IRS 1024 1998 free printable template

Show details

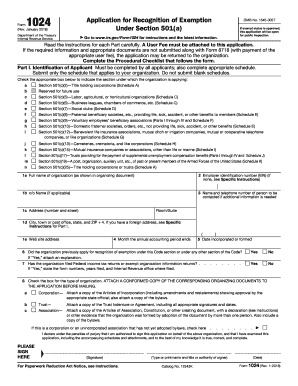

Type or print name and title or authority of signer Cat. No. 12343K Date Form 1024 Rev. 9-98 Page Part II. If No answer question 2. If you answer No to question 1 are you filing Form 1024 within 27 months from the end of the month in which the If Yes your organization qualifies under Regulation section 301. Notice Requirements Sections 501 c 9 and 501 c 17 Organizations Only Section 501 c 9 and 501 c 17 organizations Are you filing Form 1024 within 15 months from the end of the month in which...the organization was created or formed as required by section 505 c If Yes skip the rest of this Part. Has the Internal Revenue Service previously issued a ruling or determination letter recognizing the applicant organization or any predecessor organization listed in question 4 Part II of the application to be exempt under section 501 c 3 and later revoked that recognition of exemption on the basis that the applicant organization or its predecessor was carrying on propaganda or otherwise...attempting to influence legislation or on the basis that it engaged in political activity If Yes indicate the earliest tax year for which recognition of exemption under section 501 c 3 was revoked and the IRS district office that issued the revocation. the common areas of a condominium buying food or other items on a cooperative basis or providing recreational facilities or transportation services job placement or other similar undertakings If Yes explain the activities in detail including...income realized and expenses incurred. Also explain in detail the nature of the benefits to the general public from these activities. If the answer to this question is explained in Part II of the application pages 2 3 and 4 enter the page and item number here. or maintains restricted in any way are eligible for membership in the association. If employees of more than one plant or office of the same employer are eligible for membership give the address of each plant or office. Room/Suite If you...have a foreign address see Specific 1e Web site address Month the annual accounting period ends Date incorporated or formed Did the organization previously apply for recognition of exemption under this Code section or under any other section of the Code If Yes attach an explanation. Yes No Has the organization filed Federal income tax returns or exempt organization information returns If Yes state the form numbers years filed and Internal Revenue office where filed. Check the box for the type...of organization. ATTACH A CONFORMED COPY OF THE CORRESPONDING ORGANIZING DOCUMENTS TO THE APPLICATION BEFORE MAILING. Corporation Attach a copy of the Articles of Incorporation including amendments and restatements showing approval by the appropriate state official also attach a copy of the bylaws. Trust Attach a copy of the Trust Indenture or Agreement including all appropriate signatures and dates. Association other evidence that the organization was formed by adoption of the document by more...than one person. Also include a copy of the bylaws. Line 4. Indicate if the shareholder is one of the following 1. A qualified pension profit-sharing or stock bonus plan that meets the requirements of the Code 2. A government plan 3. An organization described in section 501 c 3 or including posts councils etc. of veterans organizations not qualifying or applying for exemption under section 501 c 19 or local associations of employees. Has the Internal Revenue Service previously issued a ruling or...determination letter recognizing the applicant organization or any predecessor organization listed in question 4 Part II of the application to be exempt under section 501 c 3 and later revoked that recognition of exemption on the basis that the applicant organization or its predecessor was carrying on propaganda or otherwise attempting to influence legislation or on the basis that it engaged in political activity If Yes indicate the earliest tax year for which recognition of exemption under...section 501 c 3 was revoked and the IRS district office that issued the revocation. the common areas of a condominium buying food or other items on a cooperative basis or providing recreational facilities or transportation services job placement or other similar undertakings If Yes explain the activities in detail including income realized and expenses incurred. Also explain in detail the nature of the benefits to the general public from these activities. A government plan 3. An organization...described in section 501 c 3 or including posts councils etc. of veterans organizations not qualifying or applying for exemption under section 501 c 19 or local associations of employees. Has the Internal Revenue Service previously issued a ruling or determination letter recognizing the applicant organization or any predecessor organization listed in question 4 Part II of the application to be exempt under section 501 c 3 and later revoked that recognition of exemption on the basis that the...applicant organization or its predecessor was carrying on propaganda or otherwise attempting to influence legislation or on the basis that it engaged in political activity If Yes indicate the earliest tax year for which recognition of exemption under section 501 c 3 was revoked and the IRS district office that issued the revocation. the common areas of a condominium buying food or other items on a cooperative basis or providing recreational facilities or transportation services job placement or...other similar undertakings If Yes explain the activities in detail including income realized and expenses incurred. Also explain in detail the nature of the benefits to the general public from these activities. If the answer to this question is explained in Part II of the application pages 2 3 and 4 enter the page and item number here. Submit only the schedule that applies to your organization. Do not submit blank schedules. Check the appropriate box below to indicate the section under which...the organization is applying a Section 501 c 2 Title holding corporations Schedule A page 7 b Section 501 c 4 Civic leagues social welfare organizations including certain war veterans organizations or local associations of employees Schedule B page 8 c Section 501 c 5 Labor agricultural or horticultural organizations Schedule C page 9 d Section 501 c 6 Business leagues chambers of commerce etc. Schedule C page 9 e Section 501 c 7 Social clubs Schedule D page 11 f Section 501 c 8 Fraternal...beneficiary societies etc. providing life sick accident or other benefits to members Schedule E page 13 g Section 501 c 9 Voluntary employees beneficiary associations Parts I through IV and Schedule F page 14 h Section 501 c 10 Domestic fraternal societies orders etc. not providing life sick accident or other benefits Schedule E page 13 i Section 501 c 12 Benevolent life insurance associations mutual ditch or irrigation companies mutual or cooperative telephone companies or like organizations...Schedule G page 15 j k Section 501 c 15 Mutual insurance companies or associations other than life or marine Schedule I page 17 l Section 501 c 17 Trusts providing for the payment of supplemental unemployment compensation benefits Parts I through IV and Schedule J page 18 m Section 501 c 19 A post organization auxiliary unit etc. of past or present members of the Armed Forces of the United States Schedule K page 19 n 1a Full name of organization as shown in organizing document 2 Employer...identification number EIN if none see Specific Instructions on page 2 3 Name and telephone number of person to be contacted if additional information is needed 1b c/o Name if applicable 1c Address number and street 1d City town or post office state and ZIP 4 Instructions for Part I page 2. Room/Suite If you have a foreign address see Specific 1e Web site address Month the annual accounting period ends Date incorporated or formed Did the organization previously apply for recognition of exemption...under this Code section or under any other section of the Code If Yes attach an explanation. Yes No Has the organization filed Federal income tax returns or exempt organization information returns If Yes state the form numbers years filed and Internal Revenue office where filed. Check the box for the type of organization. ATTACH A CONFORMED COPY OF THE CORRESPONDING ORGANIZING DOCUMENTS TO THE APPLICATION BEFORE MAILING. Corporation Attach a copy of the Articles of Incorporation including...amendments and restatements showing approval by the appropriate state official also attach a copy of the bylaws.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1024

