Get the free Regulation II - Debit Card Interchange - federalreserve

Show details

A document providing comments and opinions from Jack Dale, CEO of Entandem Inc., regarding the proposed rules on debit card interchange fees and routing, highlighting concerns for various stakeholders

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign regulation ii - debit

Edit your regulation ii - debit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your regulation ii - debit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing regulation ii - debit online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit regulation ii - debit. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out regulation ii - debit

How to fill out Regulation II - Debit Card Interchange

01

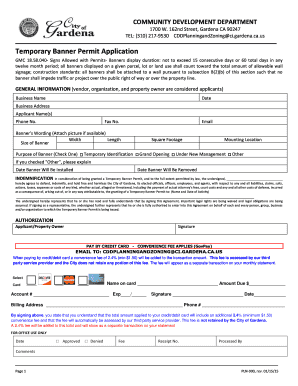

Obtain the Regulation II - Debit Card Interchange form from the appropriate regulatory agency.

02

Review the definitions and requirements outlined in the regulation to ensure compliance.

03

Gather all necessary data related to your debit card transactions, including volume, types of cards used, and fees charged.

04

Complete the form by entering your organization's information, such as name, address, and contact details.

05

Fill in the relevant sections regarding interchange fees, ensuring that you provide accurate and truthful information.

06

Double-check your entries for completeness and accuracy before submission.

07

Submit the completed form to the designated regulatory authority by the specified deadline.

Who needs Regulation II - Debit Card Interchange?

01

Financial institutions that issue debit cards.

02

Payment processors that handle debit card transactions.

03

Retailers and merchants that accept debit card payments.

04

Regulatory bodies overseeing banking and financial regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is a regulation 2 interchange fee?

Regulation II or Reg II is the “Debit Card Interchange Fees and Routing” rule, or the Durbin Amendment. Reg II is a provision of United States federal law that limits the fees that banks and financial institutions can charge merchants when consumers use their debit cards to make purchases.

What is the proposed rule for debit card interchange fee?

The central bank proposed in October 2023 to reduce the base debit interchange fee card issuers can charge by about 30% to 14.4 cents from 21 cents, per a memo produced by the Fed's staff.

Do interchange fees apply to debit cards?

Interchange fees are transaction fees charged between banks for processing credit and debit card payments. When a customer makes a purchase using a card, the business's acquiring bank pays the interchange fee to the cardholder's issuing bank.

What is the proposed rule for debit card interchange fee?

The central bank proposed in October 2023 to reduce the base debit interchange fee card issuers can charge by about 30% to 14.4 cents from 21 cents, per a memo produced by the Fed's staff.

What is the interchange rule for debit cards?

The Board's Regulation II provides that an issuer subject to the interchange fee standard (a covered issuer) may not receive, for any electronic debit transaction, an interchange fee that exceeds $0.21 plus 0.05 percent multiplied by the value of the transaction, plus a $0.01 fraud-prevention adjustment, if eligible.

What is Regulation 2 debit card interchange fees?

Regulation II or Reg II is the “Debit Card Interchange Fees and Routing” rule, or the Durbin Amendment. Reg II is a provision of United States federal law that limits the fees that banks and financial institutions can charge merchants when consumers use their debit cards to make purchases.

What is the interchange rule for debit cards?

The Board's Regulation II provides that an issuer subject to the interchange fee standard (a covered issuer) may not receive, for any electronic debit transaction, an interchange fee that exceeds $0.21 plus 0.05 percent multiplied by the value of the transaction, plus a $0.01 fraud-prevention adjustment, if eligible.

What is the payment card interchange fee regulation?

Firstly, the EU IFR imposes caps on the interchange fees that can be set. These are set at 0.2% of the total value of the transaction for consumer debit cards (including prepaid cards) and 0.3% for credit cards.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

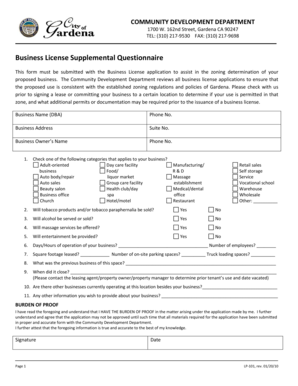

What is Regulation II - Debit Card Interchange?

Regulation II - Debit Card Interchange refers to the Federal Reserve regulation that governs the interchange fees that banks and financial institutions can charge for debit card transactions. It aims to promote competition and transparency in the debit card payment system.

Who is required to file Regulation II - Debit Card Interchange?

Entities required to file Regulation II - Debit Card Interchange include issuers of debit cards that have assets of $10 billion or more, which are subject to interchange fee standards outlined in the regulation.

How to fill out Regulation II - Debit Card Interchange?

To fill out Regulation II - Debit Card Interchange, entities must provide information regarding their debit card transactions, including the number of transactions, the average interchange fee, and total volume. Compliance requires following the specific filing instructions provided by the Federal Reserve.

What is the purpose of Regulation II - Debit Card Interchange?

The purpose of Regulation II - Debit Card Interchange is to limit the interchange fees charged for debit card transactions, thereby ensuring that these fees are reasonable and proportional to the cost incurred by issuers. It aims to foster competition and protect merchants and consumers.

What information must be reported on Regulation II - Debit Card Interchange?

Information that must be reported includes the total number of debit card transactions, the average interchange fee per transaction, total interchange revenue, and other relevant transactional data that serves to demonstrate compliance with the fee standards.

Fill out your regulation ii - debit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Regulation Ii - Debit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.