Get the free 2008 4506 t form

Show details

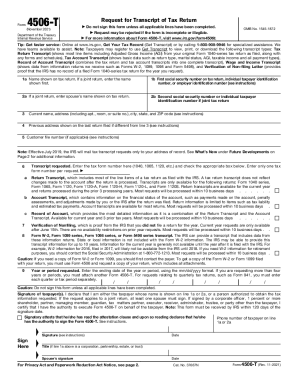

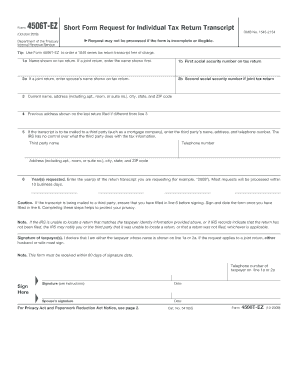

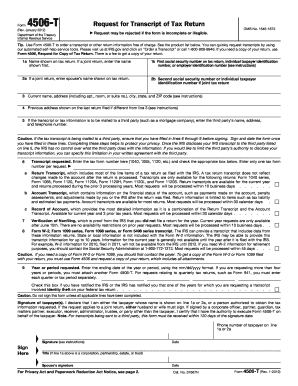

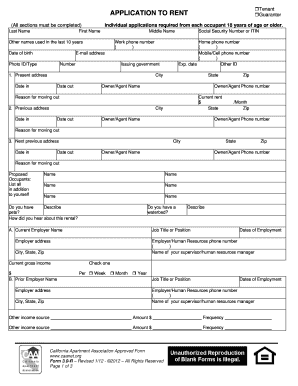

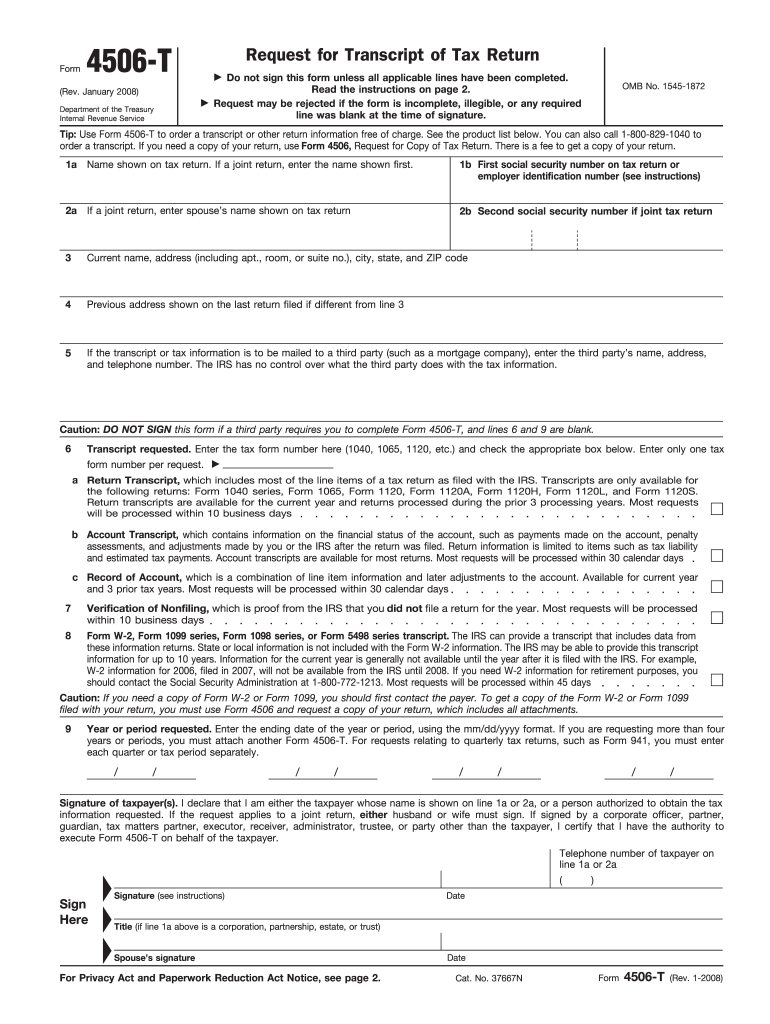

Form Request for Transcript of Tax Return 4506-T Rev. January 2008 Department of the Treasury Internal Revenue Service Do not sign this form unless all applicable lines have been completed. Read the instructions on page 2. Cat. No. 37667N Rev. 1-2008 Form 4506-T Rev. 1-2008 Page General Instructions Chart for all other transcripts Purpose of form. Use Form 4506-T to request tax return information. You can also designate a third party to receive the information. See line 5. Request may be...rejected if the form is incomplete illegible or any required line was blank at the time of signature. OMB No* 1545-1872 Tip Use Form 4506-T to order a transcript or other return information free of charge. See the product list below. You can also call 1-800-829-1040 to order a transcript. If you need a copy of your return use Form 4506 Request for Copy of Tax Return* There is a fee to get a copy of your return* 1a Name shown on tax return* If a joint return enter the name shown first. 1b First...social security number on tax return or employer identification number see instructions 2a If a joint return enter spouse s name shown on tax return 2b Second social security number if joint tax return Current name address including apt. room or suite no. city state and ZIP code Previous address shown on the last return filed if different from line 3 If the transcript or tax information is to be mailed to a third party such as a mortgage company enter the third party s name address and telephone...number. The IRS has no control over what the third party does with the tax information* Caution DO NOT SIGN this form if a third party requires you to complete Form 4506-T and lines 6 and 9 are blank. Transcript requested* Enter the tax form number here 1040 1065 1120 etc* and check the appropriate box below. Enter only one tax form number per request. a Return Transcript which includes most of the line items of a tax return as filed with the IRS* Transcripts are only available for the following...returns Form 1040 series Form 1065 Form 1120 Form 1120A Form 1120H Form 1120L and Form 1120S* will be processed within 10 business days b Account Transcript which contains information on the financial status of the account such as payments made on the account penalty assessments and adjustments made by you or the IRS after the return was filed* Return information is limited to items such as tax liability and estimated tax payments. Account transcripts are available for most returns. Most...requests will be processed within 30 calendar days c Record of Account which is a combination of line item information and later adjustments to the account. Available for current year and 3 prior tax years. Most requests will be processed within 30 calendar days Verification of Nonfiling which is proof from the IRS that you did not file a return for the year. Most requests will be processed within 10 business days Form W-2 Form 1099 series Form 1098 series or Form 5498 series transcript. The IRS...can provide a transcript that includes data from these information returns. State or local information is not included with the Form W-2 information* The IRS may be able to provide this transcript information for up to 10 years.

We are not affiliated with any brand or entity on this form

Instructions and Help about IRS 4506-T

How to edit IRS 4506-T

How to fill out IRS 4506-T

Instructions and Help about IRS 4506-T

How to edit IRS 4506-T

To edit the IRS 4506-T form, use a reliable PDF editor like pdfFiller. This platform allows you to fill in the required fields electronically, facilitating a clear and legible submission. Ensure that all information is accurate before finalizing the form.

