Canada Alberta SFA3784 2020 free printable template

Show details

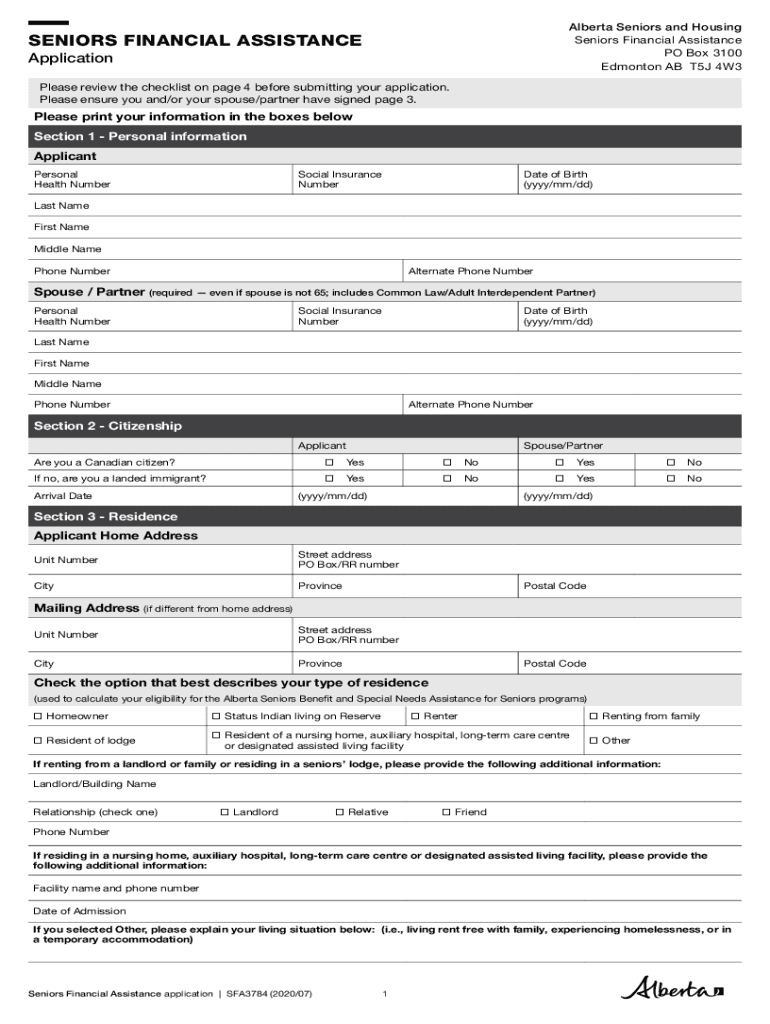

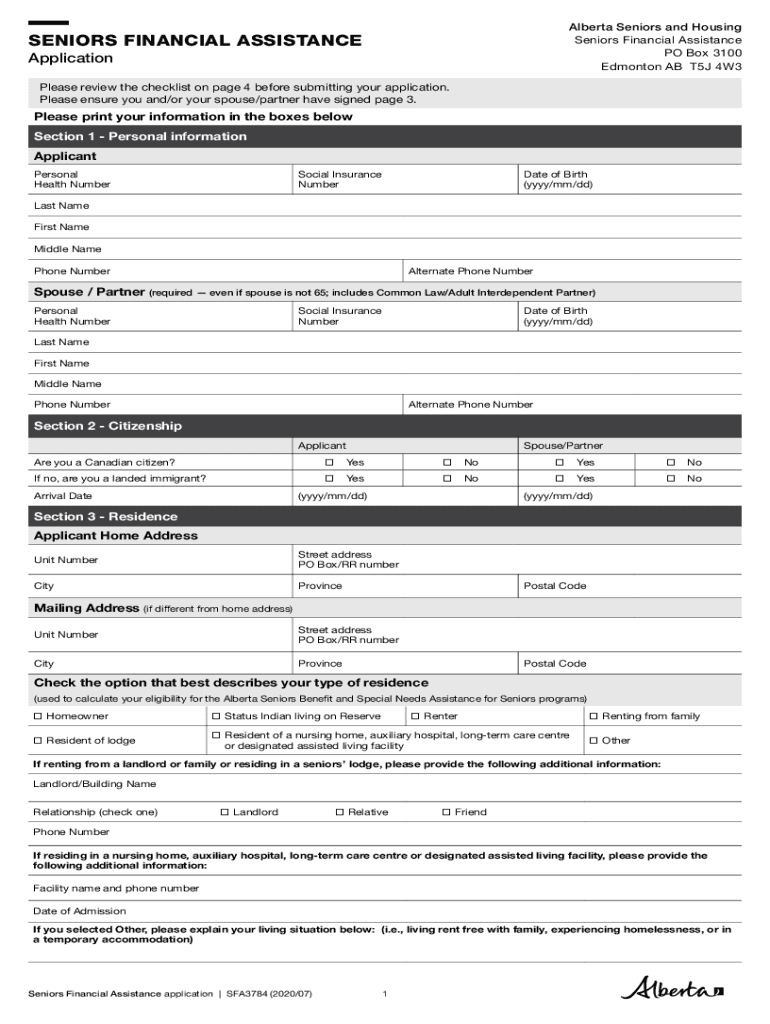

Alberta Seniors and Housing Seniors Financial Assistance PO Box 3100 Edmonton AB T5J 4W3SENIORS FINANCIAL ASSISTANCE Application Please review the checklist on page 4 before submitting your application.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada Alberta SFA3784

Edit your Canada Alberta SFA3784 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada Alberta SFA3784 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada Alberta SFA3784 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Canada Alberta SFA3784. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada Alberta SFA3784 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada Alberta SFA3784

How to fill out Canada Alberta SFA3784

01

Begin by downloading the Canada Alberta SFA3784 form from the official website or obtain a physical copy.

02

Read the instructions provided with the form to understand the requirements.

03

Fill out your personal information, including name, address, and contact details in the designated fields.

04

Provide accurate information regarding your employment or business status.

05

Complete any specific sections pertaining to your application, ensuring you follow the prompts.

06

Review all the information you've entered to ensure it is correct and complete.

07

Sign and date the form where required.

08

Submit the form as instructed, either electronically or via postal mail.

Who needs Canada Alberta SFA3784?

01

Individuals or businesses applying for financial assistance or support in Alberta, Canada.

02

Residents seeking funding for specific programs or initiatives offered by the Alberta government.

03

Applicants who need to report financial information for compliance with certain regulations.

Fill

form

: Try Risk Free

People Also Ask about

What are you entitled to when you reach 65?

