GR Claim for the Application of the Double Taxation Convention Between Greece 2003 free printable template

Show details

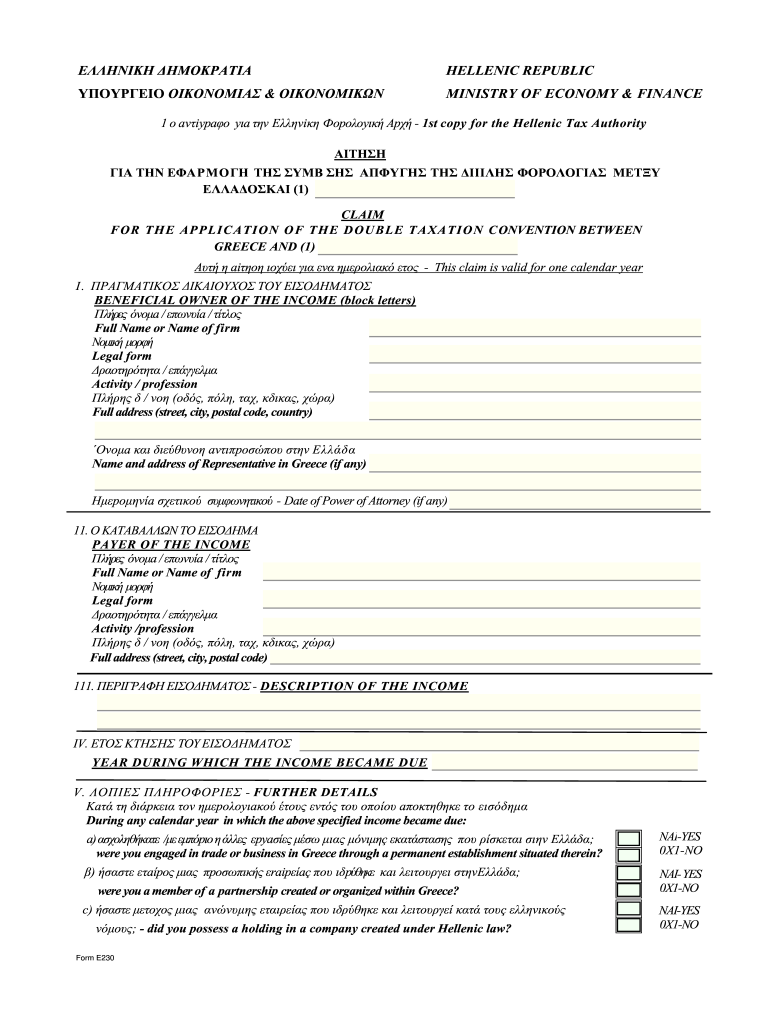

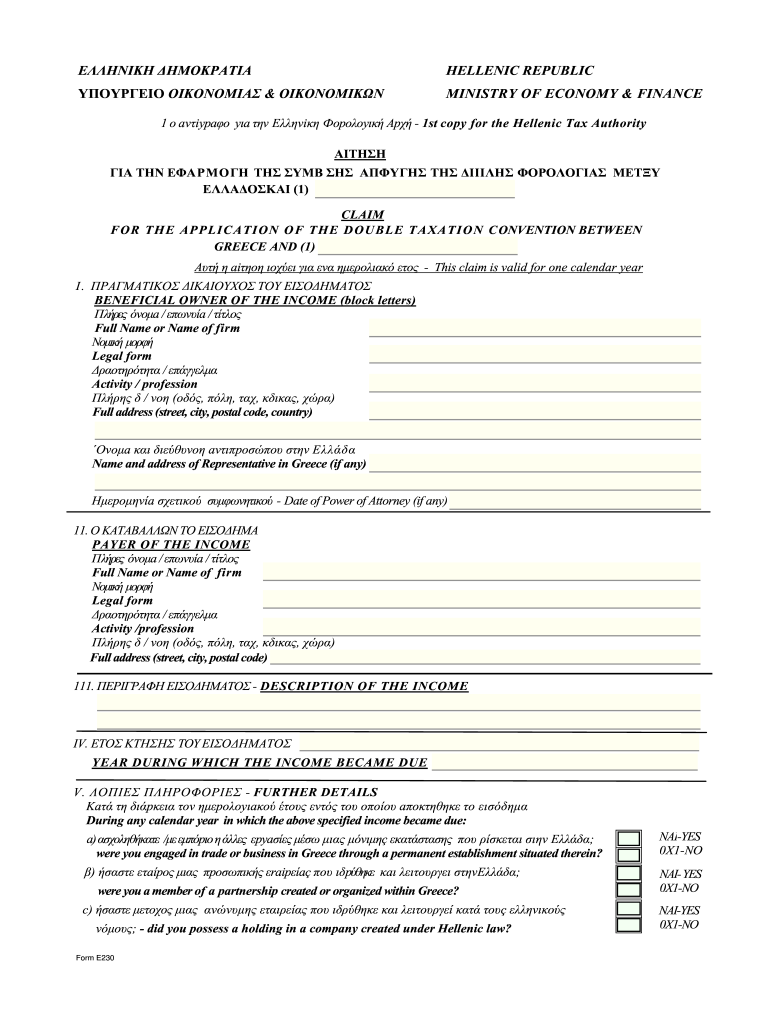

E HNIK HMOKPATIA HELLENIC REPUBLIC Y OYP EIO OIKONOMIA OIKONOMIK N MINISTRY OF ECONOMY FINANCE 1 o av iypa o y a v E vi opo oy Ap - 1st copy for the Hellenic Tax Authority AITH H THN E APMO H TH YMB H A Y H TH III H OPO O I MET E A O KAI 1 CLAIM FOR THE APPLICATION OF THE DOUBLE TAXATION CONVENTION BETWEEN GREECE AND 1 ai - This claim is valid for one calendar year I. PA MATIKO IKAIOYXO TOY EI O HMATO BENEFICIAL OWNER OF THE INCOME block letters vo a / v a / Full...