How to edit IRS 1024

How to fill out IRS 1024

Instructions and Help about IRS 1024

How to edit IRS 1024

To edit IRS 1024, you need a digital version of the form, which you can easily find online. Utilizing pdfFiller tools allows you to make corrections, add information, or update your submission details without starting from scratch. Simply upload your file and utilize the editing features to ensure all your entries are accurate and complete.

How to fill out IRS 1024

Filling out IRS 1024 requires attention to detail and an understanding of the information needed. Begin by collecting the relevant organizational data required for the application. Complete each section in the form accurately to prevent delays in the processing of your submission. Consider using pdfFiller for a guided filling experience, which can assist you in capturing all necessary details correctly.

About IRS previous version

What is IRS 1024?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS previous version

What is IRS 1024?

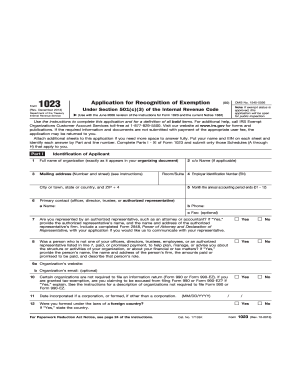

IRS 1024 is the Application for Recognition of Exemption Under Section 501(a). This form is essential for organizations seeking tax-exempt status under the Internal Revenue Code. It allows the IRS to determine whether the applicant qualifies for tax exemption based on its mission and operations.

What is the purpose of this form?

The purpose of IRS 1024 is to formally request tax-exempt status for nonprofit organizations. By completing this application, organizations provide detailed information to the IRS about their activities, governance, and financial practices, which the agency uses to evaluate eligibility for exemption from federal income tax.

Who needs the form?

Organizations that seek to obtain tax-exempt status under various sections of the Internal Revenue Code must file IRS 1024. This includes social welfare organizations, labor unions, and certain charitable entities. If your organization intends to operate without taxation on income related to your exempt purposes, filing this form is necessary.

When am I exempt from filling out this form?

An organization may be exempt from filing IRS 1024 if it qualifies under certain categories defined by the IRS, which do not require formal application for tax-exempt status. For example, churches and certain governmental entities typically do not need to submit this application. Moreover, organizations that are automatically considered tax-exempt need not apply.

Components of the form

IRS 1024 consists of multiple sections where applicants need to provide comprehensive details such as organizational structure, financial information, and descriptions of the entities' activities. Each part must be completed thoroughly to facilitate processing and review by the IRS.

What are the penalties for not issuing the form?

Failing to file IRS 1024 can result in significant consequences, including the potential loss of tax-exempt status, which can lead to tax liabilities for the organization. Organizations may also incur penalties and interest for failure to comply with IRS requirements. Furthermore, noncompliance may hinder eligibility for grants or funding from other entities that require a valid tax-exempt status.

What information do you need when you file the form?

When filing IRS 1024, you need various pieces of information, including the organization's mission statement, financial projections, and operational narratives. Additionally, it is essential to provide information regarding the board of directors and any affiliations with other entities. Accurate and complete documentation will greatly aid in the application's success.

Is the form accompanied by other forms?

IRS 1024 may be accompanied by several additional documents such as the organization’s articles of incorporation, bylaws, and any relevant financial statements. These supporting documents provide more context and validation to the application. Ensure that all accompanying documents are organized and correctly referenced to streamline the review process.

Where do I send the form?

After completing IRS 1024, you must send the form to the IRS office designated for tax-exempt organizations. The mailing address can vary based on the type of organization and the state in which it is based. It's important to verify the correct address on the IRS website or in the form instructions to avoid processing delays.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Simple and easy to use, no learning curve required, exactly what I needed, will recommend to friends

PDF Filler is an easy and portable PDF editor that does everything I need.

See what our users say