RI RI W-4 2011 free printable template

Show details

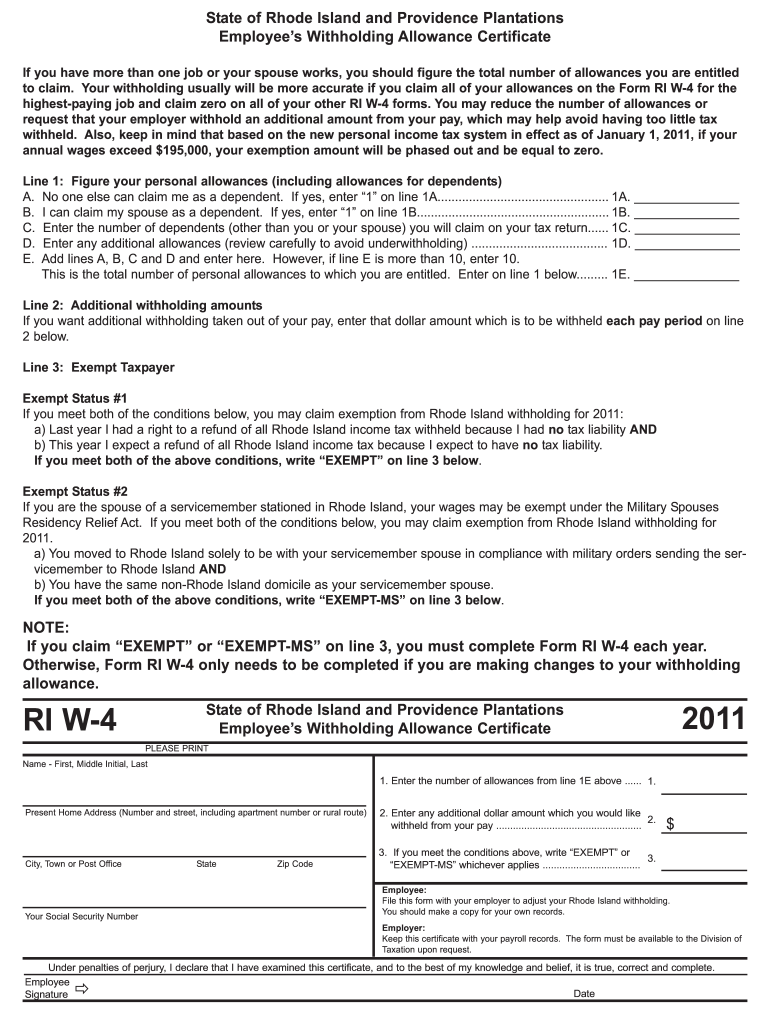

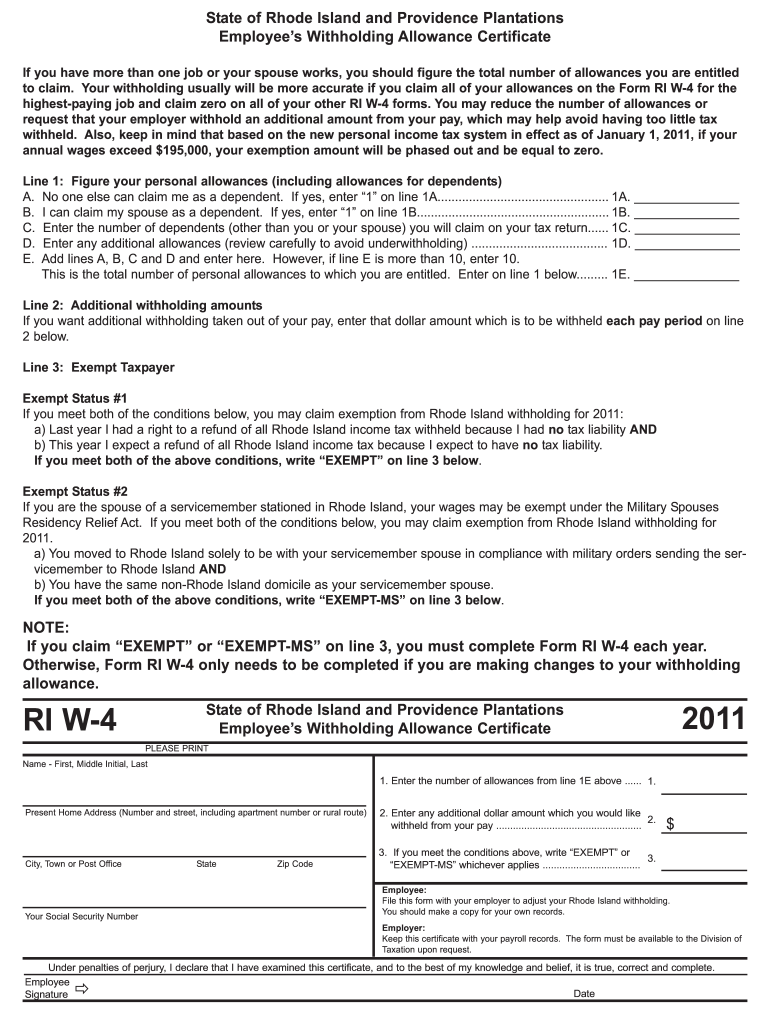

State of Rhode Island and Providence Plantations Employee's Withholding Allowance Certificate

If you have more than one job or your spouse works, you should figure the total number of allowances you

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign RI RI W-4

Edit your RI RI W-4 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your RI RI W-4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit RI RI W-4 online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit RI RI W-4. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

RI RI W-4 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out RI RI W-4

How to fill out RI RI W-4

01

Begin by entering your personal information at the top of the form, including your name, address, and Social Security number.

