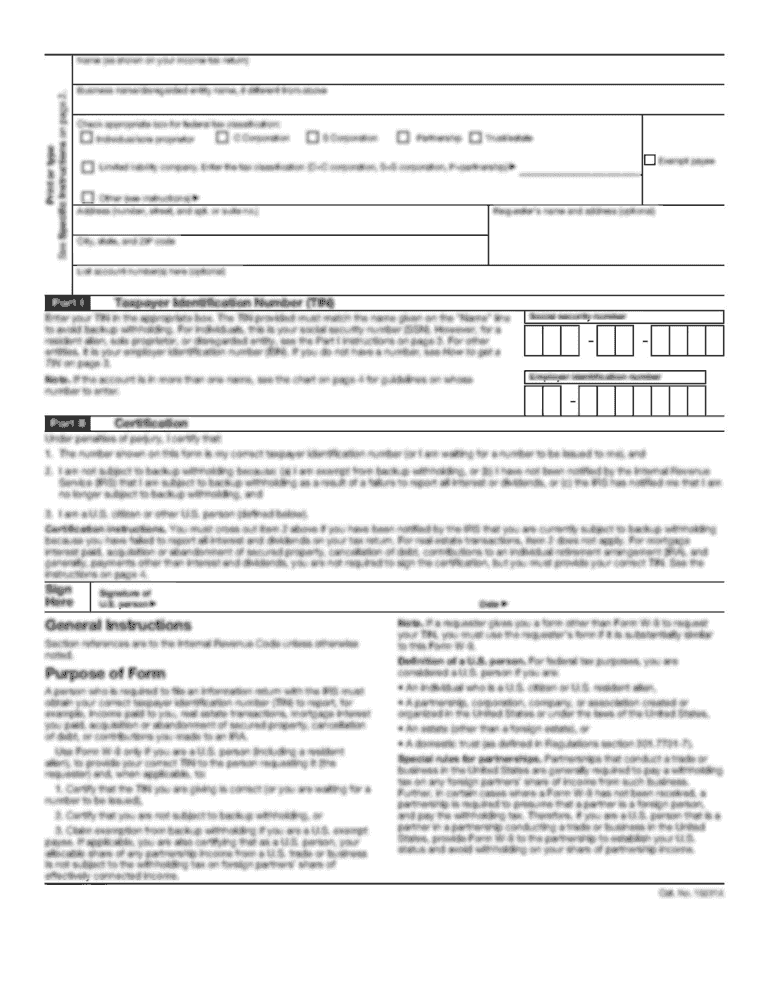

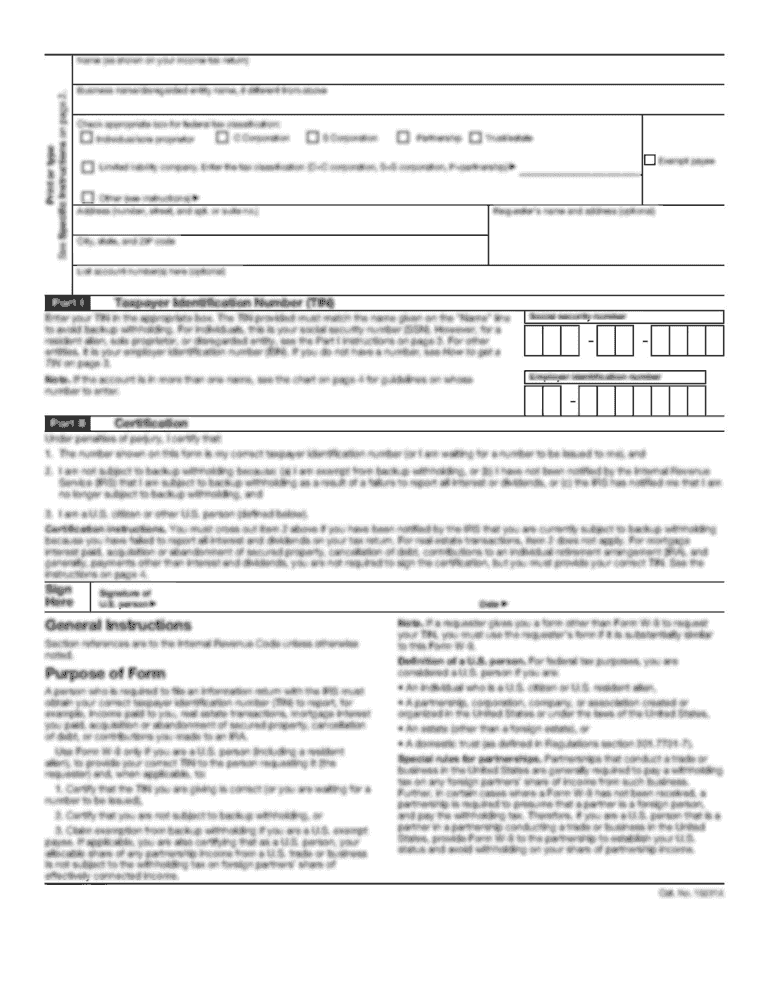

Canada Alberta SFA3784 2012 free printable template

Show details

Trustee Address Section 8 Collection of Personal Information For further information about the collection of your personal information please refer to Page 10 of the Section 9 Checklist of items to include with your Application do not send originals. Birth certificate s for both applicant and spouse/partner even if spouse is not 65 If you are submitting a birth certificate from a country other than Canada please be sure to also include a photoc...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada Alberta SFA3784

Edit your Canada Alberta SFA3784 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada Alberta SFA3784 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada Alberta SFA3784 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Canada Alberta SFA3784. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada Alberta SFA3784 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada Alberta SFA3784

How to fill out Canada Alberta SFA3784

01

Obtain the Canada Alberta SFA3784 form from the official website or relevant authorities.

02

Read the instructions carefully to understand the requirements for filling out the form.

03

Start with personal information, including your full name, address, and contact details.

04

Provide details of the incident or case relevant to the form.

05

Fill in any required financial information if applicable.

06

Complete sections requiring signatures, ensuring all signatures are current and valid.

07

Review the completed form for accuracy and completeness.

08

Submit the form either electronically or by mail as instructed.

Who needs Canada Alberta SFA3784?

01

Individuals seeking to apply for a specific service or benefit under Alberta law.

02

