Get the free Professional Certificate in Forensic Accounting

Show details

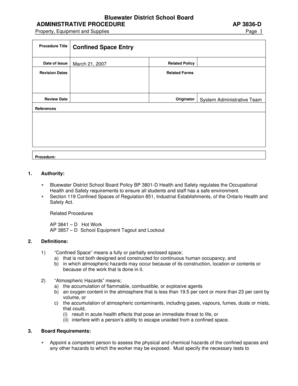

This document outlines a one-day seminar focused on forensic accounting to help professionals understand and combat corporate fraud through practical advice and strategies.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign professional certificate in forensic

Edit your professional certificate in forensic form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your professional certificate in forensic form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing professional certificate in forensic online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit professional certificate in forensic. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out professional certificate in forensic

How to fill out Professional Certificate in Forensic Accounting

01

Review the eligibility requirements for the Professional Certificate in Forensic Accounting.

02

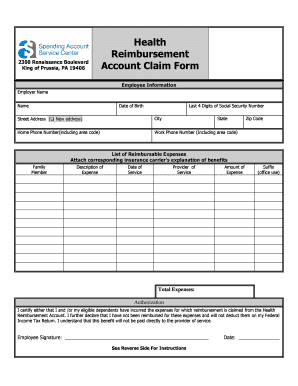

Gather necessary documents, such as your academic transcripts and professional resume.

03

Complete the application form provided by the certification body.

04

Submit your application along with any required fees.

05

Prepare for and take the required examinations or courses.

06

Complete any additional requirements, such as work experience or continuing education credits.

07

Await confirmation of your certification status from the issuing organization.

Who needs Professional Certificate in Forensic Accounting?

01

Accountants seeking to specialize in forensic accounting.

02

Lawyers and legal professionals involved in financial disputes or litigation.

03

Corporate investigators working in fraud detection and prevention.

04

Financial analysts and auditors looking to enhance their skills.

05

Law enforcement officials investigating financial crimes.

Fill

form

: Try Risk Free

People Also Ask about

What is a forensic accountant in English?

Forensic accountants are CPAs that look for evidence of crimes and commonly work for insurance companies, financial institutions, and law enforcement agencies. Forensic accountants analyze financial records and accounts that may be used as legal evidence and often testify in court cases as expert witnesses.

What is the best certification for forensic accounting?

You don't need any certification for a forensic accounting career, but CPA, CFE, and CFF credentials can all help. These certifications showcase your professional experience and field expertise, which can help you stand out from the competition.

Which course is best for forensic accounting?

The CFAP course by Indiaforensic is a highly recommended program for individuals interested in beginning the forensic accounting profession with a comprehensive curriculum covering fraud examination, fraud analysis and legal aspects the course offers valuable industry insights.

Which certification is best for forensic accounting?

Currently, Indiaforensic is the best for forensic accounting course. It offers Certified Forensic Accounting Professional (Indiaforensic) program which is one of the most recognised certification in the forensic accounting domain.

Is the CFE harder than the CPA?

Which is harder to earn: CPA or CFE? In terms of the exam, the required academic qualifications, time, and cost, the CPA is the harder qualification to achieve.

Can I be a forensic accountant without a CPA?

You could technically work as a forensic accountant with only a bachelor's or master's degree in accounting or forensic accounting, but having a CPA license and supporting your knowledge with forensic accounting CPE courses can help open the door to a new career path.

Can I be a forensic accountant without a CPA?

You could technically work as a forensic accountant with only a bachelor's or master's degree in accounting or forensic accounting, but having a CPA license and supporting your knowledge with forensic accounting CPE courses can help open the door to a new career path.

Which is better, CFE or CFF?

Which is better, the CFE or CFF exam? Neither exam is "better" than the other. These designations simply differ in their focus. CFEs have expertise in recognizing fraud committed against companies.

What credentials do you need for forensic accounting?

You don't need any certification for a forensic accounting career, but CPA, CFE, and CFF credentials can all help. These certifications showcase your professional experience and field expertise, which can help you stand out from the competition.

Do you need a CFE to be a forensic accountant?

Most FBI forensic accountants hold certifications such as Certified Public Accountant (CPA), Certified Fraud Examiner (CFE), or Certified in Financial or Forensics (CFF).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Professional Certificate in Forensic Accounting?

The Professional Certificate in Forensic Accounting is a specialized credential designed to equip professionals with the skills and knowledge needed to investigate financial discrepancies and fraud. It focuses on the intersection of accounting, auditing, and legal practices.

Who is required to file Professional Certificate in Forensic Accounting?

Individuals working in the fields of accounting, auditing, finance, or law who are involved in investigating financial fraud or misconduct may require the Professional Certificate in Forensic Accounting. This can include forensic accountants, auditors, and legal professionals.

How to fill out Professional Certificate in Forensic Accounting?

To fill out the Professional Certificate in Forensic Accounting, candidates should follow the provided application instructions, which typically include providing personal information, education details, work experience, and any requisite supporting documentation. Ensure all sections are completed accurately and submit by the deadline.

What is the purpose of Professional Certificate in Forensic Accounting?

The purpose of the Professional Certificate in Forensic Accounting is to provide practitioners with the essential skills to detect and investigate financial irregularities, assist in legal matters relating to financial disputes, and enhance their career opportunities in the field of forensic accounting.

What information must be reported on Professional Certificate in Forensic Accounting?

Information that must be reported on the Professional Certificate in Forensic Accounting typically includes personal identification details, educational background, relevant work experience, any certifications held, and a declaration of compliance with ethical standards in accounting practices.

Fill out your professional certificate in forensic online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Professional Certificate In Forensic is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.