Get the free CORPORATION/BUSINESS IDENTIFICATION FORM FOR UNCLAIMED FUNDS - caeb uscourts

Show details

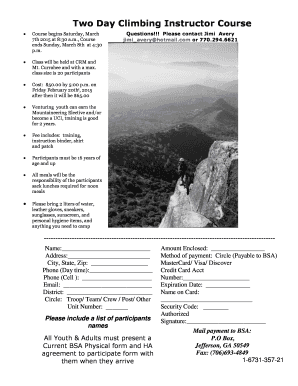

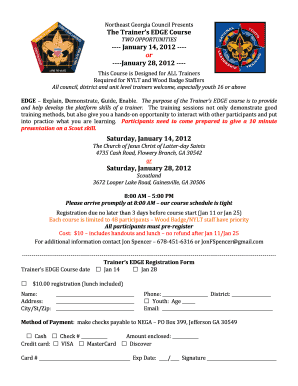

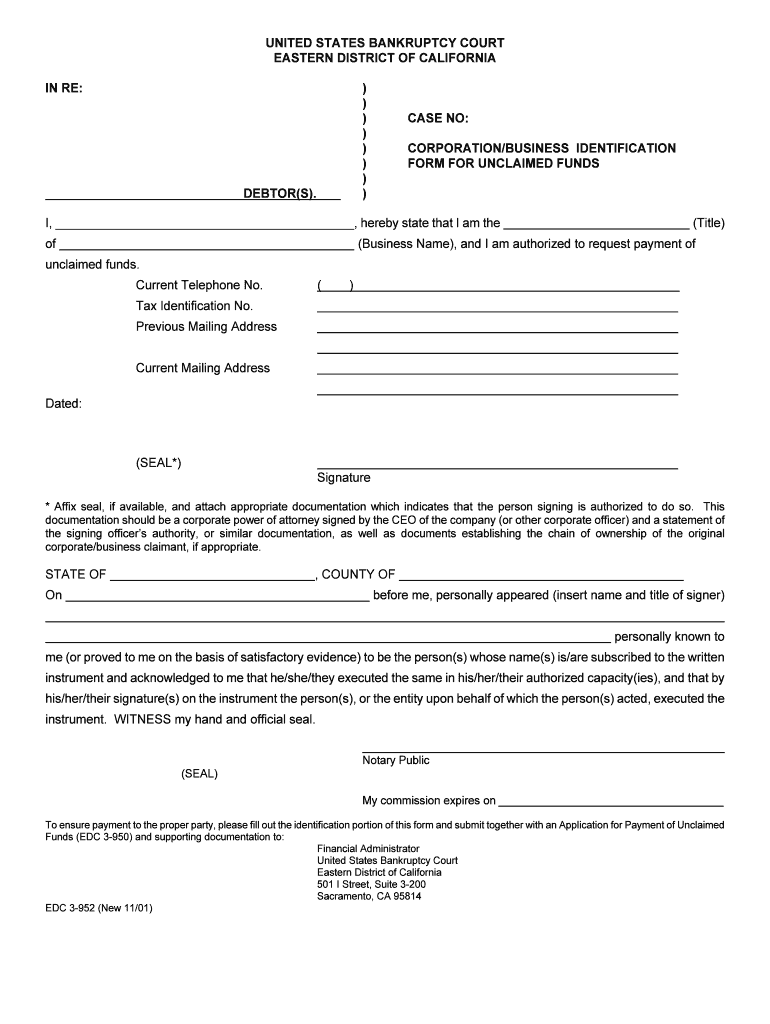

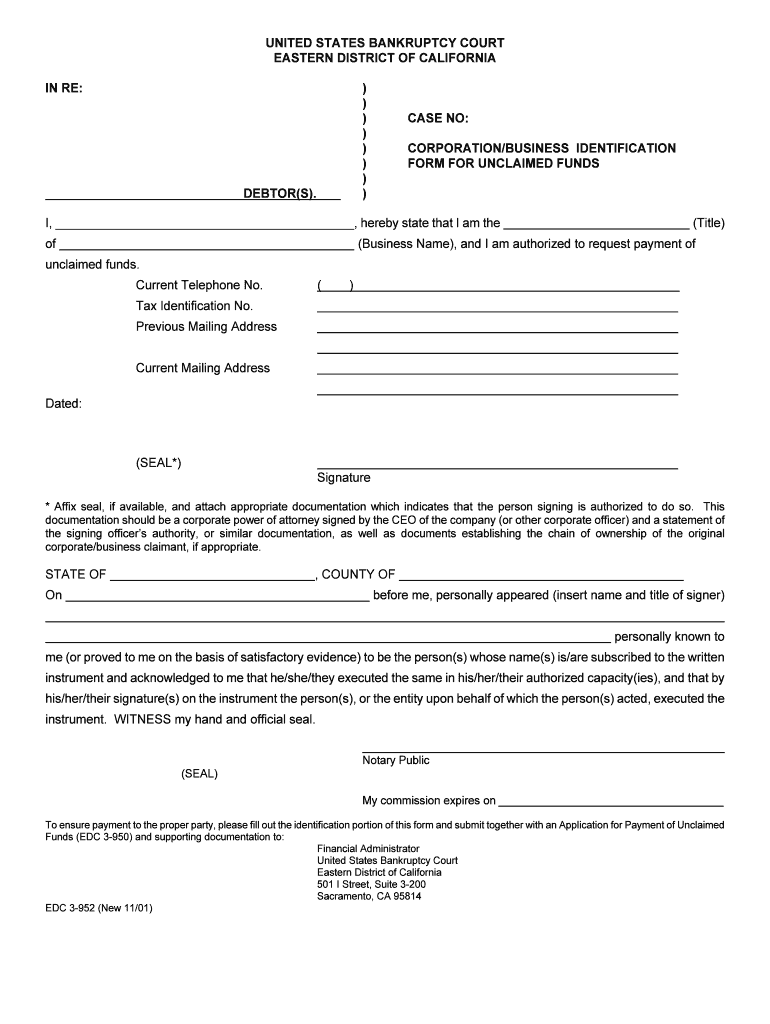

This form is used to identify a corporation or business requesting payment of unclaimed funds. The signatory must provide their title, business name, and authorized signature, along with required

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporationbusiness identification form for

Edit your corporationbusiness identification form for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporationbusiness identification form for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing corporationbusiness identification form for online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit corporationbusiness identification form for. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporationbusiness identification form for

How to fill out CORPORATION/BUSINESS IDENTIFICATION FORM FOR UNCLAIMED FUNDS

01

Start by visiting the official website where the Corporation/Business Identification Form is located.

02

Download the form or access it online.

03

Enter the corporation's legal name in the designated field.

04

Provide the business identification number or tax ID number as required.

05

Fill out the business address, including street, city, state, and zip code.

06

Include the contact person's name, phone number, and email address for any inquiries.

07

Indicate the type of business entity (e.g., corporation, LLC, etc.).

08

Answer any additional questions required on the form.

09

Review all the information for accuracy and completeness.

10

Submit the form as instructed on the website (either online or via mail).

Who needs CORPORATION/BUSINESS IDENTIFICATION FORM FOR UNCLAIMED FUNDS?

01

Any corporation or business entity that has unclaimed funds or assets they are entitled to retrieve.

02

Businesses that have gone dormant or dissolved may also need to fill out this form to claim their remaining funds.

Fill

form

: Try Risk Free

People Also Ask about

What is the New York State law on unclaimed funds?

New York State's Abandoned Property Law requires certain entities to transfer abandoned money or securities to the New York State Comptroller's Office of Unclaimed Funds. Entities required to report and remit unclaimed funds include, for example, banks, insurance companies, corporations and state agencies.

What is the dormancy period for unclaimed property in NY?

How Long Does New York State Hold Unclaimed Funds? There is no time limit for claiming unclaimed funds in New York. The state holds these funds in trust indefinitely until they are claimed by the rightful owner or heirs.

