Get the free find 433 b form this computer

Show details

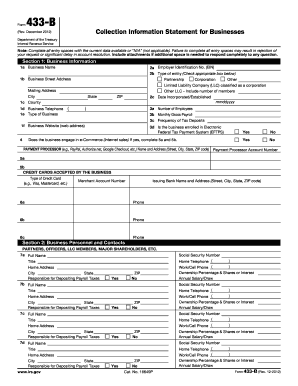

Form 433-B Collection Information Statement for Businesses Rev. January 2008 Department of the Treasury Internal Revenue Service Note Complete all entry spaces with the current data available or N/A not applicable. Failure to complete all entry spaces may result in rejection of your request or significant delay in account resolution. Include attachments if additional space is needed to respond completely to any question. Section 1 Business Infor...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign find 433 b form

Edit your find 433 b form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your find 433 b form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit find 433 b form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit find 433 b form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out find 433 b form

How to fill out Form 433-B?

01

Gather all necessary financial information: Collect documents such as bank statements, income statements, tax returns, and any other relevant financial records.

02

Provide personal information: Fill in your name, address, Social Security number, and other required personal details in the designated sections of the form.

03

Describe your business: Indicate the type of business you have, its legal structure, and provide a brief description of its activities.

04

Determine your monthly income and expenses: List your monthly sources of income and accurately report your expenses in the appropriate sections. Include details about rent or mortgage payments, utilities, insurance, transportation costs, and other necessary expenditures.

05

Disclose your assets and liabilities: Provide a detailed inventory of your assets, including real estate, vehicles, investments, and bank accounts. Additionally, report any outstanding debts or liabilities in the relevant sections.

06

Declare your business accounts: List all the financial institutions where you hold business accounts, along with the account numbers and balances.

07

Provide tax information: Report your tax filing history, including any outstanding tax liabilities or payment arrangements you have made with the IRS.

08

Provide supporting documents: Attach any necessary supporting documentation, such as bank statements, tax returns, or notices from the IRS, to validate the information provided on the form.

Who needs Form 433-B?

01

Individuals with a business: If you are an individual with a sole proprietorship, partnership, or LLC, and your business owes taxes to the IRS or needs to negotiate a payment plan, you will likely need to fill out Form 433-B.

02

Businesses facing financial difficulties: If your business is struggling financially and needs to negotiate an installment agreement or a compromise offer with the IRS, you may need to submit Form 433-B.

03

Taxpayers with significant tax debt: If you owe a substantial amount of taxes and are unable to pay the full amount, the IRS may require you to complete Form 433-B as part of the process to evaluate your financial situation and determine a suitable payment arrangement.

Note: It is always advisable to consult a tax professional or seek guidance from the IRS to ensure accurate completion of Form 433-B based on your specific circumstances.

Fill

form

: Try Risk Free

People Also Ask about

How do I submit form 433-F to the IRS?

How to Submit Form 433-F (Collection Information Statement) Once you complete the financial information statement, sign it and send it to the IRS. If you are applying for a payment plan, also include Form 9465 (Installment Agreement Request) and a copy of your tax return. Don't include any supporting documentation.

What is the fax number to send documents to IRS?

Where to fax Form SS-4: Fax NumberArea855-641-6935One of the 50 states or the District of Columbia855-215-1627 (within the US) 304-707-9471 (outside the US)If you have no legal residence, principal office, or principal agency in any state or the District of Columbia (international/US possessions) Feb 22, 2023

What is the IRS fax number for form 433-D?

Where do I fax form 433-D to IRS? Fax: 855-215-1627 (within the U.S.)

What is the 433B collection information?

Form 433-B, Collection Information Statement for Businesses is used to set up a payment plan when businesses owe federal taxes and cannot immediately pay them.

What is the fax number for the IRS installment agreement?

Mail or Fax Form SS-4: Fax: 855-215-1627 (within the U.S.) Fax: 304-707-9471 (outside the U.S.)

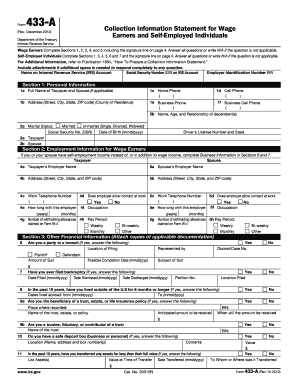

What is the difference between IRS form 433 A and 433-F?

IRS Form 433A- is a tax collection information statement for self-employed personnel and those that earn wages. IRS Form 433B- is a tax collection information statement for businesses. IRS Form 433F- is a generalized tax collection information statement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit find 433 b form straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing find 433 b form, you can start right away.

Can I edit find 433 b form on an Android device?

The pdfFiller app for Android allows you to edit PDF files like find 433 b form. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

How do I fill out find 433 b form on an Android device?

On Android, use the pdfFiller mobile app to finish your find 433 b form. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is find 433 b form?

Find 433 b form is a financial statement form used by the Internal Revenue Service (IRS) to collect information about the financial situation of individuals or businesses.

Who is required to file find 433 b form?

Individuals or businesses who owe taxes and are unable to pay the full amount may be required to file find 433 b form.

How to fill out find 433 b form?

To fill out find 433 b form, you need to provide detailed information about your assets, liabilities, income, expenses, and other financial information. It is recommended to consult the instructions provided by the IRS or seek professional assistance to ensure accurate completion of the form.

What is the purpose of find 433 b form?

The purpose of find 433 b form is to help the IRS assess an individual or business's ability to pay their tax debt and determine an appropriate course of action, such as setting up a payment plan or making a compromise settlement.

What information must be reported on find 433 b form?

Find 433 b form requires reporting of various financial information, including details of assets, income, expenses, debts, and sources of income.

Fill out your find 433 b form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Find 433 B Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.