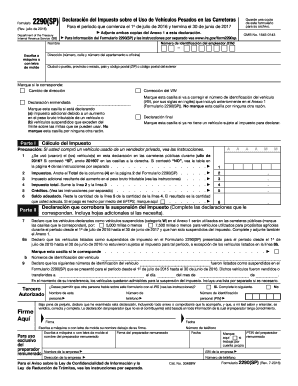

What is 2290 form 2017?

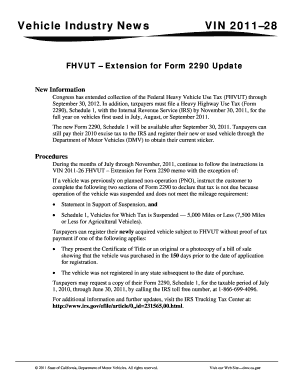

The 2290 form 2017, also known as the Heavy Highway Vehicle Use Tax Return, is a form that must be filed with the Internal Revenue Service (IRS) by owners of heavy vehicles that have a taxable gross weight of 55,000 pounds or more. This form is used to report and pay the annual vehicle use tax. It is important for owners of heavy vehicles to file this form accurately and on time to avoid penalties and interest charges.

What are the types of 2290 form 2017?

There are three main types of 2290 forms for the year 2017:

Form 2290 for vehicles used during the entire tax period, which is from July 1 to June 30 of the following year.

Form 2290 for vehicles first used in the month of July.

Form 2290 for suspended vehicles, which are those that are expected to be used for less than 5,000 miles during the tax period (7,500 miles for agricultural vehicles).

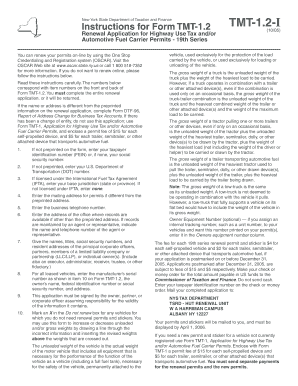

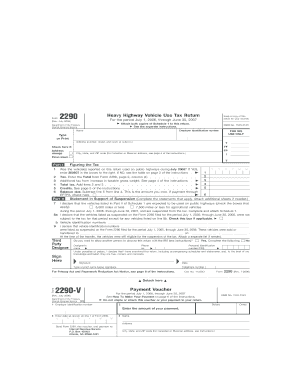

How to complete 2290 form 2017

Completing the 2290 form 2017 involves several steps. Here is a step-by-step guide to help you through the process:

01

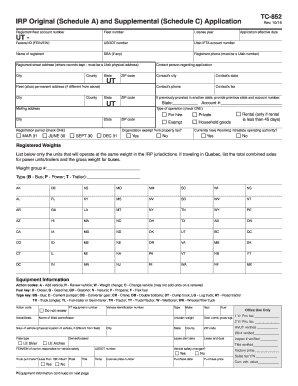

Gather all the required information, including your Employer Identification Number (EIN), vehicle details, and the taxable gross weight.

02

Determine the type of 2290 form you need to file based on the usage and first use month of your vehicle.

03

Calculate the vehicle use tax amount based on the taxable gross weight and the first use month of the vehicle.

04

Fill out the form accurately, providing all the required information and calculations.

05

Sign the form electronically or by mail, depending on your preferred method of filing.

06

Pay the vehicle use tax electronically or by mail, ensuring you submit the correct payment amount.

07

Keep a copy of the completed form and proof of payment for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.