KY Form 228-S - Fayette County 2020 free printable template

Show details

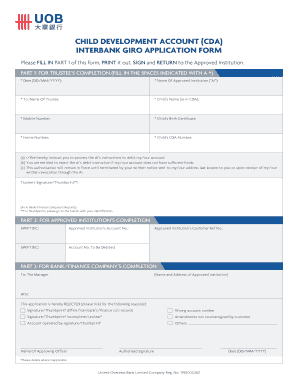

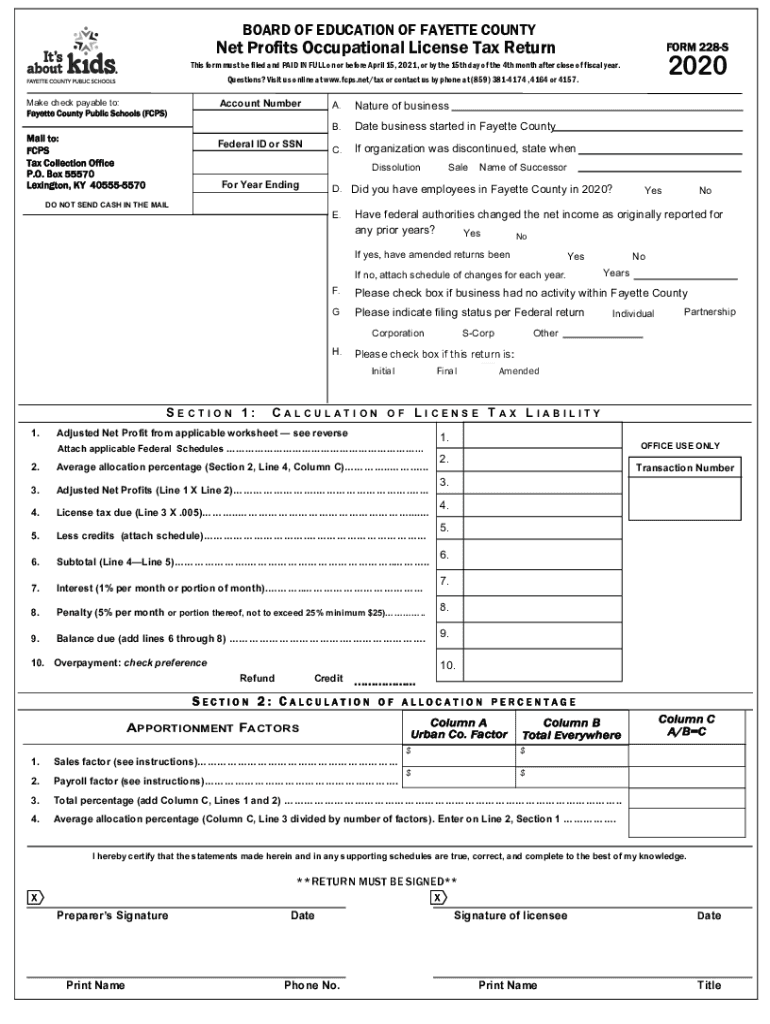

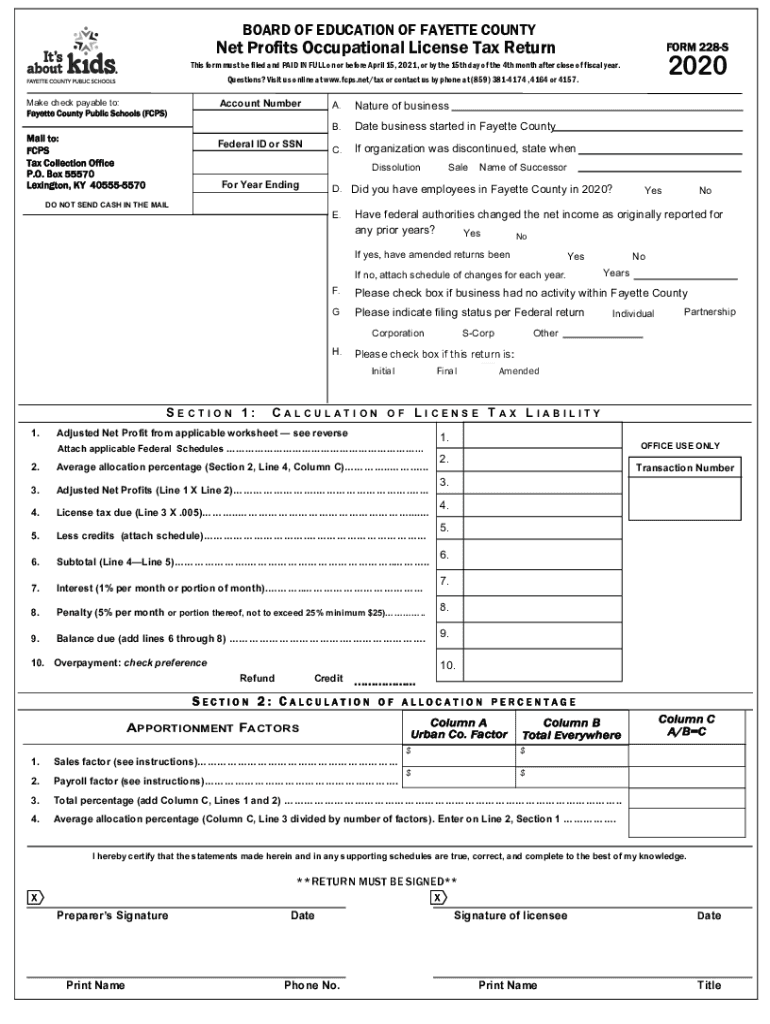

BOARD OF EDUCATION OF FAYETTE Countries Profits Occupational License Tax Returner 228S2020This form must be filed and PAID IN FULL on or before April 15, 2021, or by the 15th day of the 4th month

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY Form 228-S - Fayette County

Edit your KY Form 228-S - Fayette County form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY Form 228-S - Fayette County form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KY Form 228-S - Fayette County online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit KY Form 228-S - Fayette County. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY Form 228-S - Fayette County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY Form 228-S - Fayette County

How to fill out KY Form 228-S - Fayette County

01

Obtain the KY Form 228-S from the Fayette County website or local government office.

02

Fill in the applicant's name and contact information at the top of the form.

03

Provide the address of the property associated with the application.

04

Complete the section regarding the purpose of the request.

05

If applicable, include information about any existing permits or zoning regulations.

06

Attach any necessary documentation or supporting materials as required.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form at the designated area.

09

Submit the form to the appropriate Fayette County office by mail or in person.

Who needs KY Form 228-S - Fayette County?

01

Individuals or businesses applying for a specific permit or zoning variance in Fayette County.

02

Property owners who need to request modifications or exceptions related to development regulations.

03

Anyone seeking to obtain information or formal approval from the Fayette County government regarding their property.

Fill

form

: Try Risk Free

People Also Ask about

Does Fayette County KY have an income tax?

Kentucky does not levy a franchise tax. Kentucky has a flat income tax rate of 5% on net income. Fayette County levies a local occupational license tax at the rate of 2.25% on salaries/wages and business net profits.

What is the school district tax in Fayette County KY?

Each employer must withhold the 0.5% license tax for schools from gross wages, salaries and commissions paid to employees who are Fayette County residents for services performed within Fayette County.

Does Lexington KY have a local income tax?

Kentucky has a flat income tax rate of 5% on net income. Fayette County levies a local occupational license tax at the rate of 2.25% on salaries/wages and business net profits.

