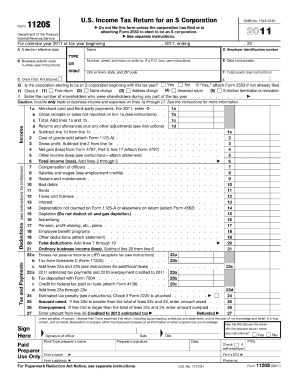

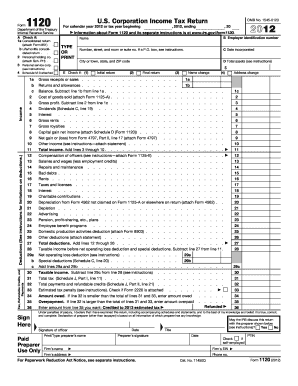

IRS 1120-C 2011 free printable template

Instructions and Help about IRS 1120-C

How to edit IRS 1120-C

How to fill out IRS 1120-C

About IRS 1120-C 2011 previous version

What is IRS 1120-C?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

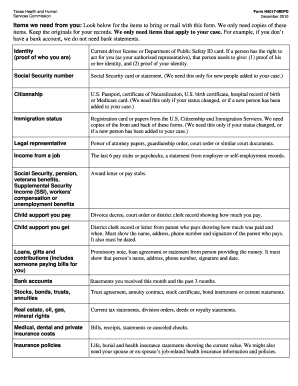

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1120-C

What should I do if I need to correct an error after filing the 2011 form 1120 c?

To correct an error after submitting the 2011 form 1120 c, you should file an amended return using Form 1120X. Be sure to include a detailed explanation of the changes made and retain records for your files. Amendments can help avoid penalties associated with inaccuracies.

How can I verify the status of my submitted 2011 form 1120 c?

To verify the status of your submitted 2011 form 1120 c, you can check through the IRS e-file status tool if you filed electronically, or contact the IRS directly for paper filings. Keep your confirmation number and relevant details handy for faster assistance.

What are some common errors to avoid when filing the 2011 form 1120 c?

Common errors when filing the 2011 form 1120 c include incorrect entity identification numbers, failing to check applicable boxes, and inconsistent financial data. Reviewing the form carefully before submission can help minimize mistakes and prevent processing delays.

Are there any special considerations for filing the 2011 form 1120 c on behalf of a foreign entity?

When filing the 2011 form 1120 c on behalf of a foreign entity, ensure you have a valid Tax Identification Number. Additionally, review any applicable tax treaties, and confirm if the foreign entity qualifies as a United States corporation to avoid complications.