IRS 1040 - Schedule D 2010 free printable template

Show details

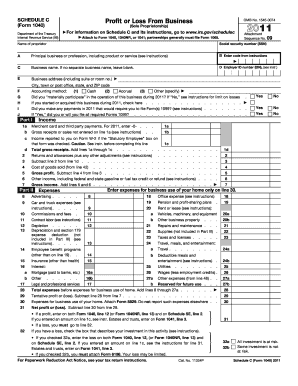

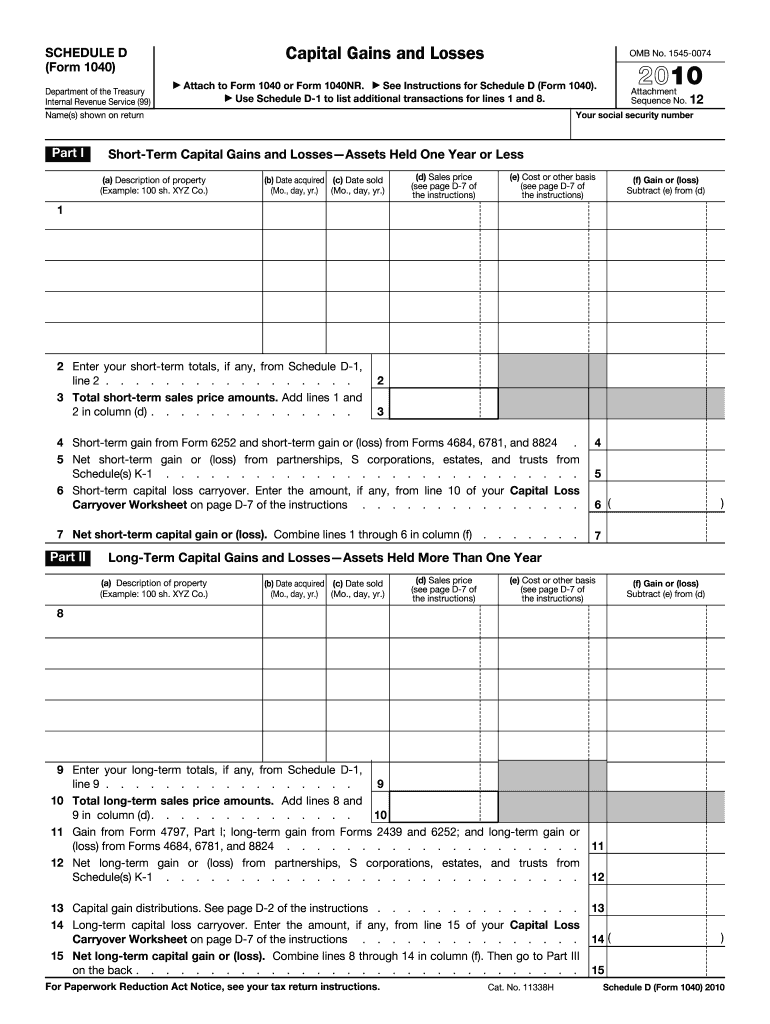

For Paperwork Reduction Act Notice see your tax return instructions. Cat. No. 11338H Schedule D Form 1040 2010 Page 2 Summary 16 Combine lines 7 and 15 and enter the result. Capital Gains and Losses SCHEDULE D Form 1040 Department of the Treasury Internal Revenue Service 99 Name s shown on return Part I OMB No* 1545-0074 Attach to Form 1040 or Form 1040NR* See Instructions for Schedule D Form 1040. Use Schedule D-1 to list additional transactions for lines 1 and 8. Attachment Sequence No* 12...Your social security number Short-Term Capital Gains and Losses Assets Held One Year or Less a Description of property Example 100 sh. XYZ Co. b Date acquired c Date sold Mo. day yr. Mo. day yr. d Sales price see page D-7 of the instructions e Cost or other basis f Gain or loss Subtract e from d 2 Enter your short-term totals if any from Schedule D-1 line 2. 3 Total short-term sales price amounts. Add lines 1 and 2 in column d. 4 Short-term gain from Form 6252 and short-term gain or loss from...Forms 4684 6781 and 8824. 5 Net short-term gain or loss from partnerships S corporations estates and trusts from Schedule s K-1. 6 Short-term capital loss carryover. Enter the amount if any from line 10 of your Capital Loss Carryover Worksheet on page D-7 of the instructions. Long-Term Capital Gains and Losses Assets Held More Than One Year 9 Enter your long-term totals if any from Schedule D-1 10 Total long-term sales price amounts. Add lines 8 and 11 Gain from Form 4797 Part I long-term gain...from Forms 2439 and 6252 and long-term gain or loss from Forms 4684 6781 and 8824. 12 Net long-term gain or loss from partnerships S corporations estates and trusts from 13 Capital gain distributions. See page D-2 of the instructions. 14 Long-term capital loss carryover. Enter the amount if any from line 15 of your Capital Loss on the back. If line 16 is a gain enter the amount from line 16 on Form 1040 line 13 or Form 1040NR line 14. Then go to line 17 below. If line 16 is a loss skip lines 17...through 20 below. Then go to line 21. Also be sure to complete line 22. If line 16 is zero skip lines 17 through 21 below and enter -0- on Form 1040 line 13 or Form 1040NR line 14. Then go to line 22. 17 Are lines 15 and 16 both gains Yes. Go to line 18. No* Skip lines 18 through 21 and go to line 22. 18 Enter the amount if any from line 7 of the 28 Rate Gain Worksheet on page D-8 of the instructions. D-9 of the instructions. 20 Are lines 18 and 19 both zero or blank Yes. Complete Form 1040...through line 43 or Form 1040NR through line 41. Then complete the Qualified Dividends and Capital Gain Tax Worksheet in the Instructions for Form 1040 line 44 or in the Instructions for Form 1040NR line 42. Do not complete lines 21 and 22 below. No* Complete Form 1040 through line 43 or Form 1040NR through line 41. Then complete the Schedule D Tax Worksheet on page D-10 of the instructions. Do not complete lines 21 and 22 below. The loss on line 16 or 3 000 or if married filing separately 1 500...Note. When figuring which amount is smaller treat both amounts as positive numbers.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1040 - Schedule D

