VA Form 1098 1993-2025 free printable template

Show details

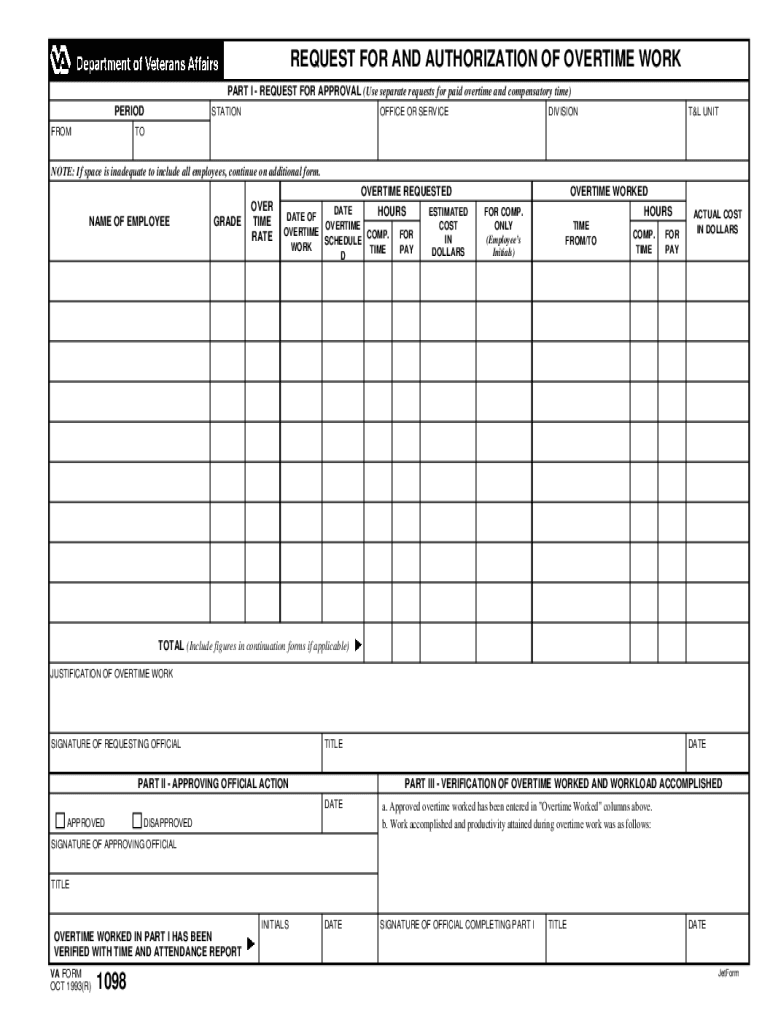

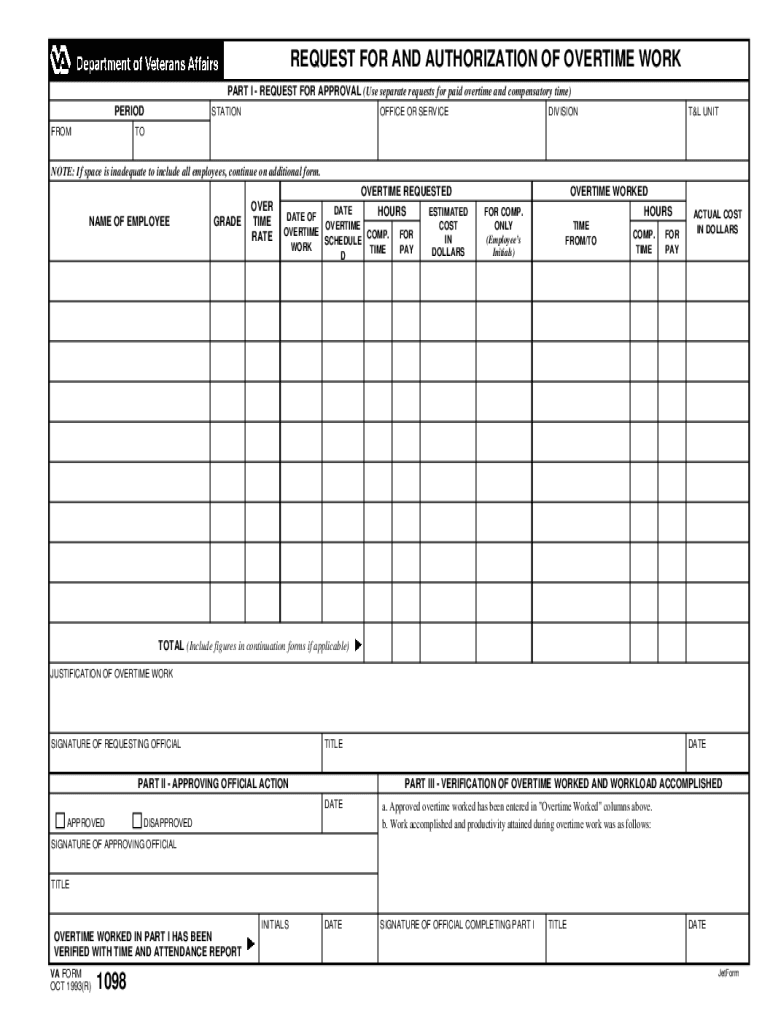

This document serves as a request for approval and authorization for overtime work, including details of employees, hours worked, and justification for the overtime.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign va form 1098

Edit your va form 1098 overtime form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 1098 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 1098 form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 1098 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 1098 form

How to fill out VA Form 1098

01

Obtain VA Form 1098 from the VA website or a VA office.

02

Fill in the year for which you are reporting.

03

Input your personal information, including name, address, and Social Security number.

04

Provide the name and address of the lender or servicer.

05

Enter the amount of interest paid during the tax year.

06

Include any points paid on the loan.

07

Review the form for accuracy.

08

Sign and date the form before submitting it to the appropriate tax authority.

Who needs VA Form 1098?

01

Veterans who have a mortgage or loan backed by the VA.

02

Individuals who are seeking to claim a mortgage interest deduction on their taxes.

03

Borrowers who have paid interest on a qualified mortgage during the tax year.

Fill

form

: Try Risk Free

People Also Ask about

How do I get my veterans affairs tax documents?

Automated Phone System: Call 800-321-1080. Select option 1 for Military Retired and Annuitant Pay. Many retirees and annuitants have opted to receive 1099Rs via the U.S. Postal Service. Tax statements are sent to the mailing address on record.

Is money from the VA considered income?

Payments you receive for education, training, or subsistence under any law administered by the VA are tax free. Don't include these payments as income on your federal tax return.

Does VA disability count as income?

Disability compensation is a benefit paid to Veterans because of injuries or disease that happened during active duty. In some cases, an existing disease or injury was worsened due to active military service. This benefit is also paid to certain Veterans disabled from VA health care. The benefits are tax-free.

Does my VA disability count as income?

VA disability pension benefits generally are not subject to federal income tax and so are not counted as income in determining eligibility for premium tax credits.

Do I have to claim VA benefits on my taxes?

Payments you receive for education, training, or subsistence under any law administered by the VA are tax free. Don't include these payments as income on your federal tax return.

Is VA disability considered countable income?