02

Indicate your filing status by checking the appropriate box: single, married, or head of household.

03

Claim your allowances on line 5. Use the worksheet provided on the form to calculate the number of allowances you are eligible for.

04

If you want additional amounts withheld from your paycheck, enter that amount on line 6.

05

Sign and date the form at the bottom to validate it and submit it to your employer.

Who needs RI RI W-4?

01

Individuals who are employed and wish to adjust their state income tax withholding for Rhode Island are required to fill out the RI RI W-4 form.

02

Anyone who wants to ensure the correct amount of tax is withheld from their paycheck according to their financial situation needs to complete this form.

Fill

form

: Try Risk Free

People Also Ask about

Does Rhode Island have state income tax withholding form?

The Rhode Island Form RIW-4, Employee's Withholding Allowance Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages.

How do I register for withholding tax in RI?

Rhode Island Withholding Account Number If you are a new business, register online with the RI Department of Revenue. If you already have a Rhode Island Withholding Account Number, you can find it on previous correspondence from the RI Department of Revenue or by contacting the agency at 401-574-8829.

What is Ri w4?

The Rhode Island Form RIW-4, Employee's Withholding Allowance Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages.

How do I fill out a RI W-4?

1:12 4:52 Step one is broken down into parts a b and c part a asks for your name and address Part B is yourMoreStep one is broken down into parts a b and c part a asks for your name and address Part B is your social security number and in Part C you'll select one of three boxes.

Does Rhode Island have a state tax form?

UMass employees who reside in Rhode Island use the RI-W4 form to instruct how RI state taxes should be calculated and withheld.

How do I fill out a RI W-4?

1:12 4:52 Filling Out the W-4 Form | Personal Finance 101 - YouTube YouTube Start of suggested clip End of suggested clip Step one is broken down into parts a b and c part a asks for your name and address Part B is yourMoreStep one is broken down into parts a b and c part a asks for your name and address Part B is your social security number and in Part C you'll select one of three boxes.

What is the RI employer registration number?

Thank you for using the Rhode Island online registration service. Contact Phone Numbers: RI Division of Taxation Registration Section 401-574-8829 - withholding and sales tax registration only questions. RI Employer Tax Section 401-574-8700 (Option 1) - unemployment and TDI.

Does RI have a w4 form?

You must complete Form RI W-4 for your employer(s). Once you have completed Form RI W-4 for your employer, Form RI W-4 only needs to be completed if you are making changes to your withholding allowance or have a new employer.

How do I fill out a withholding tax form?

How to fill out a W-4: step by step Step 1: Enter your personal information. Step 2: Account for all jobs you and your spouse have. Step 3: Claim your children and other dependents. Step 4: Make other adjustments. Step 5: Sign and date your form.

Which states have W-4 forms?

Updated federal W-4 Colorado* (employees can use either the federal W-4 or Colorado's state W-4 form) Delaware* (employees can use either the federal W-4 or Delaware's state W-4 form) Idaho. Minnesota. Montana. Nebraska. South Carolina.

Does Rhode Island have a state withholding tax form?

You must complete Form RI W-4 for your employer(s). Once you have completed Form RI W-4 for your employer, Form RI W-4 only needs to be completed if you are making changes to your withholding allowance or have a new employer. Form RI W-4 must be completed each year if you claim “EXEMPT” or “EXEMPT-MS” on line 3 below.

How do I file a WHT tax?

The payer is required to generate a withholding tax certificate on iTax which is automatically sent to the payee once the payer remits the withholding tax to KRA. Withholding tax deducted should be remitted to KRA by the 20th day of the month following the month in which the tax was deducted.

How do I register my business with the state of Rhode Island?

Register Your Business with the State of Rhode Island Gather required information. Name of Company. Get proof of good standing or legal existence. Register your business. Register with the RI Division of Taxation. Confirm your filing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my RI RI W-4 directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your RI RI W-4 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Can I sign the RI RI W-4 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your RI RI W-4 in seconds.

How do I fill out RI RI W-4 using my mobile device?

Use the pdfFiller mobile app to fill out and sign RI RI W-4. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is RI RI W-4?

RI RI W-4 is the Rhode Island Employee's Withholding Certificate used by employees to indicate their tax withholding preferences to their employer.

Who is required to file RI RI W-4?

Any employee in Rhode Island who wishes to adjust their state tax withholding or claims for exemptions must file a RI RI W-4.

How to fill out RI RI W-4?

To fill out RI RI W-4, provide your personal information like name, address, Social Security number, and the number of allowances you are claiming. You can also indicate any additional withholding amounts.

What is the purpose of RI RI W-4?

The purpose of RI RI W-4 is to inform employers of the correct amount of state income tax to withhold from an employee's paycheck.

What information must be reported on RI RI W-4?

Information that must be reported on RI RI W-4 includes the employee's name, address, Social Security number, marital status, number of allowances claimed, and any additional amount to withhold if desired.

Fill out your RI RI W-4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

RI RI W-4 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.