Canada RCP-E 34A 2007 free printable template

Show details

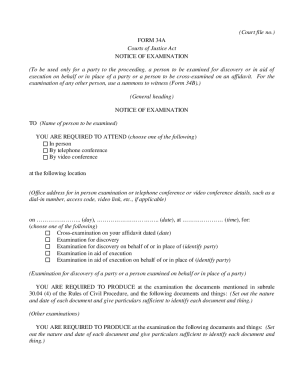

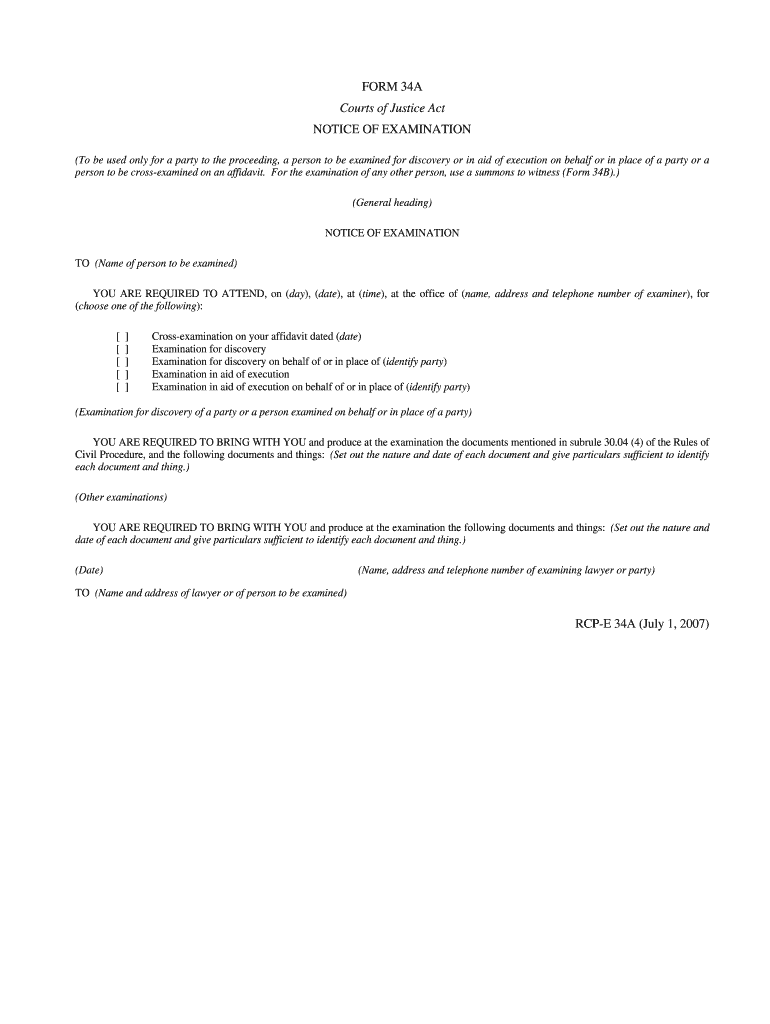

FORM 34A Courts of Justice Act NOTICE OF EXAMINATION To be used only for a party to the proceeding a person to be examined for discovery or in aid of execution on behalf or in place of a party or a person to be cross-examined on an affidavit. For the examination of any other person use a summons to witness Form 34B. General heading TO Name of person to be examined YOU ARE REQUIRED TO ATTEND on day date at time at the office of name address and telephone number of examiner for choose one of...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 34a notice - ontariocourtforms

Edit your 34a notice - ontariocourtforms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 34a notice - ontariocourtforms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 34a notice - ontariocourtforms online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 34a notice - ontariocourtforms. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada RCP-E 34A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 34a notice - ontariocourtforms

How to fill out Canada RCP-E 34A

01

Obtain the Canada RCP-E 34A form from the official website or service center.

02

Fill out your personal information in the designated sections, ensuring accuracy.

03

Provide details regarding your employment history relevant to the application.

04

Include any supporting documents required, such as proof of identity or employment.

