Get the free Housing Loan Application

Show details

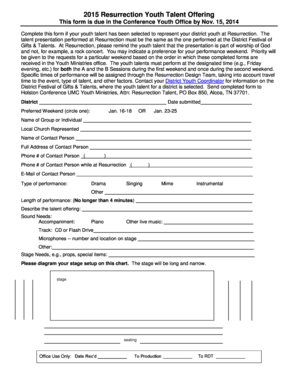

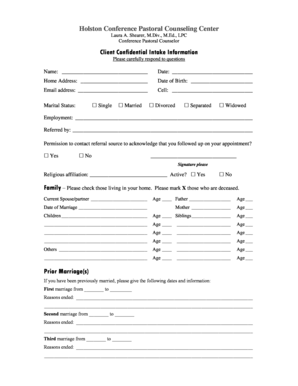

This document is designed for applicants seeking a housing loan, including sections for general information, project specifics, financial information, references, disclosures, credit permissions,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign housing loan application

Edit your housing loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your housing loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing housing loan application online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit housing loan application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out housing loan application

How to fill out Housing Loan Application

01

Gather necessary documents such as income proof, credit history, and identification.

02

Research and choose the right lender or bank to apply for a housing loan.

03

Fill out the application form accurately with personal details.

04

Provide information about the property you wish to purchase.

05

Submit the required documentation along with the application form.

06

Await assessment and verification of your application by the lender.

07

Respond to any additional queries from the lender promptly.

08

Receive the loan approval or rejection decision.

Who needs Housing Loan Application?

01

Individuals looking to purchase a new home or property.

02

First-time homebuyers seeking financial assistance.

03

Homeowners wishing to refinance their existing mortgage.

04

Investors looking to buy rental properties.

Fill

form

: Try Risk Free

People Also Ask about

How to write loan application in English?

Writing the Body of the Loan Application Letter The Introduction. Begin with a brief introduction paragraph that states your loan request amount directly. Second Paragraph. Third Paragraph. The Last Part. Be Clear About Your Purpose. Provide Complete Contact Information. Mention Your Repayment Plan. Keep It Professional.

What are the 6 items needed for a loan application?

Your 10-step guide to the mortgage loan process Submit your application. Order a home inspection. Be responsive to your lender. Purchase homeowner's insurance. Let the process play out. Avoid taking on new debt. Lock in your rate. Review your documents.

What are the six pieces of an application?

What 6 Pieces of Information Make A TRID Loan Application? Name. Income. Social Security Number. Property Address. Estimated Value of Property. Mortgage Loan Amount sought.

What is the easiest mortgage loan to get approved for?

What Are the Easiest Loans to Get Approved For? FHA Loans, which will generally have among the lowest credit score and down payment requirements. VA Loans, which don't require a down payment or a minimum credit score — but do require active military duty or veteran status.

What documents are required for loan application?

o Identity proof (PAN card, Voters ID, Passport, Aadhaar, etc.) o Address proof (Driving license, Passport, Aadhaar, etc.) For salaried individuals, provide income proof of the last 2 years' ITR/Form 16 and the latest 3 months' salary slip. Additionally, submit bank statements of the last 12 months.

What are the 6 pieces of information for loan estimate?

Submitting these 6 pieces of information: Name Income Social Security Number Property Address Estimated Value of Property Mortgage Loan Amount sought constitutes a valid loan application under the TRID rule.

What are the 6 cs of lending?

The 6 'C's — character, capacity, capital, collateral, conditions and credit score — are widely regarded as the most effective strategy currently available for assisting lenders in determining which financing opportunity offers the most potential benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Housing Loan Application?

A Housing Loan Application is a formal request submitted by an individual or entity to a financial institution or lender for funds to purchase, construct, or renovate a residential property.

Who is required to file Housing Loan Application?

Anyone seeking to obtain financing for the purchase or improvement of a home, including first-time homebuyers, real estate investors, and homeowners looking to refinance an existing loan, is required to file a Housing Loan Application.

How to fill out Housing Loan Application?

To fill out a Housing Loan Application, gather personal information, financial details, employment history, property information, and loan specifics. Complete the application form accurately, ensuring all required documents are attached, and submit it to the lender.

What is the purpose of Housing Loan Application?

The purpose of a Housing Loan Application is to provide the lender with necessary information to assess the borrower's creditworthiness, financial situation, and the viability of the proposed loan based on the property being financed.

What information must be reported on Housing Loan Application?

Essential information reported on a Housing Loan Application includes personal identification details, income and employment information, credit history, details of assets and debts, property information, and the amount being requested as a loan.

Fill out your housing loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Housing Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.