TX Comptroller 50-244 2011 free printable template

Show details

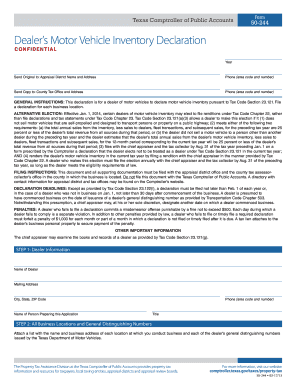

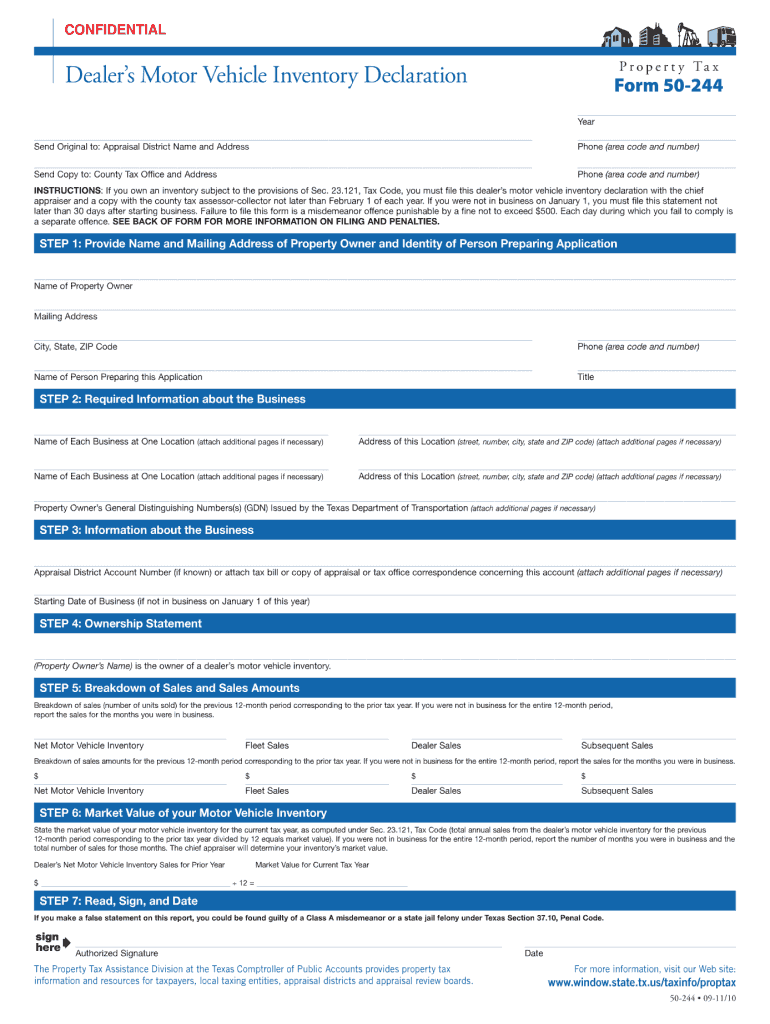

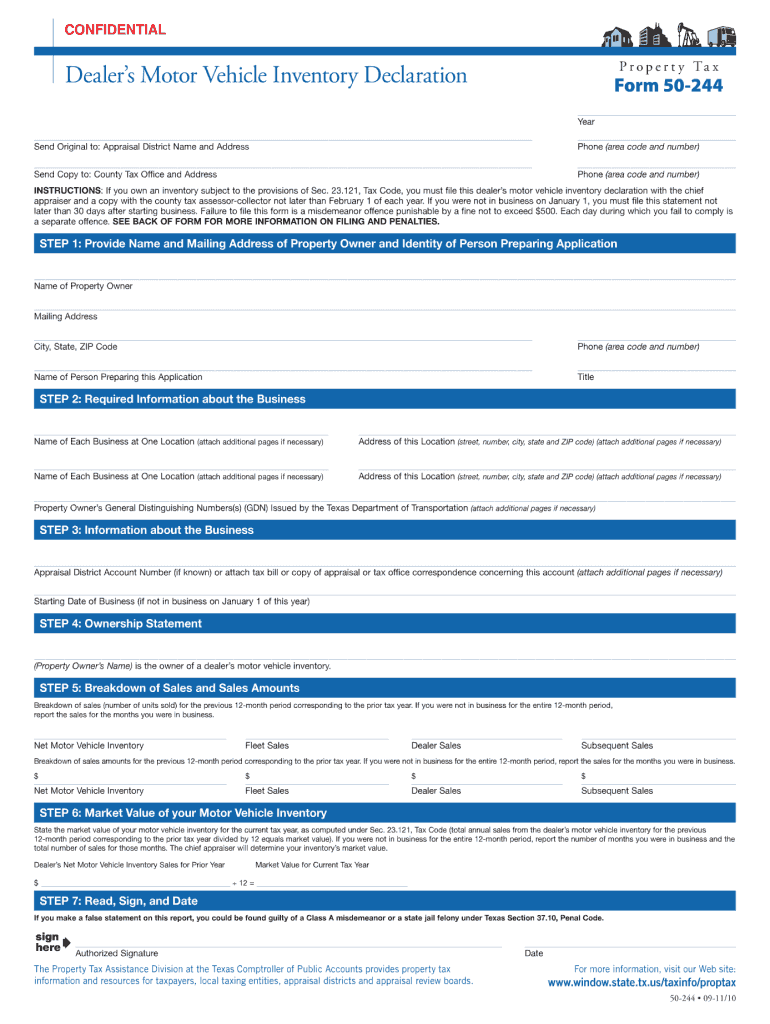

P r o p e r t y Ta x Dealer s Motor Vehicle Inventory Declaration Form 50-244 CONFIDENTIAL Year Send Original to Appraisal District Name and Address Phone area code and number Send Copy to County Tax Office and Address This document must be filed with the appraisal district office and the county tax assessor-collector s office in the county in which your business is located. Do not file this document with the office of the Texas Comptroller of Public Accounts. Location and address information...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Comptroller 50-244

Edit your TX Comptroller 50-244 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Comptroller 50-244 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX Comptroller 50-244 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit TX Comptroller 50-244. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 50-244 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Comptroller 50-244

How to fill out TX Comptroller 50-244

01

Begin by downloading the TX Comptroller form 50-244 from the official website.

02

Fill in the legal name of the organization or entity in the designated section.

03

Provide the physical and mailing addresses of the organization.

04

Indicate the nature of the organization: whether it is a non-profit, state agency, etc.

05

Include the organization’s Federal Employer Identification Number (EIN) if applicable.

06

Complete the financial information section, detailing gross receipts and expenses for the last fiscal year.

07

Specify the type of exemption being sought and ensure that all criteria are met.

08

Gather any additional documentation required to support the claim for exemption.

09

Review the form for accuracy and completeness.

10

Submit the completed form to the appropriate office as instructed on the form.

Who needs TX Comptroller 50-244?

01

Entities seeking tax-exempt status in Texas, including non-profit organizations, government entities, and other qualifying groups that operate exclusively for charitable, educational, or religious purposes.

Fill

form

: Try Risk Free

People Also Ask about

How much is inventory tax in Texas?

"It's huge," says Zavary, "It's close to 3.6 to 3.7%. So, if you have a million dollars worth of inventory, at the end of the year, you have to pay that 3.6 to 3.7%." For those who need a little help with the math, that million dollars worth of inventory means a $36,000 to $37,000 tax bill every single year.

Do I have to pay vehicle inventory tax in Texas?

For local property tax purposes, Texas law requires a motor vehicle dealer's inventory to be appraised based on the total sales of motor vehicles in the prior year. A dealer must file an annual declaration of total sales from the prior year with their county appraisal district.

