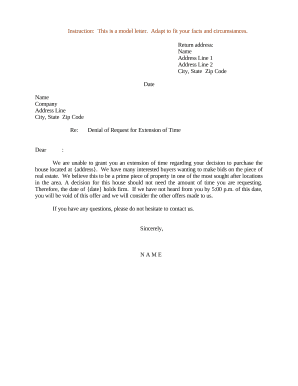

Get, Create, Make and Sign perkins loan cancellation application

Edit your perkins loan cancellation application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your perkins loan cancellation application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit perkins loan cancellation application online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit perkins loan cancellation application. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out perkins loan cancellation application

How to fill out Perkins Loan Cancellation Application

01

Obtain the Perkins Loan Cancellation Application form from your school's financial aid office or website.

02

Fill out your personal information, including your name, address, and student ID.

03

Specify the reason for your application, such as qualifying employment or other eligible circumstances.

04

Attach any required documentation that supports your cancellation request, like proof of employment.

05

Review the application for accuracy and completeness before submission.

06

Submit the completed application to your school's financial aid office.

Who needs Perkins Loan Cancellation Application?

01

Graduates who have taken qualifying public service jobs.

02

Teachers in low-income schools or special education settings.

03

Nurses and medical personnel working in underserved areas.

04

Certain types of employed professionals in specific fields as defined by the Perkins Loan guidelines.

Fill

form

: Try Risk Free

People Also Ask about

How do I apply for a Perkins Loan cancellation?

Applying for Cancellation or Discharge You need to apply for cancellation or discharge of a Perkins Loan directly to the school that made the loan or to the school's Perkins Loan servicer. The school or its servicer can provide forms and instructions specific to your type of cancellation or discharge request.

Is it possible to cancel a loan?

Contact the lender to tell them you want to cancel - this is called 'giving notice'. It's best to do this in writing but your credit agreement will tell you who to contact and how. If you've received money already then you must pay it back - the lender must give you 30 days to do this.

How do I cancel my student loan?

You can cancel all or part of a loan by notifying your school's financial aid office before your loan is disbursed (paid out). returning some or all of the loan money to your servicer.

How can I close my loan immediately?

If a borrower decides to pay off the Loan before the agreed tenure, it's called a pre-closure. Typically, this option becomes available after completing a minimum of 12 EMIs. To foreclose the Loan, the borrower must clear the current month's EMI, any pending dues, and the applicable foreclosure charges.

Does canceling a loan hurt your credit?

Cancelling a loan before the lender accesses your credit report does not impact your credit score. Cancellation at the disbursal stage involves minimal impact, while post-disbursal requires action within the cooling-off period. Know other impacts of loan disbursal on your credit score.

Can I cancel my approved loan?

Yes, you can cancel a loan after processing, but it may involve additional costs such as penalties or interest on disbursed funds. The exact terms depend on your lender's policies. Contact your lender quickly to understand the process and avoid further charges or complications.

How do I cancel my loan?

Contact your lender's customer service team or visit their nearest branch to notify them about your intent to cancel the loan. Be prepared to explain your reason for cancellation clearly, whether due to a change in financial circumstances, availability of alternative funds, or other personal reasons.

What happens if I don't pay my Perkins Loan?

For a loan made under the Federal Perkins Loan Program, the holder of the loan may declare the loan to be in default if you don't make your scheduled payment by the due date. Find out where to go for information about your Perkins Loan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Perkins Loan Cancellation Application?

The Perkins Loan Cancellation Application is a form that borrowers can use to request cancellation of their outstanding Perkins Loan debt based on qualifying circumstances such as employment in certain public service fields.

Who is required to file Perkins Loan Cancellation Application?

Borrowers who are seeking to have a portion or all of their Perkins Loan forgiven due to qualifying service or other criteria are required to file the Perkins Loan Cancellation Application.

How to fill out Perkins Loan Cancellation Application?

To fill out the Perkins Loan Cancellation Application, borrowers should provide required personal information, details about their loan, and documentation supporting their eligibility for cancellation based on their service or employment.

What is the purpose of Perkins Loan Cancellation Application?

The purpose of the Perkins Loan Cancellation Application is to formally request the cancellation of all or part of a borrower's Perkins Loan based on qualifying service in specific professions or fulfilling certain conditions set by the loan program.

What information must be reported on Perkins Loan Cancellation Application?

Borrowers must report their personal information, loan account number, details of qualifying employment or service, and any supporting documentation or evidence required to verify eligibility for cancellation.

Fill out your perkins loan cancellation application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Perkins Loan Cancellation Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.