Get the free Corporate Card Account

Show details

This document serves as an application form for individuals or companies applying for a corporate card with Diners Club, outlining the necessary details for card issuance and associated terms and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporate card account

Edit your corporate card account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporate card account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit corporate card account online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit corporate card account. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

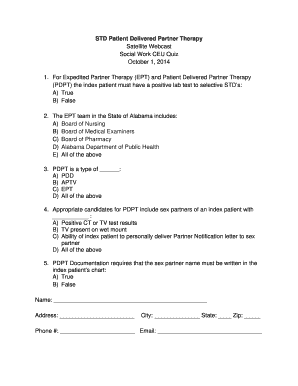

How to fill out corporate card account

How to fill out Corporate Card Account

01

Obtain the Corporate Card application form from your company's finance department or website.

02

Fill in your personal details, including your name, job title, and department.

03

Provide your company email address and contact information.

04

Specify the purpose of the Corporate Card and any specific limits required.

05

Include any necessary documentation, such as proof of employment or manager's approval.

06

Review the terms and conditions associated with the Corporate Card.

07

Submit the completed application form to the finance department for approval.

Who needs Corporate Card Account?

01

Employees who frequently travel for business purposes.

02

Staff members who need to make purchases on behalf of the company.

03

Managers or team leaders who are responsible for departmental budgets.

04

New hires requiring access to company funds for project-related expenses.

Fill

form

: Try Risk Free

People Also Ask about

Who gets corporate cards?

Corporate credit cards are typically issued to established companies with significant annual revenue (often above $4 million). Eligibility generally depends on the financial strength and creditworthiness of the business, not the individual employee. Employees receive cards at the company's discretion.

Can I use a corporate card for personal use?

No Impact on Personal Credit: Corporate credit card usage doesn't affect an employee's credit score. Restricted Use: Corporate credit cards are strictly for business-related expenses, and misuse can have financial, reputational, and legal consequences.

Does a corporate card hurt your credit score?

Corporate credit cards Some issuers may run a personal credit inquiry if a corporate card is being issued to you specifically, which could lead to a small and temporary hit to your personal credit score. However, the company's corporate card activity will likely not impact your personal credit score.

What is meant by corporate card?

A corporate credit card is a card companies issue to employees to make work-related purchases. The business is liable to repay the balance on the cards, rather than the business' owners or the individual cardholders.

What is corporate account in English?

A corporate account is a bank account opened in a company's name, helping businesses manage income and expenses separately from personal finances. Corporate accounts are typically for larger businesses, while business accounts are more common for freelancers, sole proprietors, and small companies.

What does corporate card mean?

A corporate credit card is a card companies issue to employees to make work-related purchases. The business is liable to repay the balance on the cards, rather than the business' owners or the individual cardholders.

What happens if you use corporate card for personal use?

Putting your personal purchases on your business credit card technically isn't illegal. However, making personal purchases on a business credit card likely violates the terms and conditions of your card agreement, which can come with serious consequences.

Who pays for a corporate card?

Corporate cards often use corporate liability meaning the business is responsible for payment rather than the individual businessowner.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Corporate Card Account?

A Corporate Card Account is a financial account provided by companies to their employees, allowing them to make purchases related to business expenses using company-funded credit cards.

Who is required to file Corporate Card Account?

Employees who utilize the corporate card for business expenses are typically required to file a Corporate Card Account report, along with finance or accounting departments that oversee the reconciliation of these expenses.

How to fill out Corporate Card Account?

To fill out a Corporate Card Account, employees must provide details such as the date of transaction, description of the expense, amount spent, receipts as proof of purchase, and any necessary approvals from management.

What is the purpose of Corporate Card Account?

The purpose of a Corporate Card Account is to manage and track business-related expenses, streamline the reimbursement process, and ensure compliance with company spending policies.

What information must be reported on Corporate Card Account?

Information that must be reported includes transaction dates, names of vendors, detailed descriptions of purchases, total amounts spent, receipts, and category of expenses.

Fill out your corporate card account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporate Card Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.