Get the free Schedule ED - revenue wi

Show details

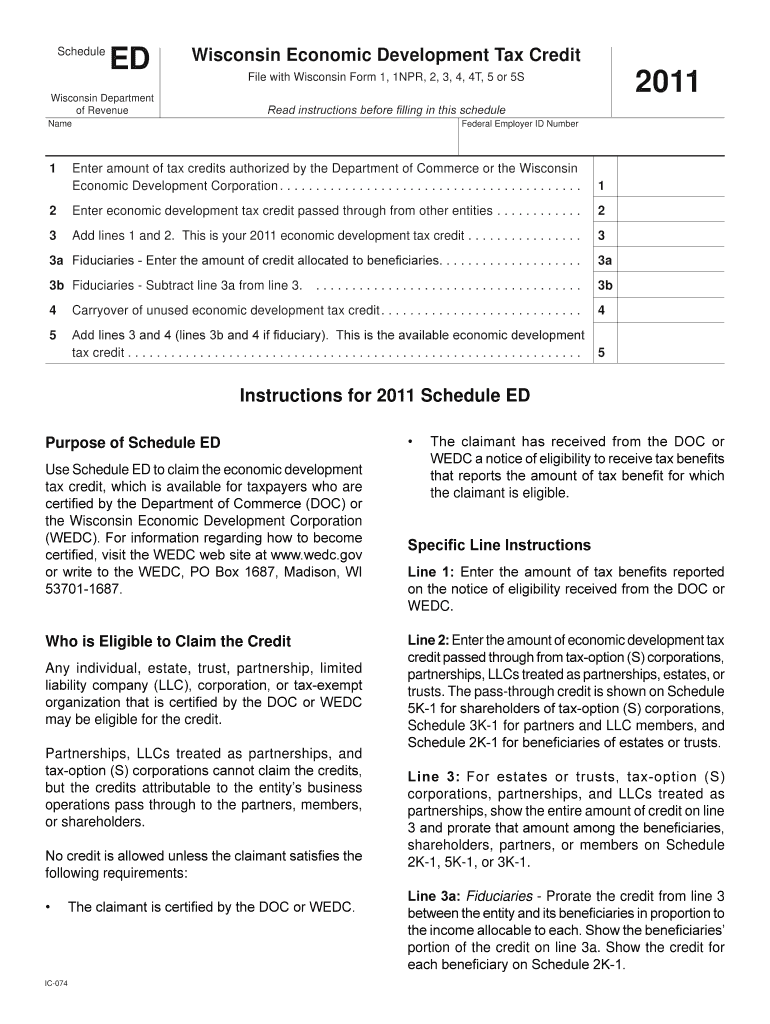

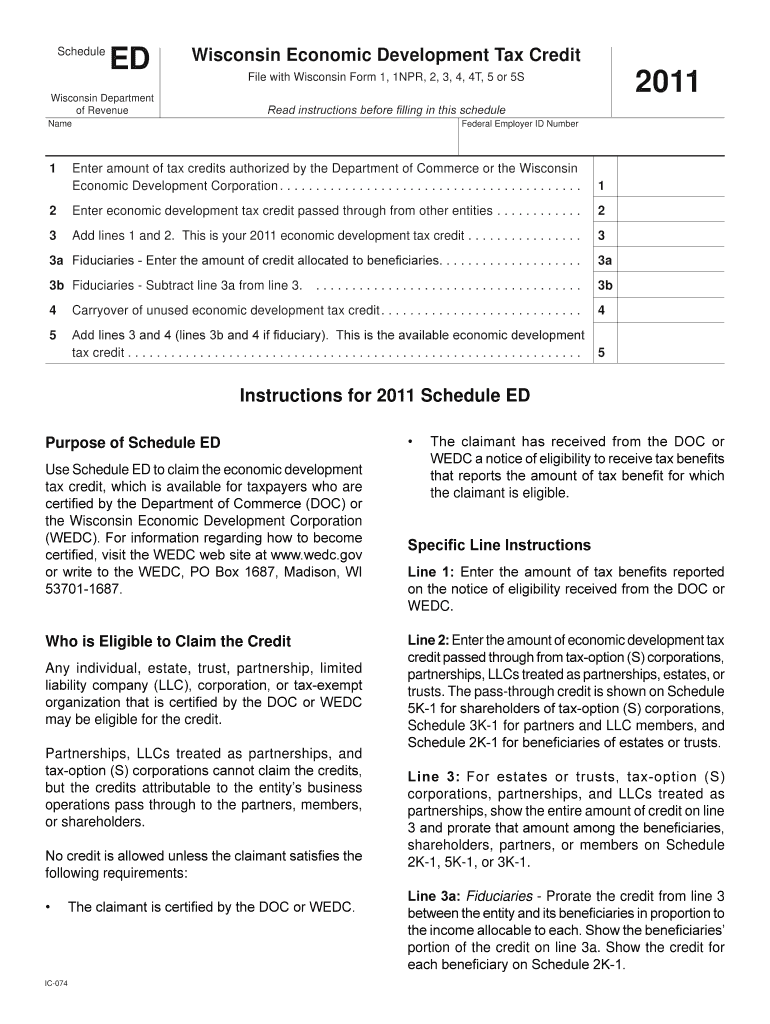

Use Schedule ED to claim the economic development tax credit, available for taxpayers certified by the Department of Commerce or the Wisconsin Economic Development Corporation. The form includes specific

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule ed - revenue

Edit your schedule ed - revenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule ed - revenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule ed - revenue online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit schedule ed - revenue. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule ed - revenue

How to fill out Schedule ED

01

Obtain the Schedule ED form from the IRS website or your tax software.

02

Gather all necessary supporting documents, such as estate information and income details.

03

Fill out the identifying information at the top of the form, including your name and social security number.

04

Complete Part I by providing a summary of the decedent's estate, including assets, liabilities, and expenses.

05

Complete Part II by listing the distributions made to beneficiaries, ensuring accurate amounts are reported.

06

Review the instructions for any specific requirements related to your situation.

07

Sign and date the form before submitting it with your overall tax return.

Who needs Schedule ED?

01

Executors or administrators of estates that need to report income generated by an estate.

02

Beneficiaries receiving distributions from an estate that need to report their share of income.

03

Individuals involved in the estate settlement process who must comply with tax filing requirements.

Fill

form

: Try Risk Free

People Also Ask about

What is English ED?

An English education degree will prepare you to teach English language arts at the secondary level (grades 5-12). To that end, the program integrates best practices in teacher education with essential content knowledge in English language arts.

How many hours do I need to study English?

How long does it take to learn English? Level of English (CEFR)Number of hours of instruction A2 to B1 100-200 hours From A1: 300-500 hours B1 to B2 150-200 hours From A1: 500-700 hours B2 to C1 200-250 hours From A1: 700-950 hours C1 to C2 200-250 hours From A1: 900-1200 hours2 more rows

What is the best schedule for learning English?

Example schedules: Every morning: 15 minutes of vocabulary while having your morning coffee. Two lunch breaks a week: 20 minutes of listening (podcast/video) Tuesday and Thursday evenings: 50 minutes of studying with a 1-on-1 tutor.

