Get the free Student Tax Information 2012-2013 - wcu

Show details

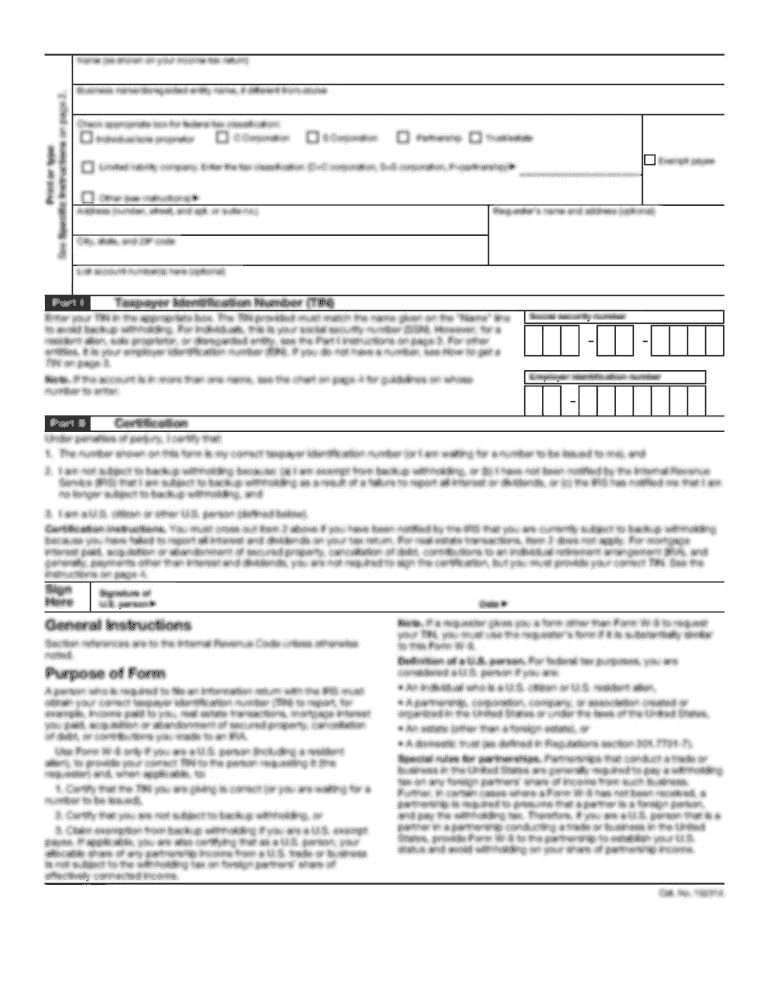

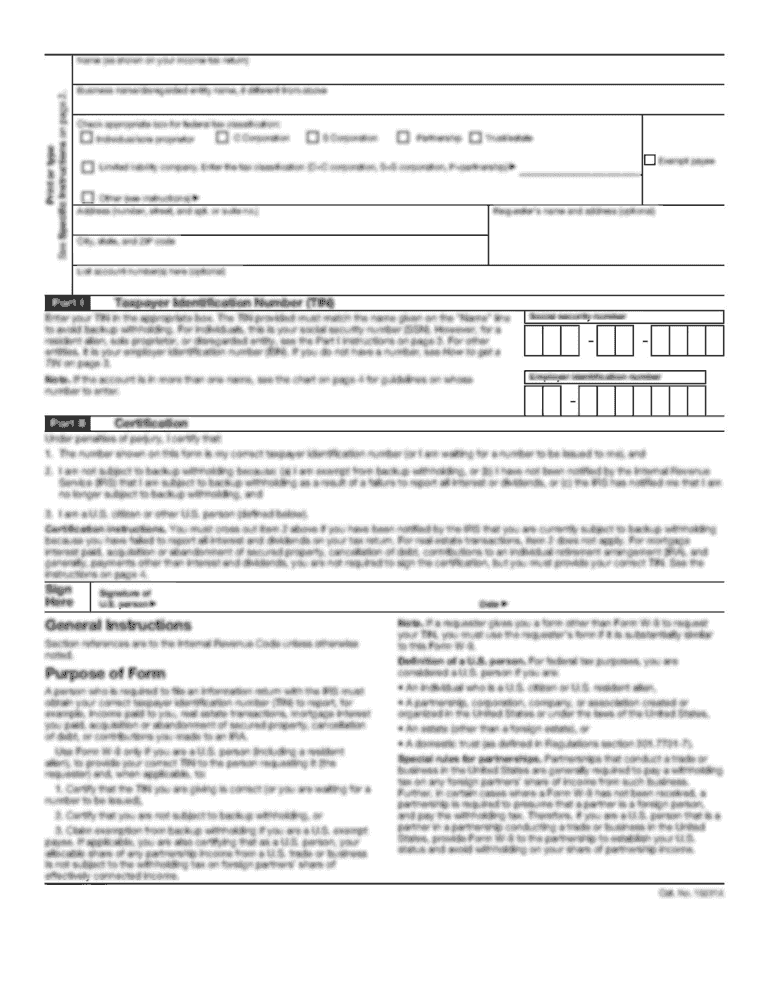

This document is used to collect and verify tax information from students for the FAFSA form for the 2012-2013 academic year.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign student tax information 2012-2013

Edit your student tax information 2012-2013 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your student tax information 2012-2013 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing student tax information 2012-2013 online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit student tax information 2012-2013. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out student tax information 2012-2013

How to fill out Student Tax Information 2012-2013

01

Gather your personal information such as your Social Security number, school code, and filing status.

02

Obtain tax documents including W-2 forms, 1098-T, and any other relevant income documents.

03

Complete the section for student income: report wages, scholarships, and grants.

04

Fill out the dependency status based on whether you are claimed as a dependent on someone else's tax return.

05

Indicate whether you have filed a tax return in previous years and include relevant financial information.

06

Review all provided information for accuracy and compliance with IRS regulations.

07

Submit the completed form by the designated deadline to ensure eligibility for financial aid.

Who needs Student Tax Information 2012-2013?

01

Any student applying for federal financial aid or scholarships for the academic year 2012-2013.

02

Parents of dependent students who need to provide their tax information for financial aid assessments.

03

Students who are filing their taxes for the first time or need to report income for the year.

Fill

form

: Try Risk Free

People Also Ask about

What is the tax return for students?

The American opportunity tax credit (AOTC) is a credit for qualified education expenses paid for an eligible student for the first four years of higher education. You can get a maximum annual credit of $2,500 per eligible student.

Where can I find student tax information?

Your college or career school will provide your 1098-T form electronically or by postal mail if you paid any qualified tuition and related education expenses during the previous calendar year. Find information about the 1098-E form, which reports the amount of interest you paid on student loans in a calendar year.

Does every student get a 1098-T?