Introduction. If you retire at 65, you may qualify for a benefit payment until you reach 66. At 66, many people will qualify for a State Pension. To qualify for this benefit payment at 65, you must have stopped working and meet the social insurance (PRSI) conditions.

Who qualifies for Alberta Seniors Benefit?

To be eligible for the Alberta Seniors Benefit you must: be 65 years of age or older (benefits may start the month of your 65th birthday) have lived in Alberta for at least 3 months immediately before applying. be a Canadian citizen or permanent resident.

What benefits do seniors get in Alberta?

Overview Alberta Seniors Benefit. Supplementary Accommodation Benefit. Special Needs Assistance for Seniors. Dental and Optical Assistance for Seniors. Coverage for Seniors. Seniors Property Tax Deferral Program. Seniors Home Adaptation and Repair Program.

What day is Alberta Seniors Benefit paid?

Alberta Seniors Benefit Payment Dates for 2022 The Alberta Seniors Benefit payment cycle runs from July to June annually just like many other income-tested government benefit programs. The payments are paid from the 5th to the last business day of each month.

What seniors will get the $500?

Seniors who receive both the OAS pension and the GIS will be eligible for both payments for a total one-time payment of $500.

Is the Canadian government giving extra money to seniors 2022?

Increasing the Old Age Security (OAS) pension by 10 per cent for seniors 75 years and older, which began in July 2022, to provide more than $800 in new support to full pensioners over the first year, and increase benefits for more than three million seniors.

What grants are available for seniors in Alberta?

Related Seniors Financial Assistance programs. Alberta Seniors Benefit. Special Needs Assistance for Seniors. Dental and Optical Assistance for Seniors. Seniors Property Tax Deferral Program.

Are prescriptions free for seniors in Alberta?

The Government of Alberta provides seniors with premium-free coverage for prescriptions drugs and other health-related services not covered under the AHCIP. Alberta Blue Cross administers the Coverage for Seniors program and claims.

What benefits are available for senior citizens in Canada?