How to edit IRS 1040 - Schedule D

How to fill out IRS 1040 - Schedule D

Instructions and Help about IRS 1040 - Schedule D

How to edit IRS 1040 - Schedule D

To edit IRS 1040 - Schedule D, you can utilize pdfFiller’s tools that allow you to modify the text directly on the form. You can effortlessly update information, correct errors, or add missing details before final submission. It's essential to ensure that all changes reflect accurate information to avoid any issues with your filing.

How to fill out IRS 1040 - Schedule D

To fill out IRS 1040 - Schedule D, follow these steps:

01

Download the form from the IRS website or access it through pdfFiller.

02

Gather all necessary documentation related to capital gains and losses, including transaction details for stocks, bonds, and real estate.

03

Complete the form by entering your information in the designated sections, detailing your capital assets and transactions.

04

Calculate your total gains or losses based on the provided guidelines and carry over any necessary information to your main 1040 form.

05

Review the completed form for accuracy and completeness before submitting it.

About IRS 1040 - Schedule D 2010 previous version

What is IRS 1040 - Schedule D?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1040 - Schedule D 2010 previous version

What is IRS 1040 - Schedule D?

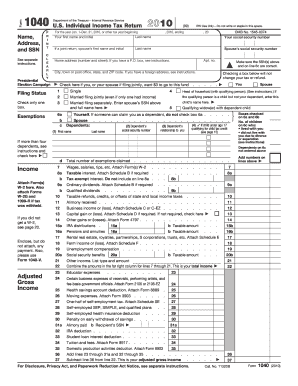

IRS 1040 - Schedule D is a tax form that reports capital gains and losses from the sale of assets. This form is crucial for taxpayers who engage in investment activities, such as buying and selling stocks, bonds, or real estate. Completing Schedule D helps determine your overall tax liability and ensures compliance with U.S. tax regulations.

What is the purpose of this form?

The purpose of IRS 1040 - Schedule D is to calculate and report capital gains and losses incurred during the tax year. It allows taxpayers to detail their transactions and assess how these impacts their taxable income. Accurate reporting on Schedule D is essential for correctly determining tax obligations and potential tax liabilities.

Who needs the form?

Taxpayers who sold capital assets during the tax year must use IRS 1040 - Schedule D. This includes individuals who sold stocks, bonds, real estate, and other investments that resulted in capital gains or losses. Anyone who meets the criteria for reporting these transactions must also attach Schedule D to their Form 1040 during tax filing.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 1040 - Schedule D if you have no capital gains or losses to report for the tax year. Additionally, if your transactions involve only capital losses that are less than the allowable deduction limits or if you qualify for specific exceptions, you may not have to complete this form. Always check IRS guidelines to confirm exemption eligibility.

Components of the form

IRS 1040 - Schedule D consists of several key components, including:

01

The Summary section, where total gains and losses are calculated.

02

Part I, reporting short-term capital gains and losses.

03

Part II, reporting long-term capital gains and losses.

04

Additional worksheets for calculating specific capital gains rates.

Each section guides taxpayers in accurately reporting their transactions and calculating their tax obligations.

What are the penalties for not issuing the form?

The penalties for failing to file IRS 1040 - Schedule D when required can be severe. Taxpayers may face fines, interest on unpaid taxes, and potential audit scrutiny. In cases of negligence or fraud, penalties can increase significantly, emphasizing the importance of accurate and timely filing.

What information do you need when you file the form?

When filing IRS 1040 - Schedule D, you will need several key pieces of information, including:

01

The dates of asset purchases and sales.

02

The proceeds from each sale.

03

The basis cost for each asset sold.

04

Documentation related to each transaction like brokerage statements and closing documents for real estate.

Collecting this data in advance streamlines the filling process and ensures accuracy.

Is the form accompanied by other forms?

IRS 1040 - Schedule D is typically accompanied by Form 8949, which is used to report individual sales of capital assets. Form 8949 details the specifics of each transaction, while Schedule D summarizes the overall results. Taxpayers must ensure both forms are completed and submitted together with their main Form 1040.

Where do I send the form?

After completing IRS 1040 - Schedule D, you must send the form to the address specified in the Form 1040 instructions. The submission may vary based on your state of residence and whether you are filing your return electronically or via mail. Always refer to the IRS guidelines for the most accurate mailing information.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

This makes form filling a lot easier than with typewriter.

I have never used a filler app so awesome like this one!

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.