Get the free 2011 Year-End Tax Memo

Show details

An annual publication detailing tax updates, filing requirements, and key payroll tax rates for the year 2011, specifically for clients and stakeholders in the construction industry.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2011 year-end tax memo

Edit your 2011 year-end tax memo form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2011 year-end tax memo form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2011 year-end tax memo online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2011 year-end tax memo. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

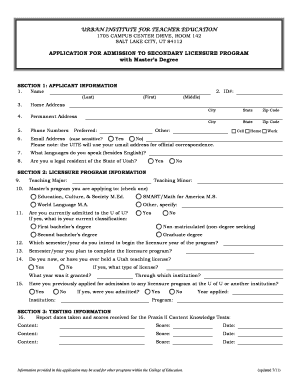

How to fill out 2011 year-end tax memo

How to fill out 2011 Year-End Tax Memo

01

Gather all necessary financial documents including income statements, expense receipts, and tax forms.

02

Organize the documents by category, such as income, deductible expenses, and credits.

03

Begin filling out the memo by summarizing total income earned for the year.

04

List all deductible expenses that are eligible, ensuring to provide accurate figures based on receipts.

05

Include any credits or deductions for which you qualify, providing necessary details and documentation.

06

Review the memo for accuracy and completeness, ensuring all figures match the supporting documents.

07

Finalize the memo and consult with a tax professional if necessary before submission.

Who needs 2011 Year-End Tax Memo?

01

Individuals and businesses who need to report their financial activities for the year in preparation for filing taxes.

02

Tax professionals assisting clients in compiling year-end financial information.

03

Anyone seeking to maximize deductions and credits available for the 2011 tax year.

Fill

form

: Try Risk Free

People Also Ask about

Where can I get an IRS instruction booklet?

Get the current filing year's forms, instructions, and publications for free from the IRS. You can also find printed versions of many forms, instructions, and publications in your community for free at: Libraries. IRS Taxpayer Assistance Centers.

Does everyone with a mortgage get a 1098?

Taxpayers: If you are a homeowner and have one or more mortgages, you should receive a Form 1098 for each mortgage where total interest and expenses (like mortgage points) are $600 or more. If your interest is less than $600, you won't get this form.

What is the year end mortgage tax statement?

Form 1098 Mortgage Interest Statement is used by lenders to report the amounts paid by a borrower if it is $600 or more in interest, mortgage insurance premiums, or points during the tax year. Lenders are required to file a separate Form 1098 for each mortgage that they hold.

Where do I find my mortgage tax statement?

Form 1098 is a tax document that homeowners will receive if they pay $600 or more in mortgage interest over the course of a year. 1 Your mortgage lender will send you a copy of Form 1098 so you can prepare to file your annual taxes.

Is a year end statement the same as a 1098?

A year-end statement, (also known as IRS tax form 1098) is essentially a status update on a mortgage. It's a document that is sent out and shows how much mortgage interest, mortgage points and property taxes have been paid by the borrower that year.

What happens if I don't file my 1098 mortgage interest statement?

If you file after August 1 or you do not file at all, the penalty is $100 per 1098 form with a maximum of $1,500,000 per year or $500,000 for small businesses.

What do you put in a memo for a tax check?

Social Security number (the SSN shown first if it's a joint return) or employer identification number. Tax year. Related tax form or notice number.

How can I get a copy of my 2011 tax return?

You'll need to file Form 4506, Request for Copy of Tax Return, to get your tax information and pay the IRS a $50 fee for each return copy requested. You should note that it takes longer for this method—up to 75 days—for the IRS to process your request.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2011 Year-End Tax Memo?

The 2011 Year-End Tax Memo is a document that summarizes tax-related information for the year 2011, including any changes in tax laws and guidelines for tax reporting.

Who is required to file 2011 Year-End Tax Memo?

Individuals and businesses that had taxable income, deductions, or credits during the year 2011 are required to file the 2011 Year-End Tax Memo.

How to fill out 2011 Year-End Tax Memo?

To fill out the 2011 Year-End Tax Memo, gather all relevant financial documents, complete the designated sections with accurate income and deduction details, and ensure to follow the proper format as stipulated by tax authorities.

What is the purpose of 2011 Year-End Tax Memo?

The purpose of the 2011 Year-End Tax Memo is to provide a clear and concise summary of the taxpayer's financial activities during the year, helping to prepare for accurate tax filings.

What information must be reported on 2011 Year-End Tax Memo?

The information that must be reported on the 2011 Year-End Tax Memo includes total income, eligible deductions, tax credits claimed, and any other relevant tax data for the year.

Fill out your 2011 year-end tax memo online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2011 Year-End Tax Memo is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.