Businesses or organizations needing to report specific incidents or claims related to Alberta regulation.

03

Residents of Alberta who need to submit information for compliance or legal purposes.

Fill

form

: Try Risk Free

People Also Ask about

How do I apply for senior benefits in Alberta?

You should get a Seniors Financial Assistance application package in the mail six months before your 65th birthday. If you did not get this package, call the Alberta Supports Contact Centre at 1-877-644-9992. To be eligible you must: be 65 years of age or older.

What money do old people get from the government?

Social Security Disability Insurance (SSDI), a federal disability insurance program. Supplemental Security Income (SSI), a federal cash assistance program for low-income people who are age 65 or older, blind, or disabled.

How much is Alberta senior benefit?

For a single senior Type of residenceMaximum annual benefit (where income for calculating benefit is $0)Homeowner, renter, lodge resident$3,431Long-Term Care Centre or Designated Supportive Living Facility$11,771Other Residence Categories$2,390

What benefits do I get at age 65 in Alberta?

Seniors health benefits Alberta Seniors Benefit. Seniors with low-income can get financial assistance to help with monthly living expenses. Coverage for Seniors Program. Premium-free coverage for prescriptions drugs and other health-related services not covered under the AHCIP. Dental and Optical Assistance for Seniors.

How do I start a senior citizen pension?

Application for Pension Photocopy of ID card attested by gazetted officer. Original ID card submitted to the Board. Photocopy of benificiary's bank passbook. Provide Living Certificate every year. Ration Card. Employer Certificate. Application can be submitted wihtin 6 months after attaining the age of sixty years.

What benefits do you get when you turn 65 in Alberta?

