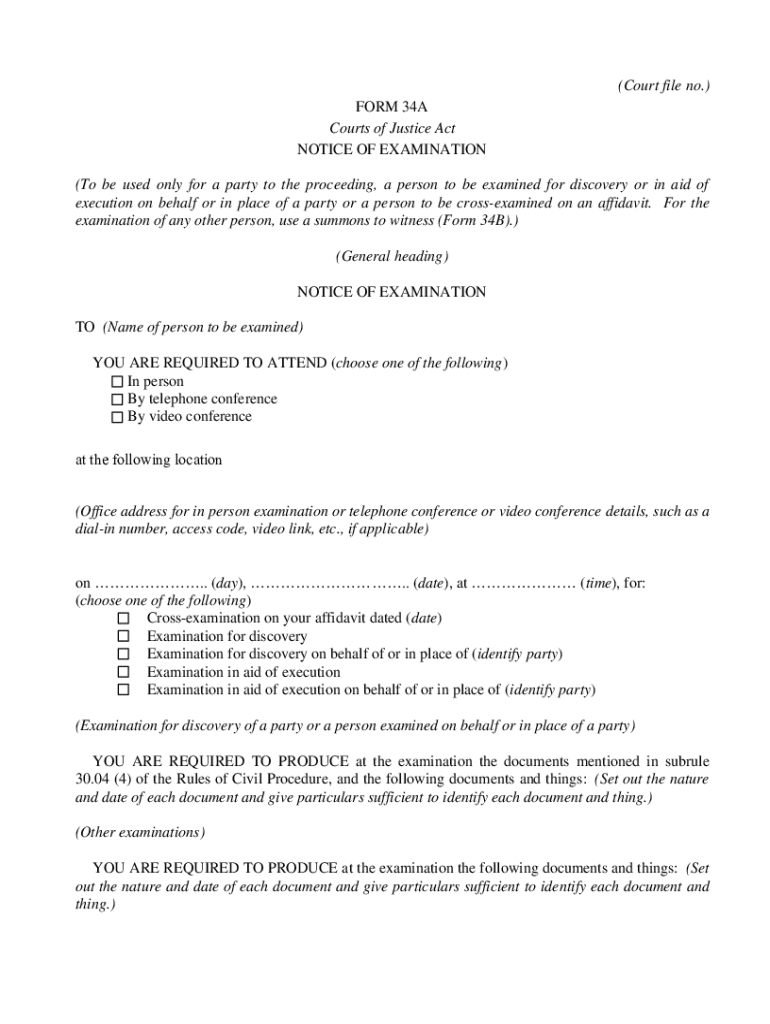

Canada RCP-E 34A 2020-2025 free printable template

Get, Create, Make and Sign form form34a form

How to edit rcp34a form create online

Uncompromising security for your PDF editing and eSignature needs

Canada RCP-E 34A Form Versions

How to fill out e 34a get form

How to fill out Canada RCP-E 34A

Who needs Canada RCP-E 34A?

Video instructions and help with filling out and completing 34a forms

Instructions and Help about 34a forms form

Laws dot-com legal forms guide form i-130 for is a form filled out by people sponsoring an alien who is not their immediate relative or employee who wishes to enter the United States but is deemed likely to become a public charge this form provided by the Department of Homeland Security is filled out by someone certifying they will take financial responsibility for the alien in question step 1 enter your name and address at the top of the form step 2 enter your birthdate and the location of your birth in America if not an American-born citizen enter the identification number applicable to you step 3 in line to enter your age and the date when you began living in the United States step 4 enter the name gender age address and the nationality of the person you are filling out the form on behalf of list the same information of spouses or children accompanying them step 5 read sections four through six confirm you understand the obligations they confer step six in section 7 enter your occupation and the name and address of your business step 7 enter your annual income the amount of money you have deposited in American banks the value of your property and the value of your life insurance list the value of any stocks and bonds and attach a full list step 8 list the names ages genders and relationship to you of all dependents in section eight step nine in section nine lists the names of any people you have previously filled out an i-130 for along with the date of the application step 10 in section 10 list any people you have submitted visa applications on behalf of and the submission dates step 11 in Section 11 note whether you intend to provide contributions to the alien in question such as room and board detail this if applicable step 12 sign and date the form to watch more videos please make sure to visit laws comm

People Also Ask about form 34a online

How does a tax foreclosure work in Texas?

