RI RI W-4 2022 free printable template

Show details

State of Rhode Island Division of Taxation

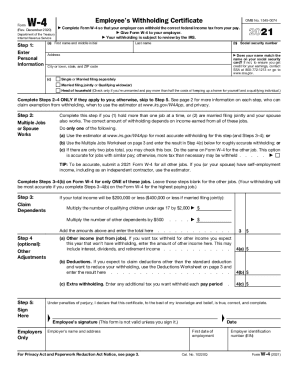

Employees Withholding Allowance Certificate

Federal Form W4 can no longer be used for Rhode Island withholding purposes. You must complete Form RI W4 for

your

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign rhode island 4 form

Edit your ri w form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rhode island w4 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rhode island 4 online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit rhode island w printable form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

RI RI W-4 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ri w4 form

How to fill out RI RI W-4

01

Start by downloading the RI RI W-4 form from the Rhode Island Division of Taxation website.

02

Fill in your personal information: name, address, and Social Security number.

03

Indicate your filing status (Single, Married, Head of Household) in the appropriate box.

04

Decide how many allowances you are claiming; this could be based on your personal circumstances.

05

If applicable, indicate any additional amount you wish to have withheld from your paycheck.

06

Sign and date the form to certify that the provided information is accurate.

07

Submit the completed form to your employer's payroll department.

Who needs RI RI W-4?

01

Anyone who is employed in Rhode Island and wishes to have state income tax withheld from their paycheck.

02

New employees who need to register for withholding tax.

03

Employees who need to update their withholding information due to changes in personal circumstances.

Fill

rhode island w 4 form

: Try Risk Free

People Also Ask about ri 4 form

Does Rhode Island have state income tax withholding form?

The Rhode Island Form RIW-4, Employee's Withholding Allowance Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages.

How do I register for withholding tax in RI?

Rhode Island Withholding Account Number If you are a new business, register online with the RI Department of Revenue. If you already have a Rhode Island Withholding Account Number, you can find it on previous correspondence from the RI Department of Revenue or by contacting the agency at 401-574-8829.

What is Ri w4?

The Rhode Island Form RIW-4, Employee's Withholding Allowance Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages.

How do I fill out a RI W-4?

1:12 4:52 Step one is broken down into parts a b and c part a asks for your name and address Part B is yourMoreStep one is broken down into parts a b and c part a asks for your name and address Part B is your social security number and in Part C you'll select one of three boxes.

Does Rhode Island have a state tax form?

UMass employees who reside in Rhode Island use the RI-W4 form to instruct how RI state taxes should be calculated and withheld.

How do I fill out a RI W-4?

1:12 4:52 Filling Out the W-4 Form | Personal Finance 101 - YouTube YouTube Start of suggested clip End of suggested clip Step one is broken down into parts a b and c part a asks for your name and address Part B is yourMoreStep one is broken down into parts a b and c part a asks for your name and address Part B is your social security number and in Part C you'll select one of three boxes.

What is the RI employer registration number?

Thank you for using the Rhode Island online registration service. Contact Phone Numbers: RI Division of Taxation Registration Section 401-574-8829 - withholding and sales tax registration only questions. RI Employer Tax Section 401-574-8700 (Option 1) - unemployment and TDI.

Does RI have a w4 form?

You must complete Form RI W-4 for your employer(s). Once you have completed Form RI W-4 for your employer, Form RI W-4 only needs to be completed if you are making changes to your withholding allowance or have a new employer.

How do I fill out a withholding tax form?

How to fill out a W-4: step by step Step 1: Enter your personal information. Step 2: Account for all jobs you and your spouse have. Step 3: Claim your children and other dependents. Step 4: Make other adjustments. Step 5: Sign and date your form.

Which states have W-4 forms?

Updated federal W-4 Colorado* (employees can use either the federal W-4 or Colorado's state W-4 form) Delaware* (employees can use either the federal W-4 or Delaware's state W-4 form) Idaho. Minnesota. Montana. Nebraska. South Carolina.

Does Rhode Island have a state withholding tax form?

You must complete Form RI W-4 for your employer(s). Once you have completed Form RI W-4 for your employer, Form RI W-4 only needs to be completed if you are making changes to your withholding allowance or have a new employer. Form RI W-4 must be completed each year if you claim “EXEMPT” or “EXEMPT-MS” on line 3 below.

How do I file a WHT tax?

The payer is required to generate a withholding tax certificate on iTax which is automatically sent to the payee once the payer remits the withholding tax to KRA. Withholding tax deducted should be remitted to KRA by the 20th day of the month following the month in which the tax was deducted.

How do I register my business with the state of Rhode Island?

Register Your Business with the State of Rhode Island Gather required information. Name of Company. Get proof of good standing or legal existence. Register your business. Register with the RI Division of Taxation. Confirm your filing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ri w4 without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your ri withholding into a dynamic fillable form that you can manage and eSign from anywhere.

How can I edit ri w 4 form on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing ri withholding allowance.

Can I edit ri w 4 form pdf on an iOS device?

Use the pdfFiller mobile app to create, edit, and share rhode island w4 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is RI RI W-4?

RI RI W-4 is a tax form used in Rhode Island for employees to indicate their state income tax withholding preferences.

Who is required to file RI RI W-4?

Employees who work and are subject to Rhode Island state income tax must file the RI RI W-4.

How to fill out RI RI W-4?

To fill out the RI RI W-4, provide your personal information, number of allowances, and any additional withholding amounts, then sign and date the form.

What is the purpose of RI RI W-4?

The purpose of RI RI W-4 is to provide employers with the information needed to calculate the correct amount of state income tax to withhold from an employee's paycheck.

What information must be reported on RI RI W-4?

The RI RI W-4 requires reporting personal information such as name, address, Social Security number, filing status, and the number of allowances claimed.

Fill out your RI RI W-4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Riw 4 is not the form you're looking for?Search for another form here.

Keywords relevant to ri w4 pdf

Related to ri w employees withholding fillable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.