If you receive a disability pension based on years of service, retroactive retirement pay based on VA disability rating, or disability payments received for injuries resulting from a terrorist or military action you must count these as income.

Do I get a 1099 for my VA disability?

The DOD will not include the amount of the VA payment on the Form 1099-R. The VA does not report the payments it makes on a Form 1099-R. There are two general scenarios that describe a military retiree's situation when claiming a disability: 1.

Does the VA send a w2?

The new W-2s will be mailed to former VA employees, while most current employees will have the forms delivered to them at work.

Does VA disability count as monthly income?

Is VA Disability Considered Income? ing to the Internal Revenue Service (IRS), VA disability is not considered income. Therefore, veterans should not include disability benefits paid by VA in their gross income when filing taxes.

Do I have to report my VA benefits on my taxes?

Payments you receive for education, training, or subsistence under any law administered by the VA are tax free. Don't include these payments as income on your federal tax return.

Do I have to report my VA disability as income?

Disability benefits received from the VA should not be included in your gross income.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form 1098 form online?

Easy online form 1098 form completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit form 1098 form in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your form 1098 form, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an electronic signature for the form 1098 form in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your form 1098 form in seconds.

What is VA Form 1098?

VA Form 1098 is a form used by the Department of Veterans Affairs (VA) to report the amount of mortgage interest that a veteran has paid on a home loan during the tax year.

Who is required to file VA Form 1098?

Lenders who file with the IRS must issue VA Form 1098 to any veteran who has paid interest on a home loan guaranteed by the VA.

How to fill out VA Form 1098?

To fill out VA Form 1098, the lender needs to provide the borrower's name, taxpayer identification number, property address, total mortgage interest paid, and any other applicable financial information for the tax year.

What is the purpose of VA Form 1098?

The purpose of VA Form 1098 is to provide veterans with a statement of the mortgage interest paid during the tax year, which can be used for tax filing purposes.

What information must be reported on VA Form 1098?

VA Form 1098 must report the borrower's identification information, the property address, the total amount of mortgage interest paid, any points paid on the mortgage, and any other relevant financial details.

Fill out your form 1098 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 1098 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.