Seniors health benefits Alberta Seniors Benefit. Seniors with low-income can get financial assistance to help with monthly living expenses. Coverage for Seniors Program. Premium-free coverage for prescriptions drugs and other health-related services not covered under the AHCIP. Dental and Optical Assistance for Seniors.

What is covered under Alberta Seniors Benefit?

Services and information. Seniors with low-income can get financial assistance to help with monthly living expenses. Premium-free coverage for prescriptions drugs and other health-related services not covered under the AHCIP. Eligible seniors can get help covering the cost of basic dental and optical services.

How to apply for senior citizen benefits?

- Applications must be through Form Perdaftaran Penang Senior Citizens are provided free of charge and can be found in Section Development District Office or Office Service Assembly respectively. - Applicants must include a copy of the applicant's identity card and their heirs.

Does government give money to senior citizens?

Pension Plans: Plans aimed at providing social security to the elderly include the Pradhan Mantri Vaya Vandana Yojana by the LIC. Another pension programme offered by the Ministry of Finance & administered by LIC is the Varishtha Pension Bima Yojana.

Who is eligible for old age pension in USA?

To receive OAP benefits, you must meet the following criteria: Be 60 years of age or older. Be a citizen, a naturalized citizen, or an eligible legal resident of the United States. Meet income limit of $771.

How much can you get from Alberta Seniors Benefit?

This benefit helps low-income seniors cover the cost of medical and personal support. You may be eligible to apply if you meet the basic requirements for the Alberta Seniors Benefit Program. The maximum benefit payable per year is $5,105 and varies with your marital status, income, and accommodation type.

What benefits do I get at age 65 in Canada?

The Old Age Security (OAS) pension is a monthly payment you can get if you are 65 and older. In some cases, Service Canada will be able to automatically enroll you for the OAS pension. In other cases, you will have to apply for the Old Age Security pension.

Who qualifies for the Alberta Seniors Benefit?

To be eligible for the Alberta Seniors Benefit you must: be 65 years of age or older (benefits may start the month of your 65th birthday) have lived in Alberta for at least 3 months immediately before applying. be a Canadian citizen or permanent resident.

What is the benefit of senior citizen certificate?

This certificate establishes the family member status of the citizen for all legal and official purpose. This certification helps the applicant thereby making him / her eligible for various government scheme, programs, benefits, etc.

Will senior citizens receive money from the government?

The Medicare Savings Program (MSP) provides free government money to seniors over 60 to help them pay their insurance premiums and Parts A & B deductibles, coinsurance, and copayments. Contact your state to apply for MSP, which has four benefit tiers with progressively higher income and resource limits.

What benefits do you get after 65?

Featured Benefits Social Security Medicare Program. Social Security Medicare Savings Program. Medicare Prescription Drug Plans. Federal Employees Retirement System (FERS) Social Security Retirement Insurance Benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit Canada Alberta SFA3784 on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing Canada Alberta SFA3784.

How do I fill out the Canada Alberta SFA3784 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign Canada Alberta SFA3784 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How can I fill out Canada Alberta SFA3784 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your Canada Alberta SFA3784 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is Canada Alberta SFA3784?

Canada Alberta SFA3784 is a tax form used for reporting specific financial information by individuals and businesses in Alberta, Canada.

Who is required to file Canada Alberta SFA3784?

Individuals and businesses who meet certain financial thresholds or engage in specific activities in Alberta are required to file Canada Alberta SFA3784.

How to fill out Canada Alberta SFA3784?

To fill out Canada Alberta SFA3784, gather the necessary financial documents and follow the instructions provided on the form, ensuring all required information is accurately completed.

What is the purpose of Canada Alberta SFA3784?

The purpose of Canada Alberta SFA3784 is to ensure compliance with provincial tax regulations and to collect data for financial assessment by the government.

What information must be reported on Canada Alberta SFA3784?

Information required on Canada Alberta SFA3784 includes income details, deductions, credits, and other relevant financial data specific to the taxpayer's circumstances.

Fill out your Canada Alberta SFA3784 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada Alberta sfa3784 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.