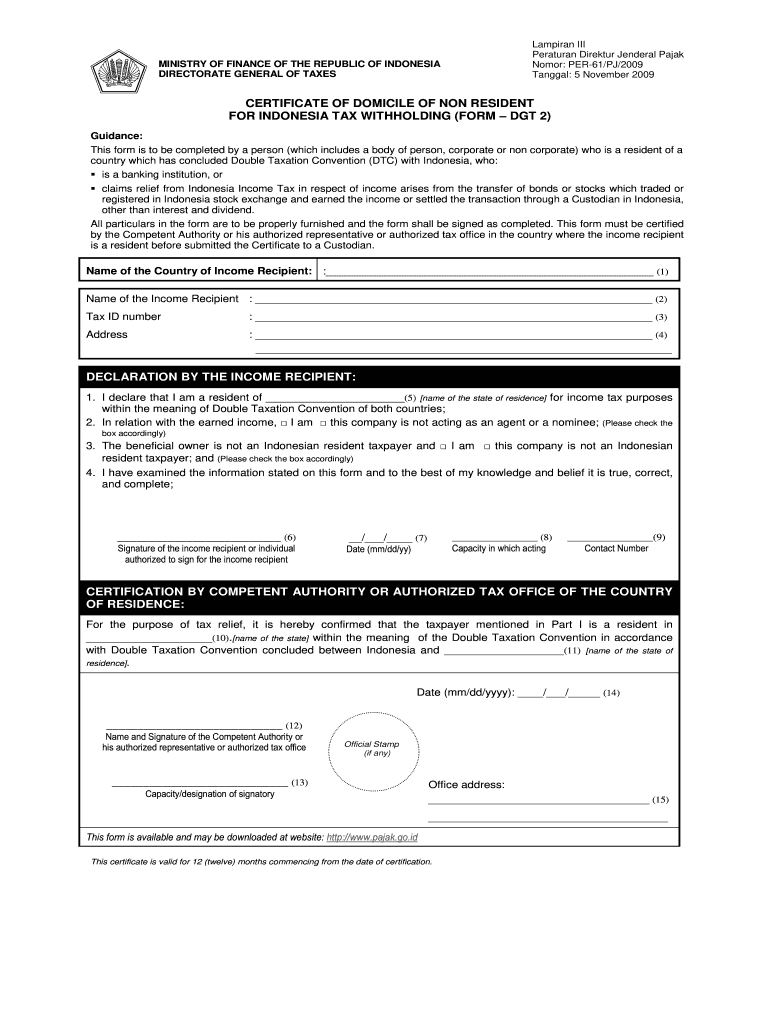

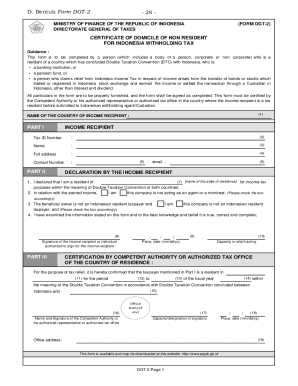

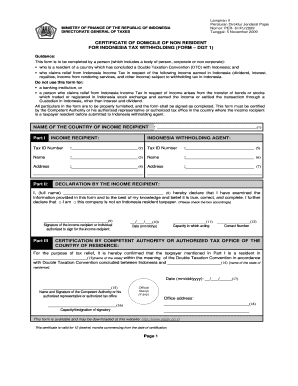

ID DGT 2 2009 free printable template

Get, Create, Make and Sign ID DGT 2

Editing ID DGT 2 online

Uncompromising security for your PDF editing and eSignature needs

ID DGT 2 Form Versions

How to fill out ID DGT 2

How to fill out ID DGT 2

Who needs ID DGT 2?

