Canada MBT-RL1 2013 free printable template

Show details

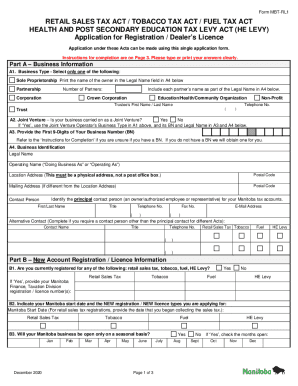

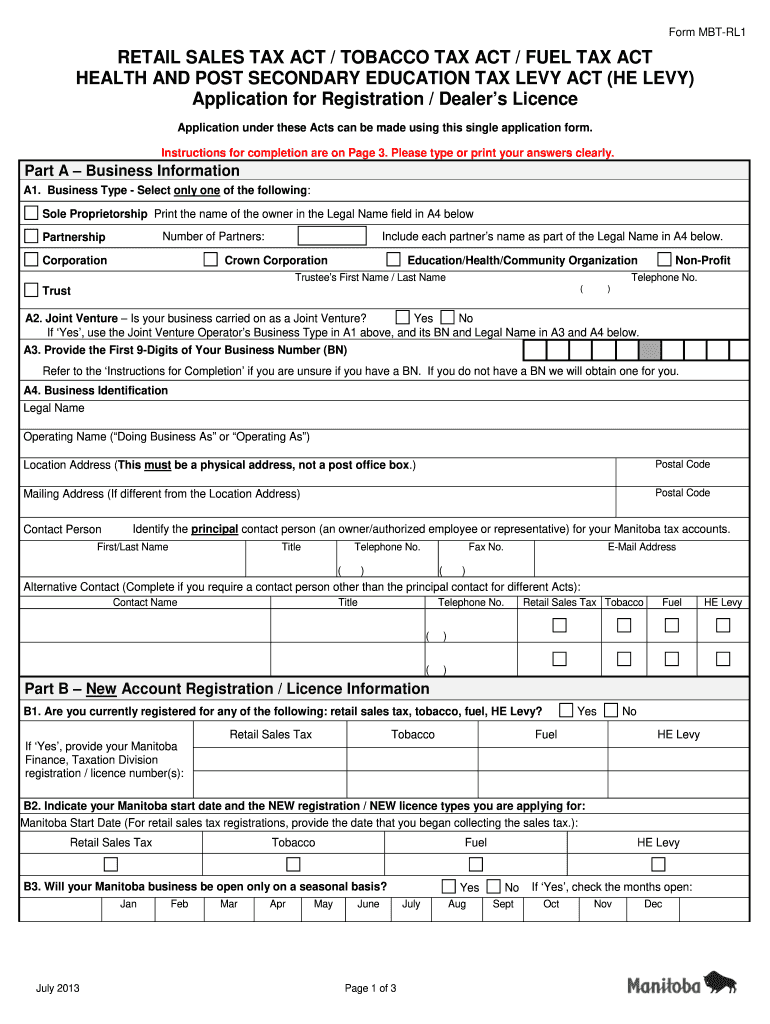

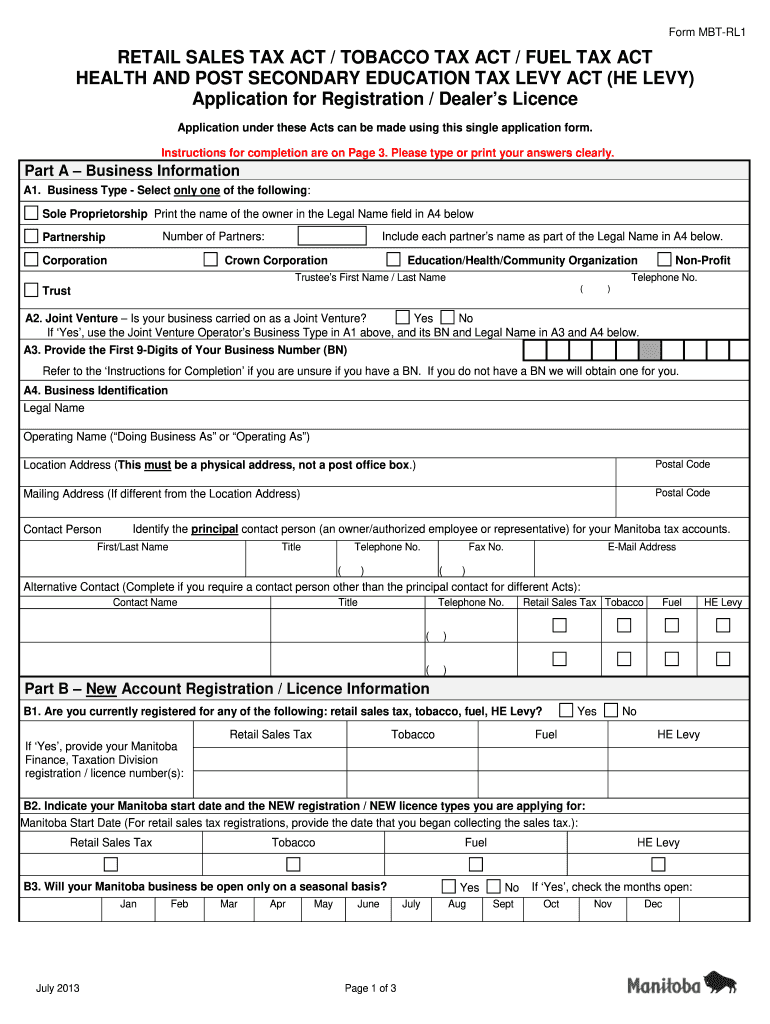

Form MBT-RL1 RETAIL SALES TAX ACT / TOBACCO TAX ACT / FUEL TAX ACT HEALTH AND POST SECONDARY EDUCATION TAX LEVY ACT HE LEVY Application for Registration / Dealer s Licence Application under these Acts can be made using this single application form. Instructions for completion are on Page 3. Please type or print your answers clearly. Part A Business Information A1. Business Type - Select only one of the following Sole Proprietorship Print the name of the owner in the Legal Name field in A4...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada MBT-RL1

Edit your Canada MBT-RL1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada MBT-RL1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada MBT-RL1 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit Canada MBT-RL1. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada MBT-RL1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada MBT-RL1

How to fill out Canada MBT-RL1

01

Obtain the Canada MBT-RL1 form from the official Canadian government website or relevant agency.

02

Read the instructions provided with the form carefully.

03

Start by filling out your personal information, including your name, address, and contact details.

04

Provide the necessary identification details as required, such as your Social Insurance Number (SIN) if applicable.

05

Complete the specific sections relevant to your situation, following any guidance provided.

06

Double-check all entries for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form to the designated address or online platform as instructed.

Who needs Canada MBT-RL1?

01

Individuals or businesses that are required to report specific information to the Canadian government.

02

People seeking to claim certain deductions or credits.

03

Taxpayers needing to disclose particular details for compliance with Canadian tax regulations.

04

Professionals assisting clients with financial planning or tax preparation may also need it for their clients.

Fill

form

: Try Risk Free

People Also Ask about

Where can I find my Relevé 1?

Where do I claim this? Under the QUICK ENTRY tab, click the QUICK SLIP icon. You will find yourself here: Type RL-1 or relevé 1 in the search field and either click the highlighted selection or press Enter to continue. When you arrive at the page for your RL-1, enter your information into the tax software.

What is RL-1 summary filing?

