Get the free FORM 511-V (2013)

Show details

#1695# ITII FORM State of Oklahoma Individual Income Tax Payment Voucher Reporting Period Due Date* 01-01-2012 to 12-31-2012 2 0 1 2 511-V Penalty and interest may be assessed if payment is not sent

We are not affiliated with any brand or entity on this form

Instructions and Help about form 511-v 2013

How to edit form 511-v 2013

How to fill out form 511-v 2013

Instructions and Help about form 511-v 2013

How to edit form 511-v 2013

To edit form 511-v 2013, utilize the editing tools available in pdfFiller. Begin by uploading the form to the platform. Afterward, you can input information directly into the form fields. Make necessary corrections and ensure all data is accurate before moving on to the next step. Once edited, you may save the form in your account for future access.

How to fill out form 511-v 2013

Filling out form 511-v 2013 is essential for certain tax processes. Start by obtaining the latest version of the form from the IRS website or pdfFiller. Review the instructions carefully before entering any information. Complete each section based on your financial activities for the year. Utilize pdfFiller’s features to facilitate easy data entry, ensuring that all required fields are filled accurately.

Latest updates to form 511-v 2013

Latest updates to form 511-v 2013

Form 511-v 2013 has undergone revisions since its introduction. It is crucial for filers to stay informed about any changes that might affect their tax filing. Updates typically relate to reporting requirements, deadlines, and definitions pertinent to form usage.

All You Need to Know About form 511-v 2013

What is form 511-v 2013?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About form 511-v 2013

What is form 511-v 2013?

Form 511-v 2013 is a tax form used by taxpayers to report certain information related to their financial activities. This form primarily addresses the reporting of purchases and tax payments on behalf of the government. Understanding its purpose is important for compliance and accurate tax reporting.

What is the purpose of this form?

The primary purpose of form 511-v 2013 is to ensure accurate and timely reporting of payments made to various government entities. This form helps maintain transparency in financial dealings and ensures that all tax responsibilities are met according to federal regulations.

Who needs the form?

Form 511-v 2013 is typically required for individuals or businesses that engage in specific financial transactions involving government payments. If you are involved in activities that necessitate reporting to the IRS, you likely need to complete this form as part of your tax filing obligations.

When am I exempt from filling out this form?

Exemptions from filing form 511-v 2013 may apply in certain situations, such as when no reportable payments or purchases have been made during the tax year. Additionally, if you are below the income thresholds established by the IRS, you may not be required to file this form. It is essential to review IRS guidelines to confirm your exemption status.

Components of the form

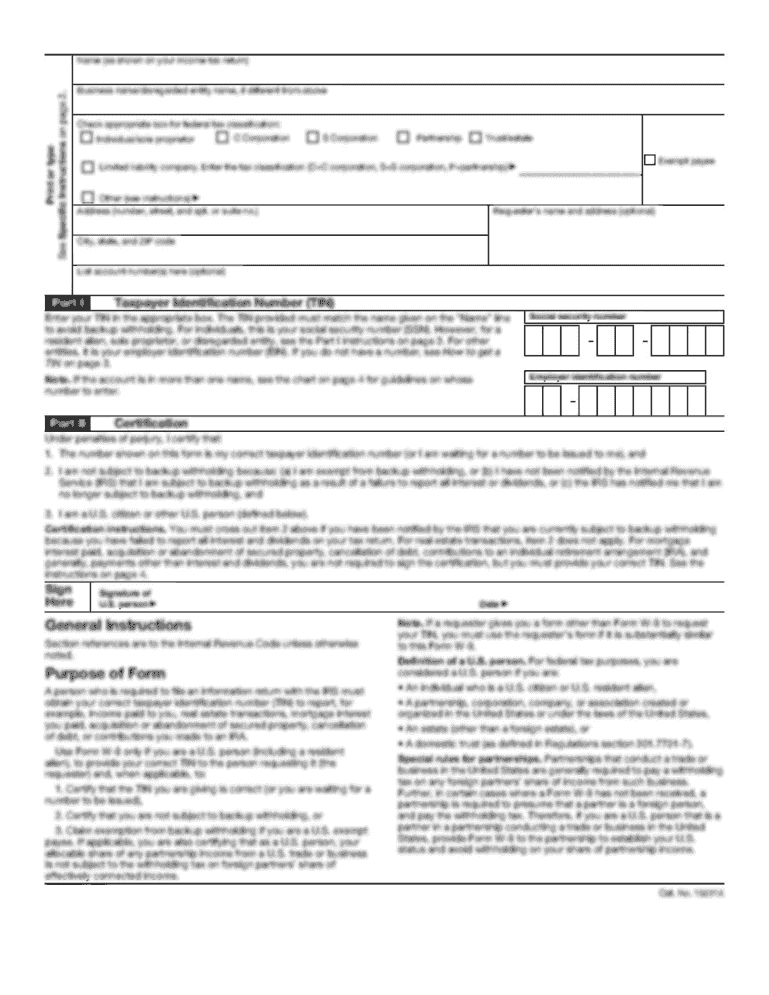

Form 511-v 2013 contains several key components that need to be accurately filled out, including taxpayer identification information, details about the transactions being reported, and signatures where required. Each section is designed to capture specific information vital for tax reporting.

Due date

The due date for submitting form 511-v 2013 aligns with the individual tax filing deadlines established by the IRS. Generally, individuals and businesses must ensure they file this form by April 15 of the following tax year, unless an extension is granted.

What payments and purchases are reported?

Form 511-v 2013 is used to report various payments and purchases made towards government services or programs. This can include but is not limited to tax payments on behalf of employees, real estate transaction fees, or other significant government-related expenditures. Accurate reporting is crucial for compliance.

How many copies of the form should I complete?

It is recommended to complete at least two copies of form 511-v 2013—one for your records and one for submission to the IRS. Depending on your specific situation, additional copies may be necessary, especially if you are filing on behalf of multiple entities.

What are the penalties for not issuing the form?

Failing to issue form 511-v 2013 can lead to serious penalties, including fines imposed by the IRS. It is crucial to file the form accurately and on time to avoid unnecessary financial consequences. Understand the specific penalties related to your situation to mitigate risk.

What information do you need when you file the form?

When filing form 511-v 2013, it is important to have all necessary financial records on hand. This includes your taxpayer identification number, details of the payments or purchases being reported, and any supporting documentation that verifies the information entered on the form.

Is the form accompanied by other forms?

Form 511-v 2013 may require accompanying documents depending on the nature of the transactions being reported. Be prepared to attach any necessary supporting documentation to substantiate the entries on the form. Review IRS instructions to ensure compliance with accompanying requirements.

Where do I send the form?

Form 511-v 2013 must be sent to the address designated by the IRS based on your location and the specific filing requirements set for the form. Generally, the mailing information is provided in the instructions accompanying the form.

See what our users say