How to fill out IRS 4506-T

Filling out the IRS 4506-T form involves several key steps:

01

Download the IRS 4506-T form from the IRS website or a trusted source.

02

Enter your personal information correctly, including name, address, and Social Security number.

03

Select the appropriate boxes to indicate who should receive the requested tax information.

04

Sign and date the form to affirm that the information is correct.

Ensure you verify all entered details to avoid delays in processing your request.

About IRS 4506-T 2008 previous version

What is IRS 4506-T?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 4506-T 2008 previous version

What is IRS 4506-T?

The IRS 4506-T, formally known as the "Request for Transcript of Tax Return," is a form used by taxpayers to request a copy of their tax transcript or any other necessary tax information maintained by the IRS. This form is especially relevant for those seeking to obtain financial records for loan applications or verification purposes.

What is the purpose of this form?

The primary purpose of the IRS 4506-T form is to allow individuals and entities to request tax return transcripts or tax account information from the IRS. This information is vital for lenders, mortgage companies, and various governmental agencies that require evidence of a taxpayer's financial status.

Who needs the form?

The IRS 4506-T form is typically required by anyone needing to confirm their past tax filings. Common users include taxpayers applying for loans, housing assistance, or any situation where financial institutions need verification of income and tax history.

When am I exempt from filling out this form?

Exemptions from filling out the IRS 4506-T form primarily apply to situations where the information needed is readily available without the need for an official transcript. For instance, certain government agencies may have direct access to tax information, thus negating the need for this form.

Components of the form

The IRS 4506-T form includes several essential components:

01

Taxpayer information section, including name and Social Security number.

02

Type of transcript requested, such as tax return transcripts or account transcripts.

03

Recipient details—where the transcript should be sent.

04

Signature and date fields to validate the request.

What are the penalties for not issuing the form?

While there are generally no penalties specifically for failing to file the IRS 4506-T, not providing required transcripts when requested by lenders or government agencies may lead to denied applications or loss of eligibility for financial assistance programs. Timely submission enhances compliance and facilitates smoother transactions.

What information do you need when you file the form?

When filing the IRS 4506-T form, you need specific information to ensure processing. This includes:

01

Your full name as it appears on your tax return.

02

Your Social Security number or Employer Identification Number.

03

The years of tax return information you are requesting.

04

The signature of the taxpayer or an authorized representative.

Is the form accompanied by other forms?

The IRS 4506-T form is generally a standalone document. However, if you file it as part of an application for credit or assistance, other documents may be required by the requesting institution. Always check their requirements to ensure a complete submission.

Where do I send the form?

The destination for submitting the IRS 4506-T form depends on your state of residence and whether you are providing it to an institution or directly to the IRS. For direct IRS submissions, you should check their official website for current mailing addresses corresponding to your location.

See what our users say