Programs and services for seniors Canada Pension Plan. Monthly, taxable benefit that replaces part of your income when you retire. Guaranteed Income Supplement. Monthly payment available to low-income Old Age Security pensioners. Old Age Security. Monthly payment you can get if you are 65 and older.

Are seniors getting $500 in 2022?

Conversation. For seniors 75 and up as of July 2022, we're going to increase Old Age Security by 10% - putting more money in the pockets of over 3 million seniors. For those 75 and up as of June 2022, we're also going to provide a one-time Old Age Security payment of $500 this August.

Is there any financial help for seniors in Canada?

The Old Age Security (OAS) program, which provides most Canadians over 65 with a modest pension, is at the top of the list of financial support for seniors. In addition, the federal government offers the Guaranteed Income Supplement (GIS), which can substantially improve the quality of life for low-income seniors.

How to apply for senior citizen benefits?

- Applications must be through Form Perdaftaran Penang Senior Citizens are provided free of charge and can be found in Section Development District Office or Office Service Assembly respectively. - Applicants must include a copy of the applicant's identity card and their heirs.

What benefits do I get at age 65 in Canada?

The Old Age Security (OAS) pension is a monthly payment you can get if you are 65 and older. In some cases, Service Canada will be able to automatically enroll you for the OAS pension. In other cases, you will have to apply for the Old Age Security pension.

How do I apply for Alberta Seniors Benefit?

You should get a Seniors Financial Assistance application package in the mail six months before your 65th birthday. If you did not get this package, call the Alberta Supports Contact Centre at 1-877-644-9992. To be eligible you must: be 65 years of age or older.

What is the coverage for seniors program in Alberta?

Through the Coverage for Seniors program, the government offers Albertans aged 65 years and older premium-free coverage for prescriptions drugs and other health-related services not covered under the AHCIP.

What benefits do I get at age 65 in Alberta?

Seniors health benefits Alberta Seniors Benefit. Seniors with low-income can get financial assistance to help with monthly living expenses. Coverage for Seniors Program. Premium-free coverage for prescriptions drugs and other health-related services not covered under the AHCIP. Dental and Optical Assistance for Seniors.

What money is available for seniors in Canada?

Old Age Security ( OAS ), Guaranteed Income Supplement ( GIS ) and Spouse's Allowance. If you are age 65 or older and have lived in Canada for 10 or more years, you can apply for the Old Age Security benefit ( OAS ).

How much does a senior get in Alberta?

For a single senior Type of residenceMaximum annual benefit (where income for calculating benefit is $0)Homeowner, renter, lodge resident$3,431Long-Term Care Centre or Designated Supportive Living Facility$11,771Other Residence Categories$2,390

How much money do you get at 65 in Canada?

For 2022, the maximum monthly amount you could receive as a new recipient starting the pension at age 65 is $1,253.59. The average monthly amount paid for a new retirement pension (at age 65) in July 2022 is $737.88. Your situation will determine how much you'll receive up to the maximum.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in Canada Alberta SFA3784 without leaving Chrome?

Canada Alberta SFA3784 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I edit Canada Alberta SFA3784 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share Canada Alberta SFA3784 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I fill out Canada Alberta SFA3784 on an Android device?

Use the pdfFiller mobile app and complete your Canada Alberta SFA3784 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is Canada Alberta SFA3784?

Canada Alberta SFA3784 is a form used by Alberta residents for reporting specific financial information related to their taxes or other income-related assessments.

Who is required to file Canada Alberta SFA3784?

Individuals or entities in Alberta who have specific financial transactions or incomes that must be reported to the provincial government are required to file Canada Alberta SFA3784.

How to fill out Canada Alberta SFA3784?

To fill out Canada Alberta SFA3784, gather all relevant financial documentation, complete the form accurately with your financial data, and submit it to the appropriate provincial tax authorities.

What is the purpose of Canada Alberta SFA3784?

The purpose of Canada Alberta SFA3784 is to ensure that residents accurately report their financial activities to comply with provincial tax laws and regulations.

What information must be reported on Canada Alberta SFA3784?

Information that must be reported on Canada Alberta SFA3784 typically includes income details, deductions, exemptions, and any other relevant financial information necessary for tax assessment.

Fill out your Canada Alberta SFA3784 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada Alberta sfa3784 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.