Get the free Group insurance

Show details

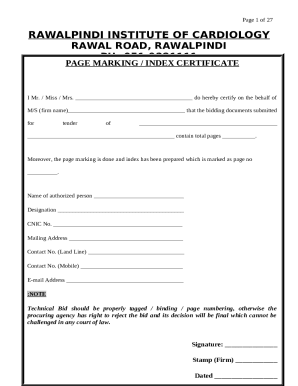

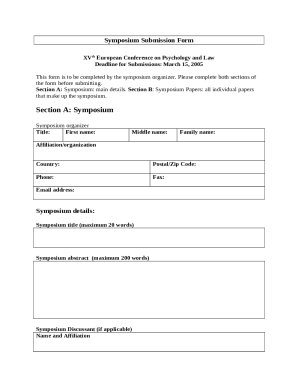

This document must be completed by the employer and by the personnel member for group insurance purposes, detailing personal and professional information necessary for data processing.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign group insurance

Edit your group insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your group insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing group insurance online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit group insurance. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out group insurance

How to fill out Group insurance

01

Identify the group of people who will be covered under the insurance policy.

02

Choose an insurance provider that offers group insurance plans.

03

Gather necessary information about each member of the group, such as age, health status, and any pre-existing conditions.

04

Determine the coverage benefits and select options that suit the group's needs.

05

Complete the application form with accurate group member information.

06

Submit the application to the chosen insurance provider.

07

Review the policy documents upon approval to ensure all details are correct.

08

Distribute information about the insurance coverage to all group members.

Who needs Group insurance?

01

Businesses with employees who want to provide health benefits.

02

Trade associations that offer insurance to their members.

03

Non-profit organizations looking to cover volunteers.

04

Professional organizations that provide insurance options to members.

05

Any group of individuals looking to lower insurance costs through collective bargaining.

Fill

form

: Try Risk Free

People Also Ask about

Why am I getting paid for group term life?

While you can buy individual term life insurance, group term life insurance — usually a benefit offered to employees of a company — can be more affordable than individual coverage. If you elect this benefit, you'll usually see the group term life coverage listed on your paycheck along with your other benefits.

What is a group policy in insurance?

Group Insurance covers a defined group of people, for example members of a professional association, or a society or employees of an organization. Group Insurance may offer life cover, health cover, and/or other types of personal insurance.

What is English insurance?

an agreement in which you pay a company money, either in one payment or in regular payments, and they pay your costs, for example, if you lose or damage something, or have an accident, injury, etc.: car/holiday/home/health, etc. insurance.

What is meant by group insurance?

Group insurance is coverage issued to a group of members as part of an employee benefits package, rather than insurance you purchase on your own. If you've ever enrolled in health, dental, vision, or other insurance coverage through your work, then you're familiar with the concept of group insurance.

What is meant by group insurance?

Group insurance is coverage issued to a group of members as part of an employee benefits package, rather than insurance you purchase on your own. If you've ever enrolled in health, dental, vision, or other insurance coverage through your work, then you're familiar with the concept of group insurance.

Is group term life insurance a good idea?

It's a good idea to take advantage of a group life insurance benefit if one is available to you — but it may not take care of all of your life insurance needs. In some cases, you might need additional coverage on top of the group policy.

What does group term mean?

A single policy that covers many people, most often provided by an employer or a group (like a union). Covers an individual for a certain amount of time only, in contrast to permanent insurance like whole life. Pays a lump sum to a deceased person's beneficiaries.

What is group insurance term?

Group term life insurance through your employer or an association offers affordable, easy-to-get coverage that provides financial protection for your family if you die. However, employment-based group life is temporary coverage that may not provide a sufficient death benefit to meet all your family's financial needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Group insurance?

Group insurance is a type of insurance coverage that is provided to a group of individuals, typically employees of a company, members of an organization, or other collective groups, allowing them to share the risk and costs associated with insurance.

Who is required to file Group insurance?

Group insurance is typically filed by employers or organizations that provide insurance coverage for their members or employees.

How to fill out Group insurance?

Filling out Group insurance involves completing the necessary forms provided by the insurance company, which may include details about the group, member information, coverage options, and premiums.

What is the purpose of Group insurance?

The purpose of Group insurance is to provide affordable insurance coverage to a larger group, reducing individual costs, and sharing risks among members, which often results in better benefits and lower premiums.

What information must be reported on Group insurance?

Information that must be reported on Group insurance typically includes the group name, policy number, details of covered individuals, their demographics, coverage options selected, and any premiums paid.

Fill out your group insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Group Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.