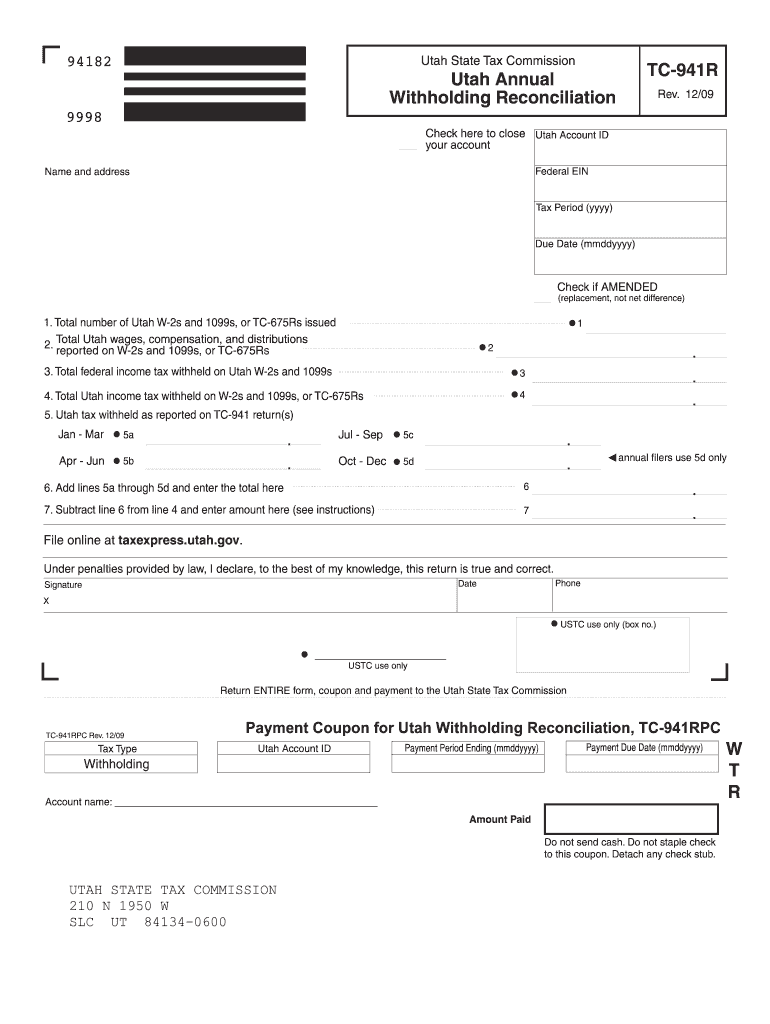

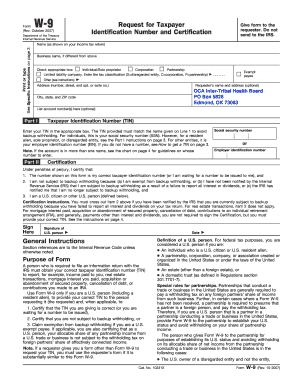

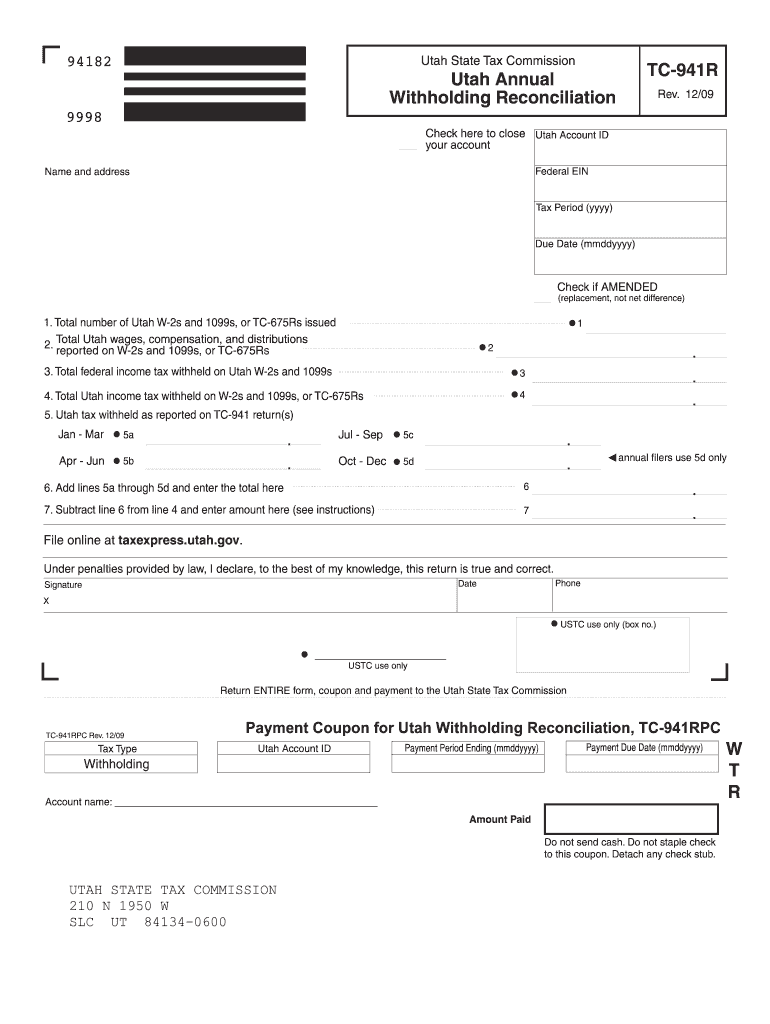

UT USTC TC-941R 2009 free printable template

Get, Create, Make and Sign UT USTC TC-941R

Editing UT USTC TC-941R online

Uncompromising security for your PDF editing and eSignature needs

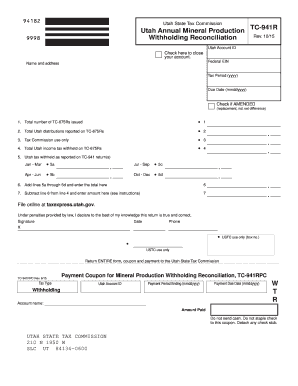

UT USTC TC-941R Form Versions

How to fill out UT USTC TC-941R

How to fill out UT USTC TC-941R

Who needs UT USTC TC-941R?

Instructions and Help about UT USTC TC-941R

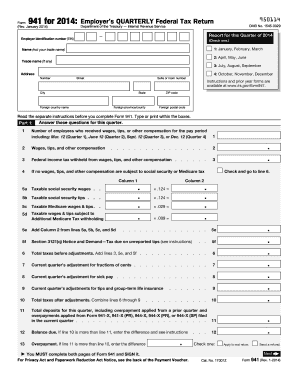

Tax form 941 also known as the employers quarterly federal tax return it's typically used by most small businesses this video or the series of videos is going to show you how to fill out quarterly federal tax return the first thing you'll need to do is to fill in the personal information that personal information involves filling in your employer identification number and in case you're not familiar with the employer identification number it's a nine-digit number that the federal government uses to identify you as an employer who is subject to tax withholding and reporting it also ensures that your business receives the proper credit for payments of taxes withheld its kind of like having a social security number for your business now if you don't have one you need to get one an EIN can easily be obtained by applying for one on the IRS website and completing the form SS — four will make sure that there is a link at the bottom of this video, so you're going to want to fill in your employer identification number as well as your name and after that you're going to want to also fill in your trade name or also business name is another word for it and your business address now if you take a look at the example that we have on the screen we've already gone ahead, and we've done that we've put in the end all the other personal information the next thing you're going to want to do is you're going to want to select the appropriate reporting period or the appropriate calendar quarter for the period that you're filing for in this case we have checked quarter number three or period number three which would be July August and September now the rest of this video is going to step you through the five parts and the 18 steps on this federal form, and it's going to show you how to fill it out, and we'll get started with the other parts in a second

People Also Ask about

Do I need a Utah income tax withholding account?

Does Utah have a state withholding form for employees?

What is the format for Utah withholding account number?

Is there a Utah withholding form?

How much do I have to withhold for Utah state taxes?

How much is Utah state withholding?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my UT USTC TC-941R directly from Gmail?

How can I edit UT USTC TC-941R from Google Drive?

Can I create an electronic signature for the UT USTC TC-941R in Chrome?

What is UT USTC TC-941R?

Who is required to file UT USTC TC-941R?

How to fill out UT USTC TC-941R?

What is the purpose of UT USTC TC-941R?

What information must be reported on UT USTC TC-941R?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.