We are not affiliated with any brand or entity on this form

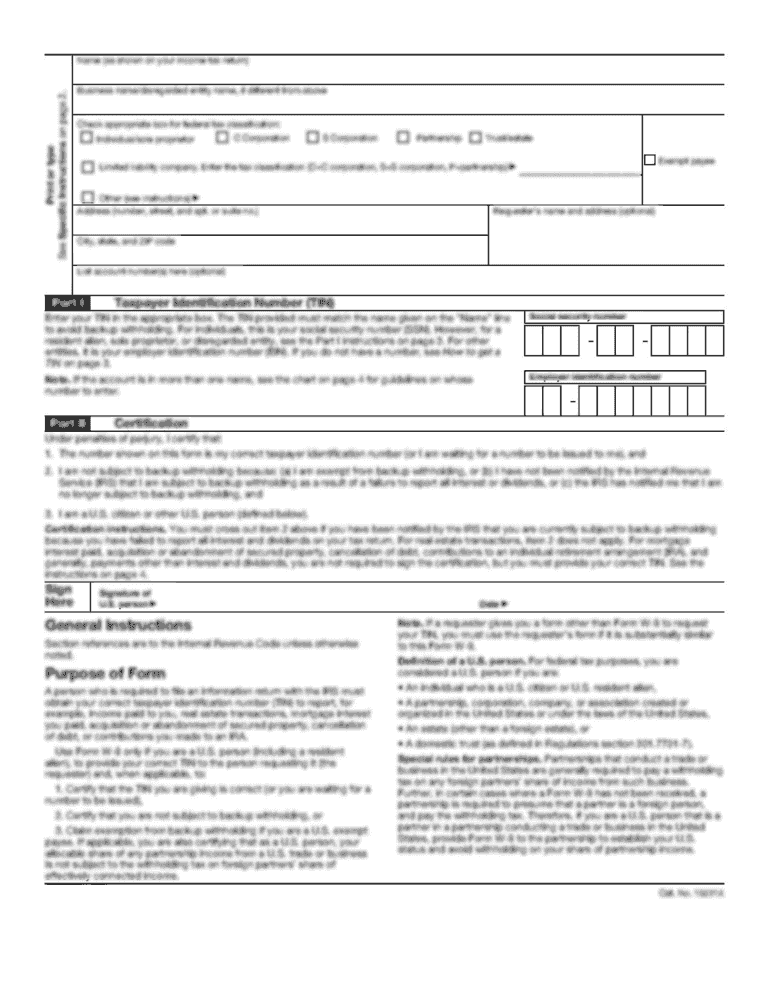

Get, Create, Make and Sign form e230 2003

Edit your form e230 2003 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form e230 2003 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form e230 2003 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form e230 2003. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

GR Claim for the Application of the Double Taxation Convention Between Greece Form Versions

Version

Form Popularity

Fillable & printabley

4.5 Satisfied (35 Votes)

4.0 Satisfied (27 Votes)

Fill

form

: Try Risk Free

People Also Ask about

What is the Israel Greece Double Tax treaty?

Greece-Israel Tax Treaty A double taxation treaty is a bilateral agreement under which two states claiming for a taxation privilege in relation to an income and/or assets in relation to a taxpayer, an individual or a corporation, designed to reconcile the taxation rights of both countries.

Do dual citizens have to pay taxes in Greece?

In principle, subject to relevant tax treaty provisions, income tax is payable by all individuals earning income in Greece, regardless of citizenship or place of permanent residence.

What article of the double taxation agreement between Greece and the UK?

ing to article 14 of Double Taxation Agreement between Greece and UK, if income is subject to tax in both territories, relief from double taxation shall be given.

What is the double taxation agreement between US and Greece?

This basically means that government employees receiving wages, salaries, compensation or pension by one of the contracting states for services provided in that state –will only be taxed by that state and will be exempt in the other state.

What is the double taxation in Greece?

Double Taxation Treaty in Greece Double taxation occurs when both source and residence countries impose a tax on the same income of an individual. To prevent this, there is an agreement called the Double Taxation Treaty. This treaty/agreement is a bilateral agreement that any two countries can make with each other.

What is the US estate tax treaty with Greece?

The Estate Tax Treaty with Greece [FN7] was executed for the purpose of avoiding double taxation and preventing fiscal evasion with respect to taxes on the movable property estates of deceased persons. Article I of the treaty lists the taxes covered as the U.S. estate tax and the Greek tax on inheritances.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form e230 2003?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific form e230 2003 and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make changes in form e230 2003?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your form e230 2003 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I make edits in form e230 2003 without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit form e230 2003 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

What is GR Claim for form Application of form Double Taxation?

GR Claim refers to the Generic Relief Claim for the application of Double Taxation Agreements, allowing taxpayers to claim relief from double taxation on income earned in foreign countries.

Who is required to file GR Claim for form Application of form Double Taxation?

Taxpayers who are residents of a country that has a double taxation agreement with another jurisdiction and have income sourced from that other jurisdiction are required to file the GR Claim.

How to fill out GR Claim for form Application of form Double Taxation?

To fill out the GR Claim, taxpayers need to complete the form with personal and income details, specify the foreign jurisdiction, provide proof of residency and claim double tax relief as per the regulations outlined in the applicable treaty.

What is the purpose of GR Claim for form Application of form Double Taxation?

The purpose of the GR Claim is to enable taxpayers to seek relief from double taxation, preventing them from being taxed on the same income in multiple jurisdictions.

What information must be reported on GR Claim for form Application of form Double Taxation?

Required information includes taxpayer's identification details, income sources, amounts earned in the foreign jurisdiction, residency status, and any applicable tax treaty provisions.

Fill out your form e230 2003 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form e230 2003 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.