Purpose of the RL-1 summary You use the RL-1 summary to compare the source deductions of income tax, Québec Pension Plan (QPP) contributions, Québec parental insurance plan (QPIP) premiums and the contribution to the health services fund with the duties you reported for the year.

What does RL-1 mean?

You'll receive a Relevé 1: Employment and other income (RL-1) from each Québec-based employer you worked for during the year. This slip shows your income as well as any amounts deducted from it, including income tax, QPP contributions, and union dues.

How to file RL-1 online?

To file, you can use: the online services in My Account for businesses; software authorized by Revenu Québec for filing RL-1 slips; software you have developed for filing RL-1 slips that meets our requirements; the PDF RL-1 slip (in French only) that can be completed onscreen; or. the paper RL-1 slip that we provide.

What is RL-1 tax information?

The RL-1 slip must be filed by any employer or payer that paid amounts such as salaries, wages, gratuities, tips, fees, scholarships or commissions. The information on the RL-1 slip is used by individuals to complete the personal income tax return (TP-1-V).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute Canada MBT-RL1 online?

Completing and signing Canada MBT-RL1 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make changes in Canada MBT-RL1?

With pdfFiller, it's easy to make changes. Open your Canada MBT-RL1 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I create an eSignature for the Canada MBT-RL1 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your Canada MBT-RL1 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is Canada MBT-RL1?

Canada MBT-RL1 is a tax form used in Canada to report the results of certain business activities for the Municipal Business Tax.

Who is required to file Canada MBT-RL1?

Businesses operating in municipalities that impose a Municipal Business Tax are required to file Canada MBT-RL1.

How to fill out Canada MBT-RL1?

To fill out Canada MBT-RL1, businesses need to provide their identification details, revenue figures, and any deductions or credits applicable, following the instructions provided with the form.

What is the purpose of Canada MBT-RL1?

The purpose of Canada MBT-RL1 is to assess and collect the Municipal Business Tax based on the operations and revenues of businesses within the municipality.

What information must be reported on Canada MBT-RL1?

The Canada MBT-RL1 requires reporting of business identification, total revenue, expenses, net income, and any other relevant financial details required by the municipality.

Fill out your Canada MBT-RL1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada MBT-rl1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.