Who is exempt from motor vehicle sales tax in Texas?

A motor vehicle purchased in Texas for use exclusively outside Texas is exempt from motor vehicle sales tax. To claim the exemption, a purchaser must not use the motor vehicle in Texas, except for transportation directly out of state, and must not register the motor vehicle in Texas.

What is the dealer inventory tax rate in Texas?

Sales: 6.25 percent of sales price, minus any trade-in allowance. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value.

Is there an inventory tax in Texas?

Texas is among nine states that have an Inventory Tax levied on the products, materials, and equipment that a business uses to keep its doors open.

What is the unit property tax factor in Texas?

The unit property tax factor is calculated by dividing the prior year's aggregate tax rate by 12. If the aggregate tax rate is expressed in dollars per $100 of valuation, divide by $100 and then divide by 12. It represents one-twelfth of the preceding year's aggregate tax rate at the location.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit TX Comptroller 50-244 from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including TX Comptroller 50-244, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I edit TX Comptroller 50-244 on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing TX Comptroller 50-244, you can start right away.

How do I edit TX Comptroller 50-244 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share TX Comptroller 50-244 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is TX Comptroller 50-244?

TX Comptroller 50-244 is a form used in Texas for reporting the property value of certain properties that are subject to property tax exemptions or specific ad valorem tax requirements.

Who is required to file TX Comptroller 50-244?

Property owners who claim a property tax exemption or those who are required to report specific property value information to the Texas Comptroller's office must file TX Comptroller 50-244.

How to fill out TX Comptroller 50-244?

To fill out TX Comptroller 50-244, provide accurate information regarding property details, ownership data, exemptions claimed, and any other relevant financial information as directed in the form instructions.

What is the purpose of TX Comptroller 50-244?

The purpose of TX Comptroller 50-244 is to provide the Texas Comptroller with necessary information for assessing property values and ensuring compliance with property tax exemption laws.

What information must be reported on TX Comptroller 50-244?

The information reported on TX Comptroller 50-244 includes property identification details, owner's name and contact information, the type of property tax exemption claimed, and any other pertinent information that helps in the assessment of the property's value.

Fill out your TX Comptroller 50-244 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller 50-244 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.