KY Form 228-S - Fayette County 2009 free printable template

Show details

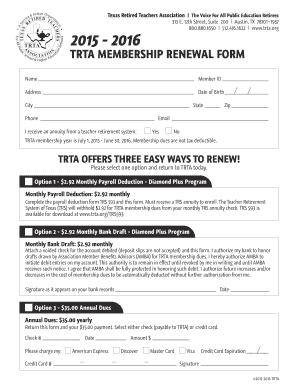

BOARD OF EDUCATION OF FAYETTE COUNTY FORM 228S 2009 Net Profits Occupational License Tax Return This form must be filed and PAID IN FULL on or before April 15, 2010, or by the 15th day of the 4th

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY Form 228-S - Fayette County

Edit your KY Form 228-S - Fayette County form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY Form 228-S - Fayette County form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KY Form 228-S - Fayette County online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit KY Form 228-S - Fayette County. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY Form 228-S - Fayette County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY Form 228-S - Fayette County

How to fill out KY Form 228-S - Fayette County

01

Obtain the KY Form 228-S from the official Kentucky Department of Revenue website or the local county office.

02

Provide your personal information including name, address, and contact details in the appropriate fields.

03

Specify the purpose of the form by checking the relevant box related to Fayette County assessments.

04

Fill in any financial information as required, ensuring accuracy in reporting any income or property details.

05

Review the completed form for any errors or omissions to ensure all necessary information is included.

06

Sign and date the form to certify that all information provided is true and correct.

07

Submit the completed form to the designated Fayette County office by mail or in-person.

Who needs KY Form 228-S - Fayette County?

01

Residents or property owners in Fayette County who need to request an assessment or report financial information to local authorities.

02

Businesses operating in Fayette County that must comply with local tax assessment requirements.

Fill

form

: Try Risk Free

People Also Ask about

What is the net profit license fee return in Mayfield Kentucky?

The City of Mayfield Net Profit License Fee is levied at the annual rate of 2% the first $50,000.00, plus 1% of $50,000 thru $500,000 and ½ % over $500,000 with a minimum of $100.00 of the net profits of all occupations, trades, professions or other businesses engaged in said activities in the City.

What is the net profit license fee in Kentucky?

The rate is equal to the greater of 1.95% of the net profit or $60. Any individual or fiduciary, which receives income from real estate rentals with excess of $100,00.00 in annual gross receipts is presumed to be in the rental business, and is subject to the greater of 1.95% of the net profit or $60.

What is the city of Midway KY net profits license fee return?

The Midway Net Profits License Fee is levied at the annual rat of 2% effective April 1, 1977 of the net profits of all occupations, trades, professions or other businesses engaged in said activities in the City of Midway.

What is the occupational license tax in Kentucky?

City Payroll For tax periods prior to January 1, 2023, the tax is 1.49% of the gross compensation paid. Beginning January 1, 2023, the tax is 1.65% of the gross compensation paid. Forms and instructions are available at the Occupational Tax Office or may be downloaded below.

What is the occupational license tax in Fayette County Kentucky?

Fayette County levies a local occupational license tax at the rate of 2.25% on salaries/wages and business net profits.

What is the net profits license fee return in franklin county ky?

Due Date-The Net Profit License Fee Return is due 105 days after the end of your tax year. For example, if you operate on a calendar year, the return is due by April 15 of each year. Federal Return-A copy of the federal return for your business must accompany your county Net Profit Return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find KY Form 228-S - Fayette County?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the KY Form 228-S - Fayette County in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I fill out KY Form 228-S - Fayette County using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign KY Form 228-S - Fayette County and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit KY Form 228-S - Fayette County on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share KY Form 228-S - Fayette County on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

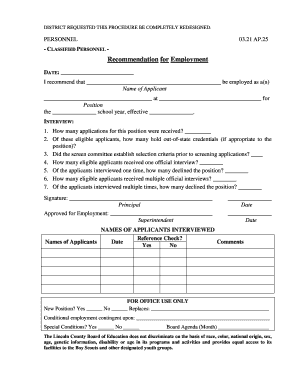

What is KY Form 228-S - Fayette County?

KY Form 228-S is a tax form used in Fayette County, Kentucky, specifically for reporting business taxes and fees.

Who is required to file KY Form 228-S - Fayette County?

Businesses operating within Fayette County and subject to local business taxes are required to file KY Form 228-S.

How to fill out KY Form 228-S - Fayette County?

To fill out KY Form 228-S, you need to provide business information, gross receipts, and calculations for the applicable taxes, then submit the form to the county's finance department.

What is the purpose of KY Form 228-S - Fayette County?

The purpose of KY Form 228-S is to assess and collect local business taxes owed by businesses operating within Fayette County.

What information must be reported on KY Form 228-S - Fayette County?

The information that must be reported includes the business name, address, gross receipts, and the calculation of taxes owed based on those receipts.

Fill out your KY Form 228-S - Fayette County online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY Form 228-S - Fayette County is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.