What is the state income tax in Lexington KY?

Kentucky has a flat 4.50 percent individual income tax rate. There are also jurisdictions that collect local income taxes. Kentucky has a 5.00 percent corporate income tax rate. Kentucky has a 6.00 percent state sales tax rate and does not levy any local sales taxes.

Does Lexington KY have an income tax?

Kentucky's individual income tax law is based on the Internal Revenue Code in effect as of December 31, 2021. The tax rate is five (5) percent and allows itemized deductions and certain income reducing deductions as defined in KRS 141.019.

What is the tax rate for Fayette County KY?

The minimum combined 2023 sales tax rate for Fayette County, Kentucky is 6%. This is the total of state and county sales tax rates. The Kentucky state sales tax rate is currently 6%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send KY Form 228-S - Fayette County for eSignature?

When your KY Form 228-S - Fayette County is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for the KY Form 228-S - Fayette County in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your KY Form 228-S - Fayette County in seconds.

How do I fill out KY Form 228-S - Fayette County on an Android device?

Use the pdfFiller mobile app to complete your KY Form 228-S - Fayette County on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is KY Form 228-S - Fayette County?

KY Form 228-S is a tax form specific to Fayette County that is used for reporting certain types of income and expenses for tax purposes.

Who is required to file KY Form 228-S - Fayette County?

Individuals or businesses that have specific tax obligations or income generated within Fayette County are required to file KY Form 228-S.

How to fill out KY Form 228-S - Fayette County?

To fill out KY Form 228-S, you need to provide your personal or business information, report income and expenses accurately, and follow the instructions included with the form.

What is the purpose of KY Form 228-S - Fayette County?

The purpose of KY Form 228-S is to provide the Fayette County Revenue Department with the necessary information to assess and collect local taxes based on the reported income.

What information must be reported on KY Form 228-S - Fayette County?

The information that must be reported includes personal or business identification details, total income, deductible expenses, and any applicable tax credits or adjustments.

Fill out your KY Form 228-S - Fayette County online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY Form 228-S - Fayette County is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.