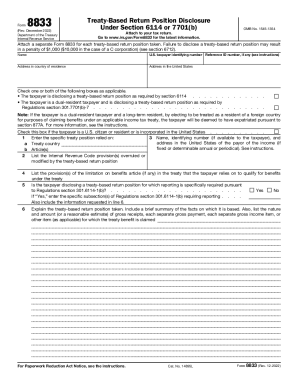

IRS 8833 2000 free printable template

Instructions and Help about IRS 8833

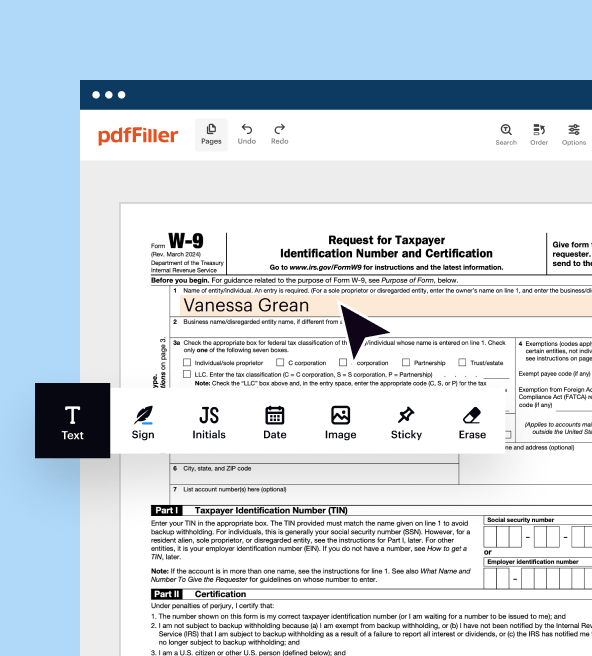

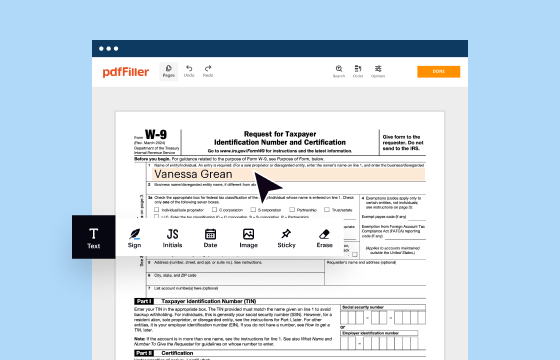

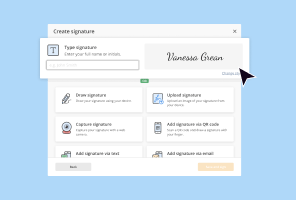

How to edit IRS 8833

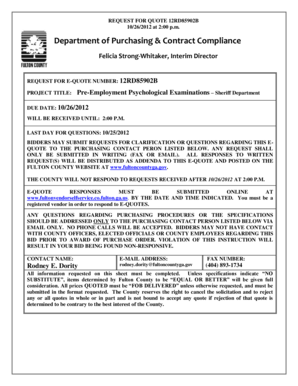

How to fill out IRS 8833

About IRS 8 previous version

What is IRS 8833?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

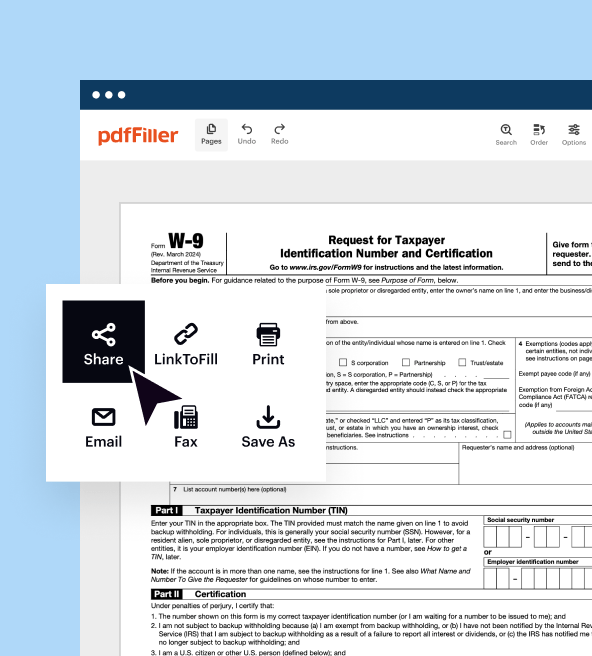

Where do I send the form?

FAQ about IRS 8833

What should I do if I made a mistake on my sample form 8833?

If you discover an error after submitting your sample form 8833, you should file an amended form as soon as possible. Use the correct version of the form and indicate that it is an amendment. Be sure to specify which parts have been changed to help processing.

How can I track the status of my submitted sample form 8833?

To verify the receipt and processing status of your sample form 8833, you can check online via the IRS website or contact their support. If you e-filed, expect confirmation emails as part of standard processing, and be aware of common rejection codes to troubleshoot if necessary.

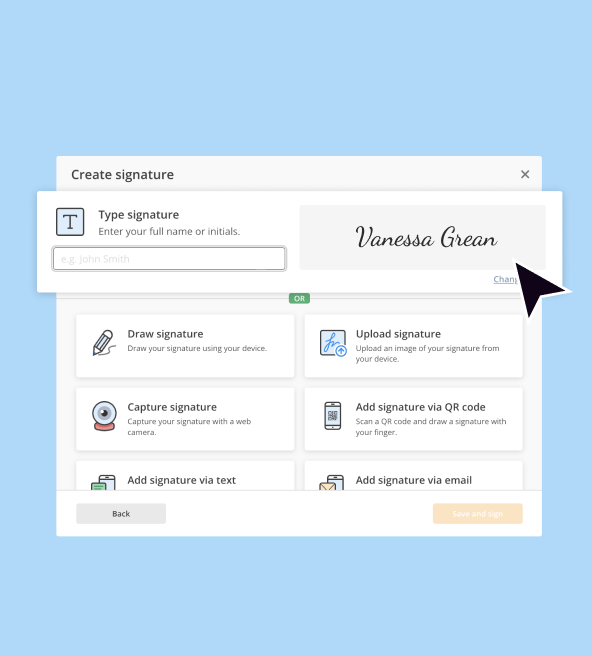

What are the implications of e-signatures on the sample form 8833?

E-signatures are generally accepted for the sample form 8833, provided they comply with IRS guidelines. It's important to ensure that any software used for e-filing meets the necessary security standards to protect your data.

What should I know about filing the sample form 8833 on behalf of someone else?

When filing the sample form 8833 on behalf of another person, it's crucial to have proper authorization, typically in the form of Power of Attorney (POA). Ensure that all necessary information for both the filer and the individual you are submitting for is accurately filled out.

What common errors should I watch out for when submitting the sample form 8833?

Common errors on the sample form 8833 include incorrect taxpayer information, mismatched signatures, or incomplete sections. To avoid issues, review your form thoroughly and ensure all information is accurate before submission.