Get the free notice 703 calculator

Show details

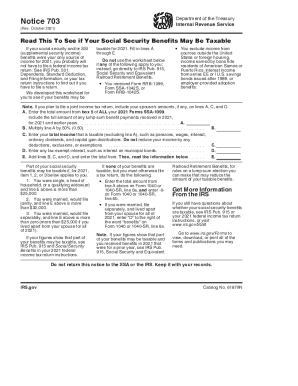

Read This To See If Your Social Security Benefits May Be Taxable. If your social security and/or SSI. (supplemental security income) benefits were your only source of income for 2015, you probably

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice 703 form

Edit your irs notice 703 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs notice 703 for 2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit how to fill out form 703 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit irs form 703. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice 703 calculator form

How to fill out irs notice 703:

01

Gather all necessary information and documents such as your tax identification number, the notice itself, and any supporting documents mentioned in the notice.

02

Read the notice carefully and understand the reason for receiving it. Determine if you agree or disagree with the information provided.

03

Respond to the notice by following the instructions provided. This may involve completing certain forms, providing additional documentation or explanation, or making a payment.

04

Double-check all information before submitting your response. Ensure that all forms are filled out accurately and completely.

05

Keep copies of everything you submit for your records.

06

Submit your response by the specified deadline mentioned in the notice.

Who needs irs notice 703:

01

Individuals who have certain discrepancies or issues with their tax returns may receive irs notice 703.

02

Taxpayers who are being audited or have outstanding tax liabilities may also receive this notice.

03

The notice is typically sent to inform the taxpayer about specific adjustments, penalties, or taxes owed by them, and to provide an opportunity to respond or resolve the issue.

Fill

form

: Try Risk Free

People Also Ask about

At what age is Social Security no longer taxable?

Are Social Security benefits taxable regardless of age? Yes. The rules for taxing benefits do not change as a person gets older. Whether or not your Social Security payments are taxed is determined by your income level — specifically, what the Internal Revenue Service calls your “provisional income.”

Can I get my 1099 from SSA online?

If you live in the United States and you need a replacement form SSA-1099 or SSA-1042S, simply go online and request an instant, printable replacement form through your personal my Social Security account.

Do you get a tax refund if you are on disability 2023?

Receiving SSDI or SSI benefits doesn't prevent you from receiving a tax refund.

What is IRS form SSA-1099?

A Social Security 1099 or 1042S Benefit Statement, also called an SSA-1099 or SSA-1042S, is a tax form that shows the total amount of benefits you received from Social Security in the previous year.

How do I determine how much of my Social Security is taxable?

You report the taxable portion of your social security benefits on line 6b of Form 1040 or Form 1040-SR. Your benefits may be taxable if the total of (1) one-half of your benefits, plus (2) all of your other income, including tax-exempt interest, is greater than the base amount for your filing status.

What is SSA Notice 703?

A worksheet (IRS Notice 703) is included for determining whether any portion of your Social Security benefits received is subject to income tax. How do you know the amount of taxes withheld from your benefits? At the end of each year, we send a Form 1042S (Social Security Benefit Statement) to each beneficiary.

At what age is Social Security no longer taxed?

Are Social Security benefits taxable regardless of age? Yes. The rules for taxing benefits do not change as a person gets older. Whether or not your Social Security payments are taxed is determined by your income level — specifically, what the Internal Revenue Service calls your “provisional income.”

What is Notice 703 link Internal Revenue Service IRS worksheet for the SSA-1099?

What is Notice 703 Tax Form for Social Security? A Notice 703 is a brief worksheet the Internal Revenue Service uses to help taxpayers determine whether their Social Security benefits are taxable in a given year. It is sent with the SSA-1099 form you should automatically receive each year.

Do I have to pay taxes on SSA-1099?

You must include the taxable part of a lump-sum payment of benefits received in the current year (reported to you on Form SSA-1099, Social Security Benefit Statement) in your current year's income, even if the payment includes benefits for an earlier year.

What is a IRS Notice 703?

A worksheet (IRS Notice 703) is included for determining whether any portion of your Social Security benefits received is subject to income tax. How do you know the amount of taxes withheld from your benefits? At the end of each year, we send a Form 1042S (Social Security Benefit Statement) to each beneficiary.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit notice 703 calculator form on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing notice 703 calculator form right away.

How do I fill out notice 703 calculator form using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign notice 703 calculator form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I fill out notice 703 calculator form on an Android device?

Complete your notice 703 calculator form and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is notice 703 calculator?

The Notice 703 calculator is a tool used to determine certain tax obligations related to business income, particularly for partnerships and corporations.

Who is required to file notice 703 calculator?

Businesses that are classified as partnerships or corporations and have specific tax liabilities must file the Notice 703 calculator.

How to fill out notice 703 calculator?

To fill out the Notice 703 calculator, users must gather necessary financial data, follow the provided instructions on the form, and accurately input their business's financial figures.

What is the purpose of notice 703 calculator?

The purpose of the Notice 703 calculator is to help businesses calculate and report their tax obligations efficiently and accurately.

What information must be reported on notice 703 calculator?

The information that must be reported on the Notice 703 calculator includes business income, deductions, credits, and any other relevant financial data necessary for tax calculations.

Fill out your notice 703 calculator form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice 703 Calculator Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.