Instructions and Help about ID DGT 2

Indonesia imposes 20% withholding tax on the payments of interest fees and royalties from Indonesian residents to non-residents now the amount of holding withholding tax payable can be reduced if there is a double taxation agreement between the entity in which the recipient is resident and Indonesia and the as a result of the ability to reduce within the museum withholding tax Indonesian companies often issue bonds to offshore SPV structures the structure that we most commonly see is that the Indonesian company incorporates a subsidiary in the Netherlands or in Singapore because the Netherlands and Singapore have double taxation agreements with Indonesia be ODAS then issued by that subsidiary and the proceeds of the bond issuance are on a lent on to the Indonesian company that means that the payments of interest on the intercompany loan of the bond proceeds by the Indonesian company to the Dutch or Singapore subsidiary only incur withholding tax at the lower rate under the Ithaca ball double taxation agreement under the Singapore Indonesia agreement that's ten percent under the Netherlands Indonesia agreement it can even be pushed down to zero percent and so there's a real benefit for the company in terms of tax saving, so you then have the bond issued by the SPV an on loan of the proceeds to the Indonesian company and the Indonesian company will then provide a guarantee for the bond now this structure again creates a lot of confusion the context of an Indonesian insolvency proceeding and the confusion essentially arises because if there is an insolvency proceeding in respect of the Indonesian company it's possible to submit two proofs of claim in respect to the bottom one in respect of the guarantee provided by the Indonesian company and two respectively intercompany loan of the bond proceeds now clearly not both of those claims can be accepted because that double counting and so the question becomes which one should be accepted now if the intercompany loan claim is accepted then the creditor is actually the SPV that issued the bond and lent the proceeds onto the Indonesian company if the guarantee frame is accepted then the creditor is either a trustee or the underlying bonds or do has the benefit of the guarantee and again whether the trustee or the underlying bondholder should have the benefit of the claim is a difficult one, and you know something which is probably best discussed you know separately and what we've seen in recent PKP use is that Indonesian companies have manipulated this confusion to serve their own purposes and so where they feel that they may not have enough votes in order to have the composition plan which they put forward in the PKP you approved they will let say influence the outcome of the PKP you to ensure that the claim in respect of the intercompany loan of the bond proceeds which is controlled by their sub controlled and voted by their subsidiary is the claim that gets accepted and voted in the PKP you and your...

People Also Ask about

What are the visa requirements for Indonesia?

Is PeduliLindungi app still needed?

What are the requirements to enter Batam?

What is SNI certificate Indonesia?

Does Indonesia give citizenship to foreigners?

How can I change my citizenship to Indonesia?

What citizenship if a child is born in Indonesia?

What is proof of citizenship Indonesia?

Does Indonesia give citizenship to foreigners?

What is SNI certification Indonesia?

Do I need PeduliLindungi to enter Indonesia?

What are valid proofs of citizenship?

What is SNI on TYRE?

What is the easiest country to get dual citizenship?

Can you hold dual citizenship in Indonesia?

Who can visit Indonesia without visa?

How to obtain Indonesian citizenship?

Will Indonesia allow dual citizenship?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ID DGT 2 straight from my smartphone?

How can I fill out ID DGT 2 on an iOS device?

How do I complete ID DGT 2 on an Android device?

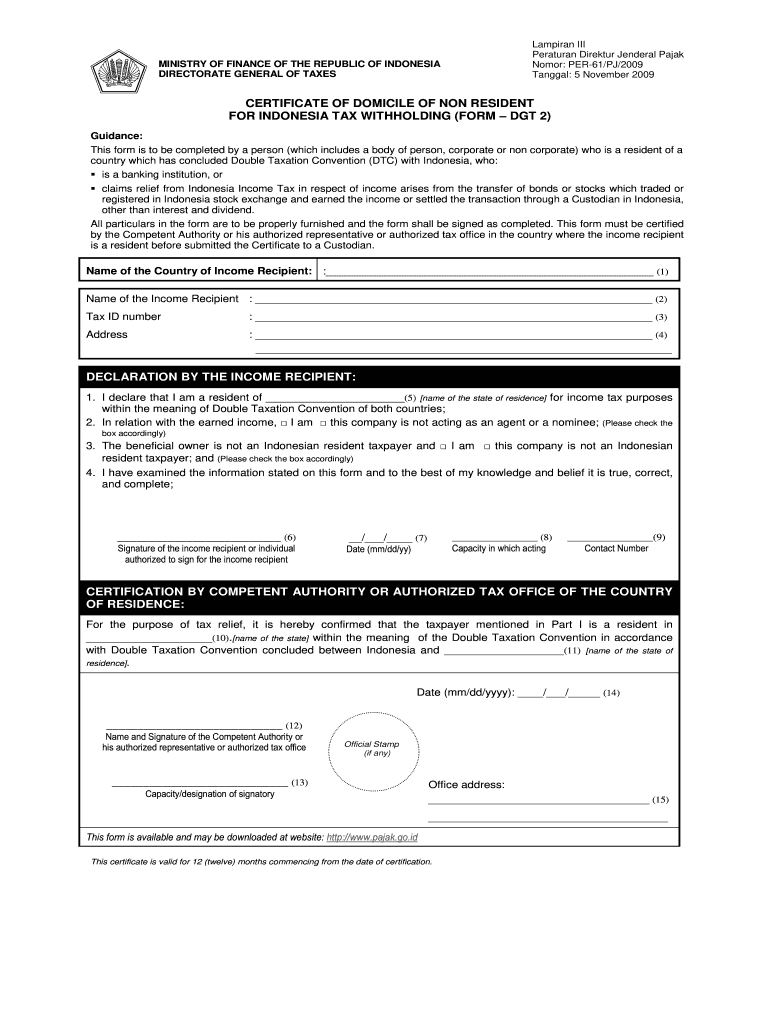

What is ID DGT 2?

Who is required to file ID DGT 2?

How to fill out ID DGT 2?

What is the purpose of ID DGT 2?

What information must be reported on ID DGT 2?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.