Get the free CAPITAL ACQUISITIONS TAX - revenue

Show details

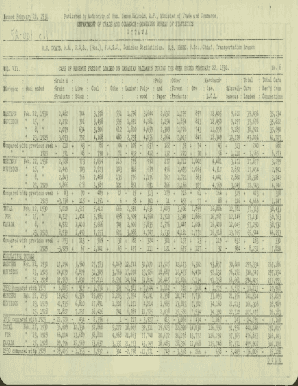

This document is a form to claim business relief for capital acquisitions tax on gifts or inheritances taken on or after 6 December, 2000, including instructions and calculations related to relevant

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign capital acquisitions tax

Edit your capital acquisitions tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your capital acquisitions tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit capital acquisitions tax online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit capital acquisitions tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out capital acquisitions tax

How to fill out CAPITAL ACQUISITIONS TAX

01

Gather necessary documentation, including the details of the asset acquired and its value.

02

Determine the date of acquisition, as the tax rate may vary depending on when the asset was acquired.

03

Calculate the tax based on the value of the asset using the relevant tax rate.

04

Complete the appropriate tax forms, ensuring all information is accurate and complete.

05

Submit the forms to the tax authority by the specified deadline.

06

Keep copies of all documents and submissions for your records.

Who needs CAPITAL ACQUISITIONS TAX?

01

Individuals or entities that receive gifts, inheritances, or certain types of capital assets.

02

Beneficiaries of estates or trusts that exceed the tax exemption threshold.

03

Any party involved in transactions that trigger capital acquisitions taxes in their jurisdiction.

Fill

form

: Try Risk Free

People Also Ask about

What is the new CAT rule?

The 'Rule of Three' means that you can gauge the time it might take for your cat to fully acclimate to his home in threes: three days, three weeks, and three months. Three Days: Be Patient! The first 3 days are the initial “detox period” as the cat transitions from the shelter to your home.

What is the 5 year CAT rule?

An inheritance taken by a parent on the death of a child to whom either parent had made a non-exempt gift in the previous 5 years is exempt from CAT. A gift or inheritance for public or charitable purposes is exempt from CAT.

What is a CAT tax?

Noun. cat tax (plural cat taxes) (Internet slang) An image or video of one's pet cat posted online, seen as a duty to be fulfilled upon introduction to a forum or social media platform.

How to avoid Irish inheritance tax?

If the parents are married or in a civil partnership, they can pass assets between each other completely tax-free. So inheritance tax doesn't usually bite after the first parent dies — the surviving spouse simply inherits everything without a bill from Revenue.

What does CAT mean in business?

You must file a Capital Acquisitions Tax (CAT) IT38 Return if the total taxable value of the benefits taken exceeds 80% of the relevant group threshold.

Is CAT the same as inheritance tax?

CAT is a tax on gifts and inheritances. You may receive gifts and inheritances up to a set value over your lifetime before having to pay CAT.

What is the lifetime gift tax exemption for 2025?

The lifetime gift/estate tax exemption is $13.99 million in 2025. The lifetime gift/estate tax exemption is projected to be $7 million in 2026.

What is capital acquisition tax?

CAT is a tax on gifts and inheritances. You may receive gifts and inheritances up to a set value over your lifetime before having to pay CAT. Once due, it is charged at the current rate of 33% (valid from 6 December 2012). For more information on previous rates see CAT thresholds, rates and rules.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CAPITAL ACQUISITIONS TAX?

Capital Acquisitions Tax (CAT) is a tax imposed on the value of property acquired through inheritance or gift.

Who is required to file CAPITAL ACQUISITIONS TAX?

Individuals who receive gifts or inheritances that exceed the tax-free threshold must file Capital Acquisitions Tax.

How to fill out CAPITAL ACQUISITIONS TAX?

To fill out Capital Acquisitions Tax, individuals must complete a tax return form, providing details about the estate or gift, including the relationship to the deceased or donor and the value of the assets.

What is the purpose of CAPITAL ACQUISITIONS TAX?

The purpose of Capital Acquisitions Tax is to generate revenue for the government and to impose a tax on wealth transfers from one generation to another.

What information must be reported on CAPITAL ACQUISITIONS TAX?

The information that must be reported includes the full name and address of the donor or deceased, the recipient's details, a description of the property acquired, its market value, and any exemptions or reliefs claimed.

Fill out your capital acquisitions tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Capital Acquisitions Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.