What is the unclaimed funds law in NY?

New York State's Abandoned Property Law requires certain entities to transfer abandoned money or securities to the New York State Comptroller's Office of Unclaimed Funds. Entities required to report and remit unclaimed funds include, for example, banks, insurance companies, corporations and state agencies.

What does it mean when a business is unclaimed?

Unclaimed or “abandoned” property refers to property or accounts within financial institutions or companies—in which there has been no activity generated (or contact with the owner) regarding the property for one year or a longer period.

What is the finders keepers law in NY?

If the finder of lost property under the value of ten dollars has made reasonable effort to find the owner and restore it to him, and has been unable to do so, the title to such property shall vest in the finder at the end of one year after the finding.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CORPORATION/BUSINESS IDENTIFICATION FORM FOR UNCLAIMED FUNDS?

The Corporation/Business Identification Form for Unclaimed Funds is a document that businesses must complete to report unclaimed property or funds that they hold, which have not been claimed by the rightful owners.

Who is required to file CORPORATION/BUSINESS IDENTIFICATION FORM FOR UNCLAIMED FUNDS?

Corporations and businesses that hold unclaimed funds or abandoned property are required to file this form to comply with state laws regarding unclaimed property reporting.

How to fill out CORPORATION/BUSINESS IDENTIFICATION FORM FOR UNCLAIMED FUNDS?

To fill out the form, provide accurate business identification information, details of the unclaimed funds, and any other required financial information. Ensure that all sections are completed thoroughly to avoid processing delays.

What is the purpose of CORPORATION/BUSINESS IDENTIFICATION FORM FOR UNCLAIMED FUNDS?

The purpose of this form is to identify and report unclaimed funds to the appropriate government authorities, facilitating the potential return of these funds to their rightful owners.

What information must be reported on CORPORATION/BUSINESS IDENTIFICATION FORM FOR UNCLAIMED FUNDS?

The form typically requires the business's name, address, tax identification number, details of the unclaimed funds including amounts, description of the funds, and any efforts made to contact the owners.

Fill out your corporationbusiness identification form for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporationbusiness Identification Form For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.