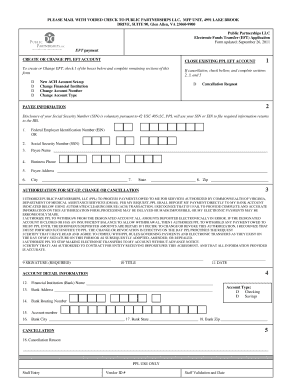

Public Partnership Electronic Funds Transfer (EFT) Application 2010 free printable template

Get, Create, Make and Sign Public Partnership Electronic Funds Transfer EFT

Editing Public Partnership Electronic Funds Transfer EFT online

Uncompromising security for your PDF editing and eSignature needs

Public Partnership Electronic Funds Transfer (EFT) Application Form Versions

How to fill out Public Partnership Electronic Funds Transfer EFT

How to fill out Public Partnership Electronic Funds Transfer (EFT) Application

Who needs Public Partnership Electronic Funds Transfer (EFT) Application?

Instructions and Help about Public Partnership Electronic Funds Transfer EFT

To better serve today's customers information must be delivered quickly and concisely the industry can use universal language to explain ACH payments and the role of the ACH network why is that important so the industry all understands what the terms are I think that's the key to effective communication you can have individuals who are speaking about technology in particular and if one person uses a term in one way and another person uses differently they might think they're communicating head-on and in fact they're missing each other ACH network messaging addresses a need for consistent communication in the industry it also provides important opportunities for the ACH network people still don't understand the safety the security the reliability associated with the ACH network direct deposit and direct payment are the statements that actually say what we do it's a direct deposit it's a direct payment payroll or hunt and direct positive payroll has been around for years and years people understand it, so that's a book that's an understanding that can be leveraged, and I think that's that's why we need to do that this project if businesses and consumers understand the ACH network understand the framework that supports it I think we have opportunities for increased volume we've seen a clear bent in corporations as well as in consumers in wanting to be more dream wanting to get away from paper tomorrow more electronics being able to have a seamless flow I get my bill I look at it is coming to me electronically I click on pay it's paid electronically it's seamless I think about it anymore that's that's that's the that's the ultimate goal I think words can be very powerful, and they can develop a brand very quickly, but you got to be very careful and how you choose those words and how you deploy them I think it's especially important as usage of the network expands small businesses are becoming more technically sophisticated smaller banks are more actively engaged in that they lack the sort of framework but a consistent vocabulary and terminology hazard not sure within the last few years has done a fantastic job of making sure we message ACH its attributes but what we should be doing and what we shouldn't so really what we've done over the course of the last four decades is really build a network that's according to AFP the most state payment mechanism that exists today within the United States NACA empowers you and your customers by providing the language you need to speak concisely consistently and clearly about the benefits and opportunities of ACH payments for messaging resources and materials visit notch or

People Also Ask about

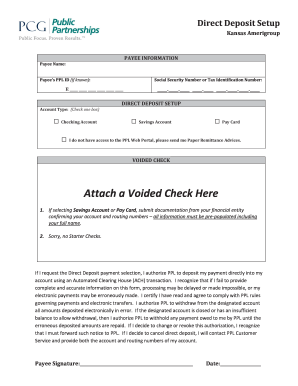

How do I get my paper for direct deposit?

How do you get a direct deposit form?

Do you need a voided check to get a direct deposit form?

Is there a form for direct deposit?

Should I do direct deposit or paper check?

Can I fill out a direct deposit form online?

Can I print off a direct deposit form?

What paper do you need for direct deposit?

How long does it take to go from direct deposit to paper check?

How do I set up direct deposit with public partnership?

Can I create my own direct deposit form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my Public Partnership Electronic Funds Transfer EFT directly from Gmail?

How can I fill out Public Partnership Electronic Funds Transfer EFT on an iOS device?

How do I complete Public Partnership Electronic Funds Transfer EFT on an Android device?

What is Public Partnership Electronic Funds Transfer (EFT) Application?

Who is required to file Public Partnership Electronic Funds Transfer (EFT) Application?

How to fill out Public Partnership Electronic Funds Transfer (EFT) Application?

What is the purpose of Public Partnership Electronic Funds Transfer (EFT) Application?

What information must be reported on Public Partnership Electronic Funds Transfer (EFT) Application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.