2290 Tax Due Date

What is 2290 tax due date?

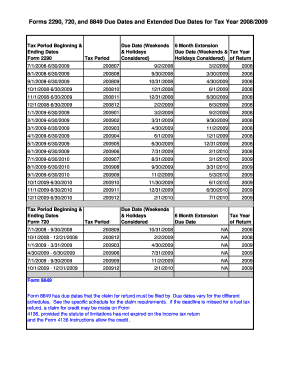

The 2290 tax due date refers to the deadline by which heavy highway vehicle owners are required to file Form 2290 and pay their annual federal excise tax. This tax is imposed on vehicles with a gross weight of 55,000 pounds or more that are used on public highways. The 2290 tax due date for most vehicles is August 31st of each year. It is important to submit your Form 2290 and make the necessary payment by the due date to avoid penalties and interest charges.

What are the types of 2290 tax due date?

There are two types of 2290 tax due dates based on when the vehicle is first used during the tax period. The regular due date is August 31st, and it applies to vehicles that are used on the road from July 1st to June 30th of the following year. The alternative due date is used for vehicles that are first used on the road after July of the tax period. In this case, the due date will be the last day of the month following the month of first use.

How to complete 2290 tax due date

Completing the 2290 tax due date is a straightforward process. Follow these steps to ensure you meet the requirements and file your form accurately:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done. By using pdfFiller, users can easily complete and file their Form 2290 on time, ensuring compliance with the 2290 tax due date.