Canada MBT-RL1 2014 free printable template

Show details

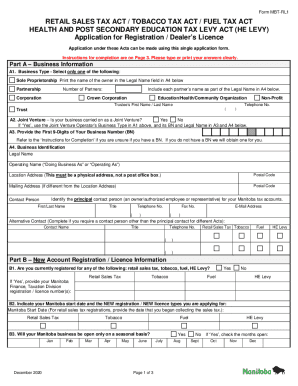

Form MBT-RL1 RETAIL SALES TAX ACT / TOBACCO TAX ACT / FUEL TAX ACT HEALTH AND POST SECONDARY EDUCATION TAX LEVY ACT HE LEVY Application for Registration / Dealer s Licence Application under these Acts can be made using this single application form. Instructions for completion are on Page 3. Please type or print your answers clearly. Part A Business Information A1. Business Type - Select only one of the following Sole Proprietorship Print the name of the owner in the Legal Name field in A4...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada MBT-RL1

Edit your Canada MBT-RL1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada MBT-RL1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada MBT-RL1 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Canada MBT-RL1. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada MBT-RL1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada MBT-RL1

How to fill out Canada MBT-RL1

01

Start by gathering all necessary personal identification information, including your full name, address, and contact details.

02

Obtain your employment history and income details for the past fiscal year.

03

Locate the specific sections on the form that require your data and fill in each section accurately.

04

If applicable, provide details regarding any tax credits or deductions you are claiming.

05

Review your completed form for any errors or omissions.

06

Sign and date the form where indicated.

07

Submit the form as directed, either electronically or by mailing it to the specified address.

Who needs Canada MBT-RL1?

01

Individuals who are required to report their income to the Canada Revenue Agency (CRA) for tax purposes.

02

Employees or self-employed workers who have earned income in Canada.

03

Those who are claiming specific tax credits or deductions relevant to their financial situation.

Fill

form

: Try Risk Free

People Also Ask about

Where can I find my Relevé 1?

Where do I claim this? Under the QUICK ENTRY tab, click the QUICK SLIP icon. You will find yourself here: Type RL-1 or relevé 1 in the search field and either click the highlighted selection or press Enter to continue. When you arrive at the page for your RL-1, enter your information into the tax software.

What is RL-1 summary filing?

Purpose of the RL-1 summary You use the RL-1 summary to compare the source deductions of income tax, Québec Pension Plan (QPP) contributions, Québec parental insurance plan (QPIP) premiums and the contribution to the health services fund with the duties you reported for the year.

What does RL-1 mean?

You'll receive a Relevé 1: Employment and other income (RL-1) from each Québec-based employer you worked for during the year. This slip shows your income as well as any amounts deducted from it, including income tax, QPP contributions, and union dues.

How to file RL-1 online?

To file, you can use: the online services in My Account for businesses; software authorized by Revenu Québec for filing RL-1 slips; software you have developed for filing RL-1 slips that meets our requirements; the PDF RL-1 slip (in French only) that can be completed onscreen; or. the paper RL-1 slip that we provide.

What is RL-1 tax information?

The RL-1 slip must be filed by any employer or payer that paid amounts such as salaries, wages, gratuities, tips, fees, scholarships or commissions. The information on the RL-1 slip is used by individuals to complete the personal income tax return (TP-1-V).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in Canada MBT-RL1 without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing Canada MBT-RL1 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I edit Canada MBT-RL1 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share Canada MBT-RL1 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

How do I complete Canada MBT-RL1 on an Android device?

On Android, use the pdfFiller mobile app to finish your Canada MBT-RL1. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is Canada MBT-RL1?

Canada MBT-RL1 is a form used by businesses in Canada to report certain tax information related to the federal tax program, specifically focusing on the calculation of the provincial mining tax.

Who is required to file Canada MBT-RL1?

Businesses engaged in mining activities in Canada that earn income from mining operations are required to file Canada MBT-RL1.

How to fill out Canada MBT-RL1?

To fill out Canada MBT-RL1, businesses must provide all required financial information related to mining income, expenses, and deductions, following the instructions provided by the Canada Revenue Agency.

What is the purpose of Canada MBT-RL1?

The purpose of Canada MBT-RL1 is to ensure compliance with tax laws by capturing detailed financial information regarding mining operations, which is essential for the calculation of taxes owed.

What information must be reported on Canada MBT-RL1?

Canada MBT-RL1 must report detailed information such as mining income, expenses, investment tax credits, and any adjustments from previous filings.

Fill out your Canada MBT-RL1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada MBT-rl1 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.