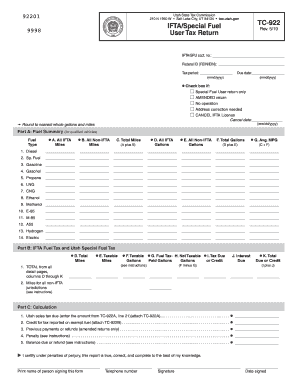

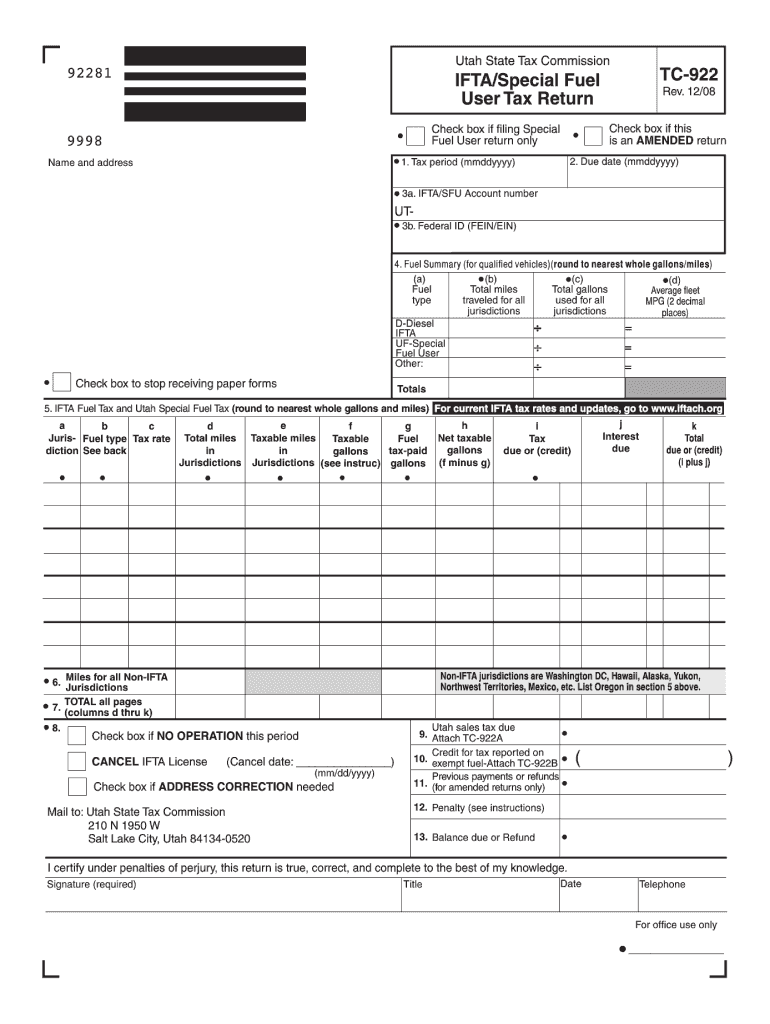

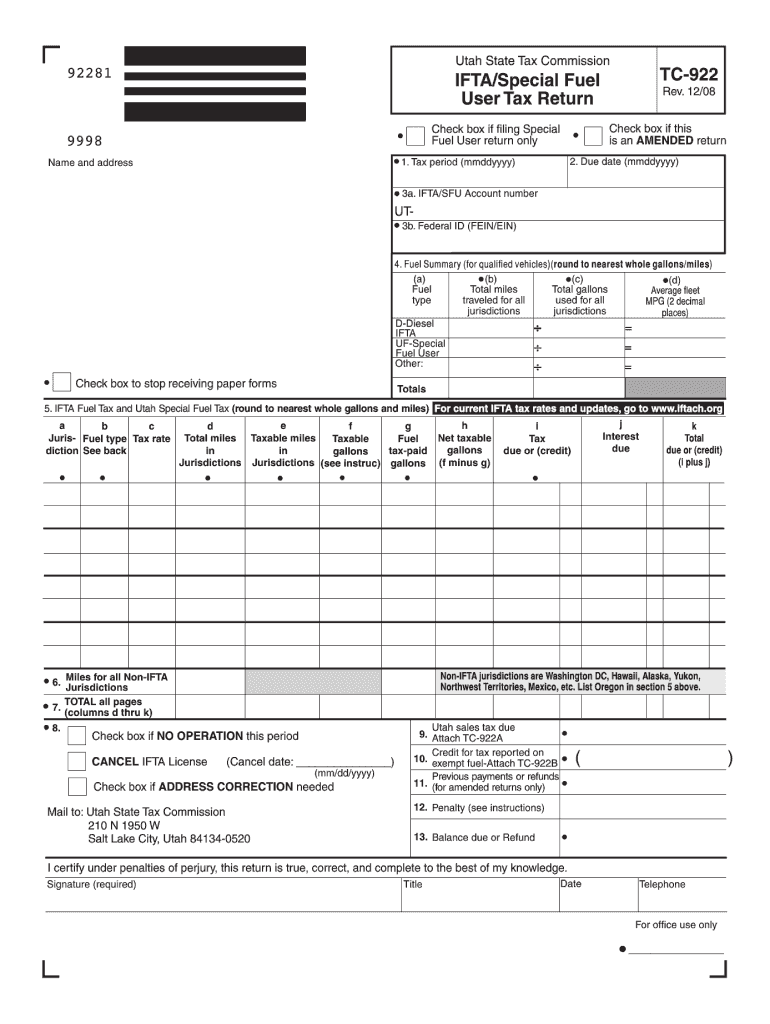

UT USTC TC-922 2008 free printable template

Show details

Attach TC-922A Credit for tax reported on 10. exempt fuel-Attach TC-922B Previous payments or refunds 11. for amended returns only 12. Penalty see instructions 13. Balance due or Refund I certify under penalties of perjury this return is true correct and complete to the best of my knowledge. Signature required Title Date Telephone For office use only 90000 Instructions For TC-922 Each IFTA licensee must file quarterly tax returns and submit payment of the tax if any is due. Clear form Utah...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT USTC TC-922

Edit your UT USTC TC-922 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT USTC TC-922 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UT USTC TC-922 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit UT USTC TC-922. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT USTC TC-922 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT USTC TC-922

How to fill out UT USTC TC-922

01

Begin by obtaining the UT USTC TC-922 form from the relevant website or office.

02

Fill out your personal information in the designated fields, including your name, address, and contact information.

03

Provide details related to the reason for your application, ensuring you clearly state the purpose.

04

Include any necessary supporting documents or information as required by the form.

05

Review the form for accuracy and completeness before submission.

06

Submit the completed form through the specified method (online, mail, or in-person).

07

Keep a copy of the submitted form for your records.

Who needs UT USTC TC-922?

01

Individuals applying for a specific service or benefit as outlined in the UT USTC TC-922 form.

02

Businesses or organizations that are required to complete the form for compliance or reporting purposes.

03

Anyone involved in transactions that necessitate the use of the UT USTC TC-922 form.

Fill

form

: Try Risk Free

People Also Ask about

What is the corporate income tax in Utah?

Utah also has a flat 4.85 percent corporate income tax. Utah has a 6.10 percent state sales tax rate, a max local sales tax rate of 2.95 percent, and an average combined state and local sales tax rate of 7.19 percent. Utah's tax system ranks 8th overall on our 2023 State Business Tax Climate Index.

Where do I send my Utah state tax return?