How many hours do I need to learn English?

How long does it take to learn English? Level of English (CEFR)Number of hours of instruction A2 to B1 100-200 hours From A1: 300-500 hours B1 to B2 150-200 hours From A1: 500-700 hours B2 to C1 200-250 hours From A1: 700-950 hours C1 to C2 200-250 hours From A1: 900-1200 hours2 more rows

What is Ed D in English?

The Doctor of Education (Ed. D.)

How much time should I study English?

Specifically, a year is the average amount of time it will take an adult to become fluent enough to work in English if he starts out as a beginner and studies at least 5 hours a day. But everyone is different. How long it will take you to learn English depends on many things: Your current level of English.

How many hours of English do you need to be fluent?

How long does it take to become fluent in English, to be more specific? The common consensus states that it typically takes anywhere between 70 and over 1100 hours to learn conversational English. The time really depends on the level that you want to reach.

Can I learn English in 3 months?

However, while learning English can be exciting, it's also challenging. Many people believe it takes years to become fluent—but what if we told you that you could learn English in just 3 months? Yes, it's possible with the right plan, resources, and commitment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule ED?

Schedule ED is an IRS form that is used by certain entities to report information and data about their education expenses in relation to tax credits.

Who is required to file Schedule ED?

Entities that are eligible to claim education-related tax credits or those who are required to report education expenses must file Schedule ED.

How to fill out Schedule ED?

To fill out Schedule ED, you need to provide detailed information about the educational institution, the types of expenses incurred, and the eligible students. Follow the IRS instructions and provide all required documentation.

What is the purpose of Schedule ED?

The purpose of Schedule ED is to facilitate the reporting of education expenses to determine eligibility for tax benefits related to educational expenses.

What information must be reported on Schedule ED?

Schedule ED requires reporting of information such as the name and address of the educational institution, the type of expenses incurred (tuition, fees, etc.), and the identification details of the eligible student.

Fill out your schedule ed - revenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule Ed - Revenue is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.