05

Review your application carefully to check for errors or missing information.

06

Sign and date the form as required.

07

Submit the completed form along with any necessary fees to the appropriate agency.

Who needs Canada RCP-E 34A?

01

Individuals applying for certain government programs or services in Canada.

02

People seeking employment in specific sectors that require background checks.

03

Applicants for residency or immigration who need to verify their employment history.

04

Those looking to access benefits that necessitate proof of past employment.

Fill

form

: Try Risk Free

People Also Ask about

How does a tax foreclosure work in Texas?

After you become delinquent on your real property taxes in Texas, the taxing authority gets a lien on your home. It may then initiate a foreclosure by filing a lawsuit in court. The court will enter a judgment, and the property will be sold to a new owner. The proceeds from the sale pay off your tax debt.

What is Section 34.03 Texas property tax code?

Section 34.03 - Disposition of Excess Proceeds (a) The clerk of the court shall: (1) if the amount of excess proceeds is more than $25, before the 31st day after the date the excess proceeds are received by the clerk, send by certified mail, return receipt requested, a written notice to the former owner of the property

Can you buy struck off properties in Texas?

Texas law allows the public to purchase properties from the county at a monthly tax foreclosure sale. The states sells the deed to the property. Note: The state does not sell tax lien certificates where a buyer becomes the lienholder for the back taxes.

Does a tax sale wipe out a mortgage in Texas?

Because a property tax lien has priority, if your home is sold through a tax foreclosure, the sale wipes out any mortgages. So, the loan servicer will usually advance money to pay delinquent property taxes to prevent this from happening.

What is Section 34.04 in Texas property tax?

34.04. CLAIMS FOR EXCESS PROCEEDS. (a) A person, including a taxing unit and the Title IV-D agency, may file a petition in the court that ordered the seizure or sale setting forth a claim to the excess proceeds. The petition must be filed before the second anniversary of the date of the sale of the property.

How many years can you go without paying property taxes in Texas?

Many Texas homeowners wonder how long their property taxes can remain delinquent before their home is foreclosed on, and, unfortunately, the answer is – there is no specific answer. The state of Texas and individual counties don't set specific repayment deadlines for delinquent property taxes.

How do you buy property struck off in Texas?

When the property is bid, or struck-off to the entity, the deed will be made out to the taxing entities, and filed with the County Clerk's office. These properties may be sold through a private bidding process if all taxing entities with a claim on them agree and approve offers from prospective buyers.

What happens to the mortgage on a tax sale in Texas?

Because a property tax lien has priority, if your home is sold through a tax foreclosure, the sale wipes out any mortgages. So, the loan servicer will usually advance money to pay delinquent property taxes to prevent this from happening.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 34a notice - ontariocourtforms?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific 34a notice - ontariocourtforms and other forms. Find the template you want and tweak it with powerful editing tools.

How do I complete 34a notice - ontariocourtforms online?

Completing and signing 34a notice - ontariocourtforms online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make edits in 34a notice - ontariocourtforms without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing 34a notice - ontariocourtforms and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

What is Canada RCP-E 34A?

Canada RCP-E 34A is a form used for reporting the income of certain unincorporated businesses to the Canada Revenue Agency.

Who is required to file Canada RCP-E 34A?

Individuals or partners of unincorporated businesses that earn income and are required to report it for tax purposes must file Canada RCP-E 34A.

How to fill out Canada RCP-E 34A?

To fill out Canada RCP-E 34A, gather all relevant financial information, including income earned and expenses incurred, and follow the instructions in the guide provided by the Canada Revenue Agency.

What is the purpose of Canada RCP-E 34A?

The purpose of Canada RCP-E 34A is to provide a detailed account of the income and expenses of unincorporated businesses, which is necessary for determining tax liability.

What information must be reported on Canada RCP-E 34A?

Information that must be reported on Canada RCP-E 34A includes gross income, operating expenses, and any applicable deductions related to the business operations.

Fill out your 34a notice - ontariocourtforms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

34a Notice - Ontariocourtforms is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.