What is Section 34.03 Texas property tax code?

Can you buy struck off properties in Texas?

Does a tax sale wipe out a mortgage in Texas?

What is Section 34.04 in Texas property tax?

How many years can you go without paying property taxes in Texas?

How do you buy property struck off in Texas?

What happens to the mortgage on a tax sale in Texas?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 34a notice from Google Drive?

Can I create an eSignature for the 34a forms od in Gmail?

How do I edit rcp 34a notice straight from my smartphone?

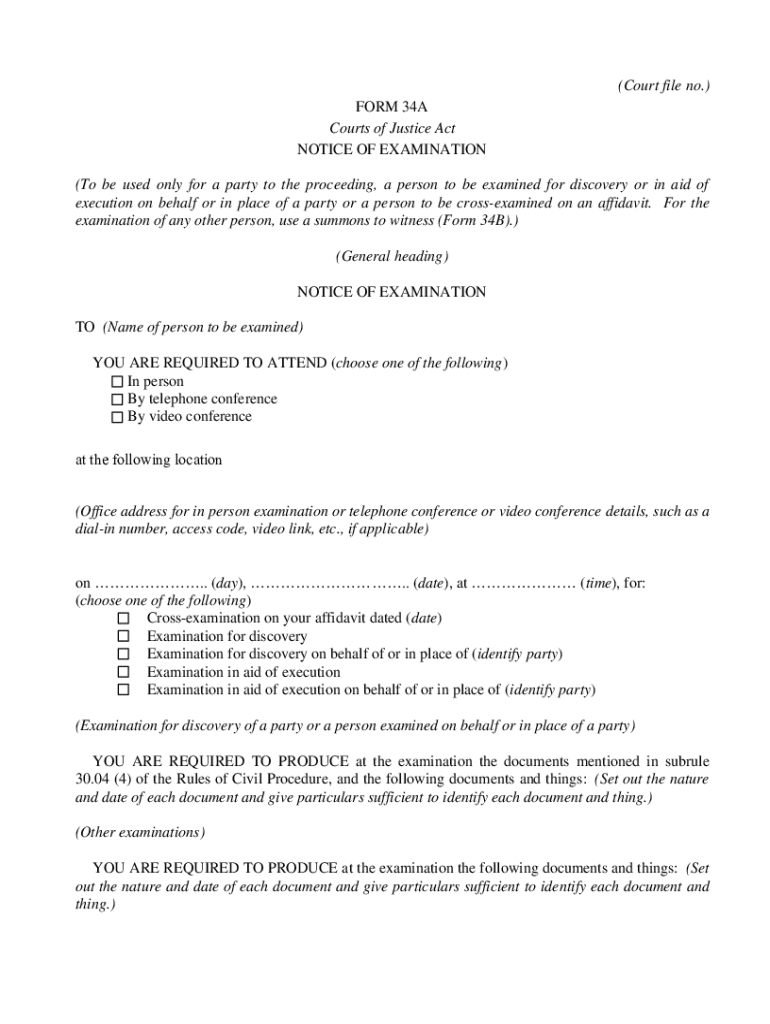

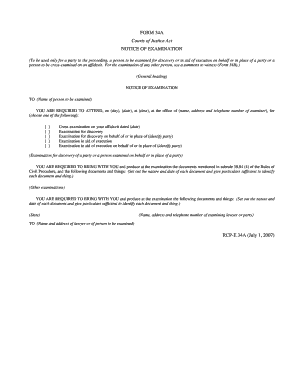

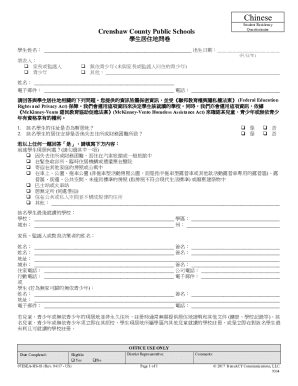

What is Canada RCP-E 34A?

Who is required to file Canada RCP-E 34A?

How to fill out Canada RCP-E 34A?

What is the purpose of Canada RCP-E 34A?

What information must be reported on Canada RCP-E 34A?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.