Get the free Winthrop University Sales and Use Tax Exemption Request - winthrop

Show details

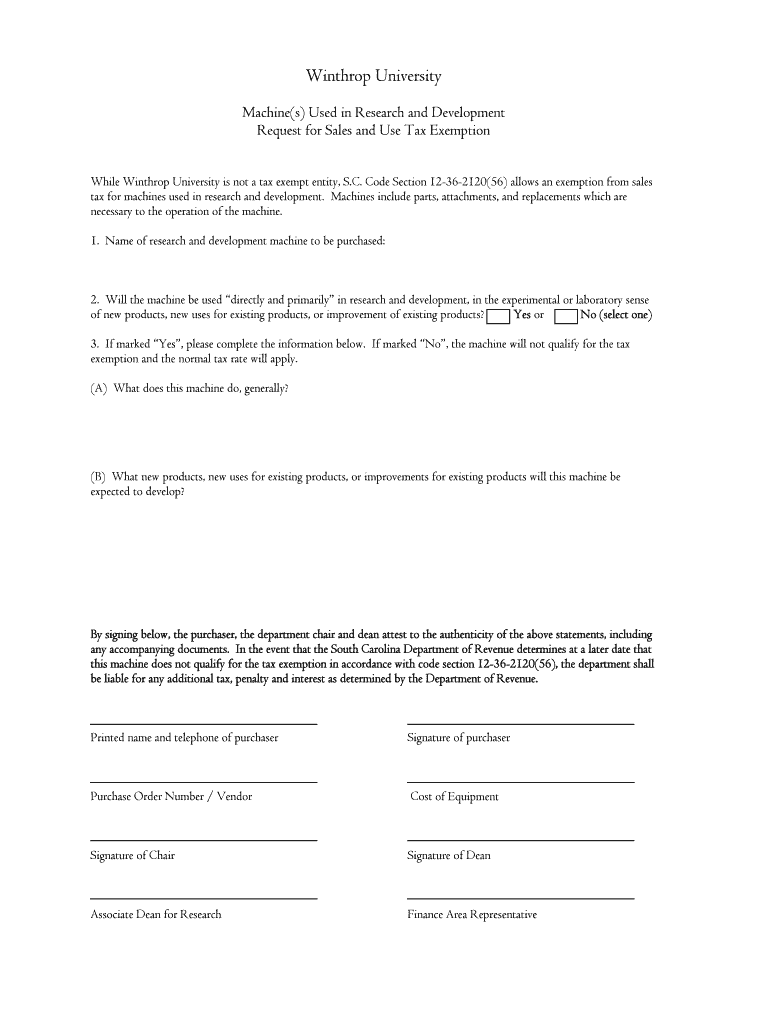

This document serves as a form to request a sales and use tax exemption for machines that will be utilized in research and development at Winthrop University, in accordance with S.C. Code Section

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign winthrop university sales and

Edit your winthrop university sales and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your winthrop university sales and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit winthrop university sales and online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit winthrop university sales and. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out winthrop university sales and

How to fill out Winthrop University Sales and Use Tax Exemption Request

01

Visit the Winthrop University website to locate the Sales and Use Tax Exemption Request form.

02

Download the form and open it using a suitable PDF viewer.

03

Fill in your personal and contact information in the designated fields.

04

Provide details about the purpose of the exemption request, including specific items or services.

05

Indicate your affiliation with Winthrop University, such as student, faculty, or staff status.

06

Review all entered information for accuracy and completeness.

07

Print the form if required, then sign and date it.

08

Submit the completed form to the appropriate department or office at Winthrop University, as instructed.

Who needs Winthrop University Sales and Use Tax Exemption Request?

01

Students of Winthrop University who are purchasing materials related to their courses.

02

Faculty or staff making purchases for university-related activities or events.

03

Any individual or organization that is conducting business on behalf of Winthrop University.

Fill

form

: Try Risk Free

People Also Ask about

Why are some universities tax-exempt?

Colleges and universities are tax-exempt because the government recognizes the education they provide fosters civic engagement and citizens' success. Every year, tax-exempt entities demonstrate compliance with federal and state laws and regulations to maintain their status.

What is a tax exempt university?

Tax-exempt private and public universities and colleges do not pay income taxes; however, they do pay other forms of taxes, such as payroll taxes for their employees.

What does tax-exempt status mean?

Tax-exempt status means that an organization is exempt from paying federal corporate income tax on income generated from activities that are substantially related to the purposes for which the entity was organized (i.e., to the purposes for which the organization was granted tax-exempt status).

Is Harvard University tax-exempt?

Harvard, like many American colleges and charities, enjoys a federal tax exemption, a status granted by the Internal Revenue Service that allows the wealthy Ivy League university to forgo paying perhaps hundreds of millions of dollars a year in taxes.

Is Winthrop University tax exempt?

Winthrop pays sales tax just like any consumer. The phrase "exempt from taxation" refers to Federal and State income tax — not sales tax.

What institutions are tax-exempt?

Exempt organization types Charitable organizations. Churches and religious organizations. Private foundations. Political organizations. Other nonprofits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Winthrop University Sales and Use Tax Exemption Request?

The Winthrop University Sales and Use Tax Exemption Request is a formal submission that allows the university to exempt certain purchases from sales and use taxes under applicable state laws.

Who is required to file Winthrop University Sales and Use Tax Exemption Request?

Individuals or departments within Winthrop University making purchases that qualify for tax exemption are required to file the Winthrop University Sales and Use Tax Exemption Request.

How to fill out Winthrop University Sales and Use Tax Exemption Request?

To fill out the Winthrop University Sales and Use Tax Exemption Request, provide necessary purchase details, specify the nature of the items to be purchased, and include information about the department and person making the request.

What is the purpose of Winthrop University Sales and Use Tax Exemption Request?

The purpose of the request is to formally document and justify the eligibility for tax exemption for qualifying purchases made by the university to reduce costs and allocate funds efficiently.

What information must be reported on Winthrop University Sales and Use Tax Exemption Request?

The request must report information such as the name of the requester, department, details of the purchase, item descriptions, and a justification for the tax exemption.

Fill out your winthrop university sales and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Winthrop University Sales And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.