Canada CPT30 E 2011 free printable template

Show details

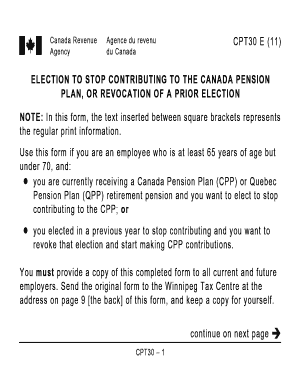

Privacy Act Personal Information Bank number CRA PPU 005 CPT30 E 11 Vous pouvez obtenir ce formulaire en fran ais www. ELECTION TO STOP CONTRIBUTING TO THE CANADA PENSION PLAN OR REVOCATION OF A PRIOR ELECTION Use this form if you are an employee who is at least 65 years of age but under 70 and you are currently receiving a Canada Pension Plan CPP or Quebec Pension Plan QPP retirement pension and you want to elect to stop contributing to the CPP or you elected in a previous year to stop...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada CPT30 E

Edit your Canada CPT30 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada CPT30 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada CPT30 E online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit Canada CPT30 E. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada CPT30 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada CPT30 E

How to fill out Canada CPT30 E

01

Obtain a copy of the Canada CPT30 E form from the Canada Revenue Agency website.

02

Fill in your personal information such as name, address, and contact details in the appropriate sections.

03

Complete the 'Part 1 - Information about your business' section by providing details about your business activities.

04

In 'Part 2 - Information about your income and expenses', accurately report your income and expenses related to your business.

05

Ensure you correctly enter any applicable deductions and tax credits in 'Part 3 - Deductions and credits'.

06

Review all provided information for accuracy and completeness.

07

Sign and date the form to confirm your submission.

08

Submit the completed form to the Canada Revenue Agency by the specified deadline.

Who needs Canada CPT30 E?

01

Individuals and businesses that have to report amounts owed to the Canada Revenue Agency.

02

Self-employed individuals or sole proprietors managing their business affairs.

03

Anyone who has received a notice from the Canada Revenue Agency requesting completion of the CPT30 E form.

Fill

form

: Try Risk Free

People Also Ask about

Where do I send CPT30?

Where do you send the form? You are responsible for sending an original completed Form CPT30 to the CRA. If you agree to have your employer send the original to the CRA, the CRA will accept it.

Under what circumstances is CPP proration necessary?

Note: A proration is performed in the case of an employee who turns 70 or who begins to receive a retirement pension from the CPP or QPP in the year.

Does the CPT30 need to be filed every year?

Once you file this form with your employer, you cannot make a change until the next calendar year. So, if for example, you elect to stop making CPP contributions and you give a copy of this completed form to your employer in the current year, you will have to wait until next year to file a new form to restart.

When should I file CPT30?

The signing date of CPT30 has to be after your 65th birthday. You only need to send CRA one copy of CPT30 and it will stay in effect until you turn 70 years old (at that time you don't need to pay CPP anyway). These are the general rules.

When should I file a CPT30?

Fill out this form if you are an employee who is at least 65 years of age but under 70, you are receiving a Canada Pension Plan (CPP) or Quebec Pension Plan (QPP) retirement pension, and you are making CPP contributions and would like to stop.

What is the meaning of CPT30?

CPT30 Election to Stop Contributing to the Canada Pension Plan, or Revocation of a Prior Election.

How do I submit CPP?

- You can choose to apply for your CPP retirement pension online through your My Service Canada Account. Applying online is easy, safe, and fast! For more information, visit .canada.ca/msca. - You can choose to complete a paper application or a fillable form that can be found online at .canada.ca/esdc-forms.

How do I submit a CPT30?

Promptly give a copy of the form to your employer. If you are working or will work for more than one employer, give each employer a copy of this completed form. Keep a copy of the form for your records. Finally, send the original form to the Winnipeg Tax Centre at the address on this page.

How to calculate CPP deductions 2023?

As of 2023, if you earn less than the earnings ceiling, there will be no further rate increases for you. The CPP contribution rate will stay at 5.95% for employers and employees and at 11.9% for people who are self-employed, unless their earnings rise higher than the earnings ceiling.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in Canada CPT30 E without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your Canada CPT30 E, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit Canada CPT30 E on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share Canada CPT30 E from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I edit Canada CPT30 E on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share Canada CPT30 E on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is Canada CPT30 E?

Canada CPT30 E is a tax form used by employers to report amounts paid to employees and certain other recipients for the purposes of calculating and remitting income tax deductions.

Who is required to file Canada CPT30 E?

Employers who pay salary, wages, or other payments to employees or recipients are required to file the Canada CPT30 E form to report these amounts and remit applicable withholdings.

How to fill out Canada CPT30 E?

To fill out the Canada CPT30 E, employers must provide details such as the total amounts paid to each employee, the type of payments, the income tax deducted, and the relevant employer identification number.

What is the purpose of Canada CPT30 E?

The purpose of Canada CPT30 E is to provide the Canada Revenue Agency (CRA) with accurate information about employment income and taxes withheld, ensuring proper compliance with tax obligations.

What information must be reported on Canada CPT30 E?

The information that must be reported on Canada CPT30 E includes the employer's identification details, recipient information, total amounts paid, and income tax amounts withheld from each recipient.

Fill out your Canada CPT30 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada cpt30 E is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.