Get the free form 10r

Show details

2011-2012 FORM 10R (Section 27) APPLICATION FOR RENEWAL OF TRAVEL AGENT S License TO: THE SUPERINTENDENT OF INSURANCE: The undersigned hereby applies for a license to carry on the business of a travel

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 10r

Edit your form 10r form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 10r form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 10r online

To use our professional PDF editor, follow these steps:

1

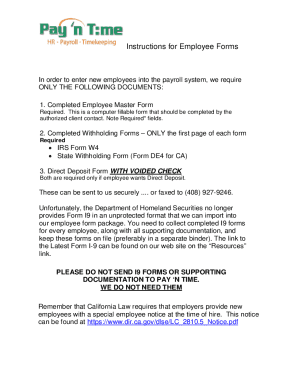

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 10r. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 10r

How to fill out form 10r:

01

Start by carefully reading the instructions provided with the form. This will give you a clear understanding of what information is required and how to properly fill out each section.

02

Begin by entering your personal information in the designated fields. This may include your name, address, social security number, and any other relevant details.

03

Move on to the section that pertains to your income. Here, you will need to provide information about your earnings, such as wages, salaries, tips, and any other sources of income.

04

If you have any deductions or adjustments to your income, make sure to include them in the appropriate section. This can include items such as student loan interest, self-employment tax, or other eligible expenses.

05

Once you have filled out all the required sections, review the form to ensure accuracy and completeness. Double-check all the information you have provided to avoid any mistakes.

06

Before submitting the form, make a copy for your own records. This will serve as a reference in case any issues arise in the future.

07

Finally, submit the completed form 10r to the designated recipient. This may vary depending on the purpose of the form, so be sure to follow the instructions provided.

Who needs form 10r:

01

Individuals who have received income from multiple sources throughout the tax year.

02

Those who have deductions or adjustments to their income that need to be reported.

03

Individuals who are self-employed or have income from rental properties.

04

Students who have received student loan interest payments or have education-related expenses.

05

Anyone who needs to report income or deductions that are not covered by other tax forms.

06

Certain types of businesses or organizations may also need to fill out form 10r.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

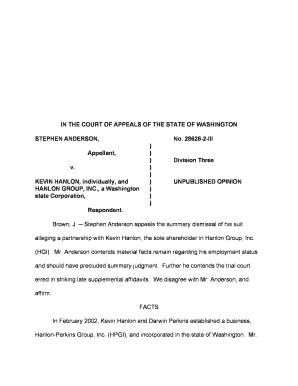

What is form 10r?

Form 10R refers to a specific form used by the United States Internal Revenue Service (IRS) for requesting the Employer Identification Number (EIN) for a retirement plan. EIN is a unique nine-digit number assigned to businesses by the IRS to identify them for tax purposes. The form requires information regarding the employer, the plan administrator, and the plan details. It is used to establish or update the EIN associated with the retirement plan.

Who is required to file form 10r?

Form 10R is not a specific form recognized by the Internal Revenue Service (IRS) or any other official tax authority. Therefore, there is no specific requirement for anyone to file Form 10R. It is possible that you may be referring to a different form, so if you can provide further information or context, I can assist you better.

How to fill out form 10r?

Form 10R is a specific form used for requesting a change in tax details. To properly fill out Form 10R, follow these steps:

1. Download Form 10R: Visit the official website of the tax authority or search for "Form 10R" to find the correct form in PDF format.

2. Personal Information: Provide your personal details accurately. This includes your full name, residential address, taxpayer identification number (TIN), contact number, and email address. Enter your status, such as "individual" or "company."

3. Tax Office Details: Provide the details of the tax office you are currently assigned to. This includes the office name, office code, and address.

4. Requested Changes: Specify the changes you are requesting. This could include changes in address, contact information, or any other relevant details. Provide the old information in the first column, and the new information in the second column.

5. Reason for Change: Briefly explain why you need to make the requested changes. For example, if you are changing your address, state the reason for your relocation.

6. Supporting Documents: If required, attach any supporting documents that substantiate the changes you are requesting. This can include a photocopy of your updated ID card, updated lease agreement, or any other document relevant to the change.

7. Declaration and Signature: Read the declaration carefully and sign the form. Date the form in the designated area.

8. Submission: After filling out the form completely, submit it to the appropriate tax office either in person or through the provided online submission system. Retain a copy for your records.

Note: It is advisable to consult the tax department's guidelines or seek assistance from a tax professional if you have any concerns or doubts while completing Form 10R.

What is the purpose of form 10r?

Form 10R is used to document a taxpayer's request for a refund of income tax that was withheld from their wages, pension, or annuity. The purpose of this form is to allow individuals to claim a refund for any excess tax withheld from their income.

What information must be reported on form 10r?

Form 10R is a form used by the Internal Revenue Service (IRS) to report certain retirement plan distributions. The information that must be reported on Form 10R includes:

1. Taxpayer Identification Number (TIN): The TIN of the taxpayer receiving the distribution must be reported.

2. Name and address of the taxpayer: The full name and address of the taxpayer receiving the distribution must be reported.

3. Description of the retirement plan: The type of retirement plan from which the distribution is made must be described, such as an individual retirement account (IRA), 401(k) plan, etc.

4. Distribution code: A code indicating the reason for the distribution must be reported. There are various codes available, such as early distribution, normal distribution, qualified distribution, etc.

5. Amount of distribution: The total amount of the distribution received from the retirement plan must be reported.

6. Withholding information: If any federal income tax was withheld from the distribution, the amount of withholding must be reported.

7. Name and address of the payer: The full name and address of the institution or individual making the distribution must be reported.

8. Signature: The form must be signed by the taxpayer receiving the distribution or their authorized representative.

It is important to note that specific reporting requirements may vary depending on the taxpayer's individual circumstances. It is advisable to consult the instructions for Form 10R or seek professional tax advice to ensure accurate reporting.

How can I edit form 10r from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your form 10r into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I sign the form 10r electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your form 10r and you'll be done in minutes.

How can I fill out form 10r on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your form 10r. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your form 10r online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 10r is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.