All offices are closed on state holidays. Ogden. 2540 Washington Blvd. 6th floor. Ogden, Utah 84401. Provo. 150 East Center #1300. Provo, Utah 84606. 801-374-7070. Salt Lake City. 210 North 1950 West. Salt Lake City, Utah 84116. 801-297-2200, option “0” Washington County – Tax Commission. 100 South 5300 West. Hurricane, Utah 84737.

Does Utah have a state income tax form?

Utah Income Taxes. Utah State Income Taxes for Tax Year 2022 (January 1 - Dec. 31, 2022) can be prepared and e-Filed now along with an IRS or Federal Income Tax Return (or you can learn how to only prepare and file a UT state return).

What is TC 40S?

More about the Utah Form TC-40S Tax Credit We last updated Utah Form TC-40S in January 2023 from the Utah State Tax Commission. This form is for income earned in tax year 2022, with tax returns due in April 2023.

What is a TC-40B form?

General Information. Use TC-40B to calculate the Utah tax for a nonresident or a part-year resident.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in UT USTC TC-922 without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing UT USTC TC-922 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I edit UT USTC TC-922 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share UT USTC TC-922 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I complete UT USTC TC-922 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your UT USTC TC-922 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is UT USTC TC-922?

UT USTC TC-922 is a tax form used in the United States for reporting specific tax information related to certain types of income or tax situations.

Who is required to file UT USTC TC-922?

Individuals or entities that meet certain criteria regarding their income, tax obligations, or specific situations outlined by the IRS are required to file UT USTC TC-922.

How to fill out UT USTC TC-922?

To fill out UT USTC TC-922, gather the necessary financial documents and information, follow the instructions provided with the form, and complete each section accurately.

What is the purpose of UT USTC TC-922?

The purpose of UT USTC TC-922 is to ensure accurate reporting of income and to facilitate proper tax assessment and compliance with U.S. tax laws.

What information must be reported on UT USTC TC-922?

The information that must be reported on UT USTC TC-922 typically includes details about income, deductions, credits, and other relevant financial information as required by the IRS.

Fill out your UT USTC TC-922 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT USTC TC-922 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.