Not all students are eligible to receive a 1098-T. Forms will not be issued under the following circumstances: The amount paid for qualified tuition and related expenses* in the calendar year is less than or equal to the total scholarships disbursed that year.

Can I still file my 2013 tax return?

No e-file for 2013: The IRS shuts down its e-file portal in mid-October. Individual tax returns submitted after that date can easily be prepared online with Priortax but must be downloaded, printed, signed, and mailed to the IRS. The same applies to late state tax return.

How does the IRS know if you are a full-time student?

The number of hours that qualify a student as full-time is determined by the school; the Internal Revenue Service (IRS) uses the school's definition. In addition, ing to the IRS, the student must attend school five months per year. (Those months don't need to be consecutive.)

What happens if I didn't get my 1098-T from my school?

Form 1098-T should be sent for anyone who had education expenses or received scholarships, fellowships, or grants. If you, your spouse, or your dependent had education expenses and did not receive Form 1098-T, you may need to still report the amounts on the return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Student Tax Information 2012-2013?

Student Tax Information 2012-2013 refers to the financial information required for students to complete their tax returns for the fiscal year 2012-2013, including details on income, scholarships, grants, and other financial considerations.

Who is required to file Student Tax Information 2012-2013?

Students who earned income during the fiscal year 2012-2013 or who received scholarships and grants that are taxable are required to file Student Tax Information.

How to fill out Student Tax Information 2012-2013?

To fill out Student Tax Information 2012-2013, students should gather their income records, fill out the necessary tax forms (like the 1040 or 1040EZ), report income and financial aid appropriately, and ensure they claim any applicable tax credits.

What is the purpose of Student Tax Information 2012-2013?

The purpose of Student Tax Information 2012-2013 is to ensure that students accurately report their financial situation to comply with tax laws, claim any eligible taxes or refunds, and maintain financial responsibility.

What information must be reported on Student Tax Information 2012-2013?

Students must report all sources of income, including wages, scholarships, and grants, along with deductions, credits, and any other relevant financial information that may affect their tax obligations.

Fill out your student tax information 2012-2013 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Student Tax Information 2012-2013 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.