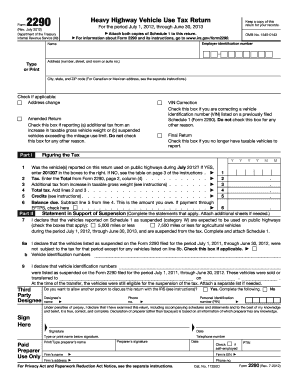

Form 2290 Instructions

What is form 2290 instructions?

Form 2290 instructions refer to the guidelines provided by the Internal Revenue Service (IRS) for filling out and filing Form 2290, also known as the Heavy Highway Vehicle Use Tax Return. These instructions are essential for individuals and businesses that own and operate heavy vehicles weighing 55,000 pounds or more on public highways. By following these instructions, taxpayers can ensure that they accurately report and pay the required taxes on their heavy vehicles.

What are the types of form 2290 instructions?

Form 2290 instructions can be broadly classified into two types: general instructions and specific instructions. General Instructions: These instructions provide an overview of the form, explain who must file, and outline the tax rates and payment deadlines. They also cover topics such as when to use Form 2290 and how to calculate the tax amount. Specific Instructions: These instructions guide taxpayers on how to fill out each section of Form 2290 in detail. They provide step-by-step directions, explain various terms and fields, and include examples for better understanding. By familiarizing themselves with both types of form 2290 instructions, taxpayers can ensure compliance with IRS regulations and accurately complete their tax returns.

How to complete form 2290 instructions

To complete form 2290 instructions and file your Heavy Highway Vehicle Use Tax Return, follow these steps:

By following these simple steps and carefully adhering to the form 2290 instructions, you can fulfill your tax obligations and ensure proper reporting of your heavy vehicles. Remember, for a more convenient and efficient experience, consider using pdfFiller to create, edit, and share your documents online. With its unlimited fillable templates and powerful editing tools, pdfFiller is the ideal PDF editor to help you get your documents done quickly and accurately.