IRS Notice 703 2021 free printable template

Show details

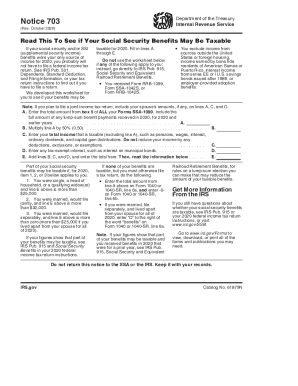

Department of the Treasury Internal Revenue ServiceNotice 703 (Rev. October 2021)Read This To See if Your Social Security Benefits May Be Taxable If your social security and/or SSI (supplemental security

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Notice 703

Edit your IRS Notice 703 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Notice 703 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS Notice 703 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IRS Notice 703. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Notice 703 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Notice 703

How to fill out IRS Notice 703

01

Obtain a copy of IRS Notice 703 from the official IRS website or your tax professional.

02

Read the notice carefully to understand the instructions and the information required.

03

Gather the necessary documents and information, including your tax return and any related financial records.

04

Complete the form by filling in your personal information, such as your name, address, and Social Security number.

05

Provide any specific details requested in the notice, including the reason for the notice and any required supporting documentation.

06

Review your completed form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Send the completed IRS Notice 703 to the address specified in the notice or to your tax professional for submission.

Who needs IRS Notice 703?

01

IRS Notice 703 is typically needed by taxpayers who have received a notice from the IRS concerning their tax return or tax obligations.

02

Any individual or business that is facing issues regarding their tax compliance or disputes with the IRS may need to respond using IRS Notice 703.

Instructions and Help about IRS Notice 703

Fill

form

: Try Risk Free

People Also Ask about

What is tax computation sheet?

The Computation Report displays the Employee wise Income Tax Computation details in the Form 16 format. Along with the Total Tax payable, it also displays the balance tax payable, tax already paid and tax amount to be deducted in the subsequent month.

How does getting a lump sum affect my Social Security benefits?

If you take your government pension annuity in a lump sum, Social Security will calculate the reduction as if you chose to get monthly benefit payments from your government work.

What is the tax bracket for 2022 in South Africa?

2022 tax year (1 March 2021 – 28 February 2022) Taxable income (R)Rates of tax (R)1 – 216 20018% of taxable income216 201 – 337 80038 916 + 26% of taxable income above 216 200337 801 – 467 50070 532 + 31% of taxable income above 337 800467 501 – 613 600110 739 + 36% of taxable income above 467 5003 more rows

What is a qualifying lump sum distribution?

What Is a Qualified Lump-Sum Distribution? It is the distribution or payment in 1 tax year of a plan participant's entire balance from all of an employer's qualified plans of one kind (for example, pension, profit-sharing, or stock bonus plans) in which the participant had funds.

Where is the tax computation worksheet?

The second worksheet is called the “Tax Computation Worksheet.” It can be found in the instructions for 1040 Line 16.

How do I find my tax table?

You can find the latest tax table which you'll use in 2023 to file 2022 taxes on the IRS' website, specifically its publication named Tax Year 2022—1040 and 1040-SR Tax and Earned Income Credit Tables.

What is considered a lump sum payment from Social Security?

A lump-sum payment is a one-time Social Security payment that you received for prior-year benefits. For example, when someone is granted disability benefits they'll receive a lump sum to cover the entire time since they first applied for disability. This period could cover months or years.

What is the tax table for 2022?

2022 Tax Rates and Brackets Tax RateTaxable Income (Single)Taxable Income (Married Filing Jointly)12%$10,276 to $41,775$20,551 to $83,55022%$41,776 to $89,075$83,551 to $178,15024%$89,076 to $170,050$178,151 to $340,10032%$170,051 to $215,950$340,101 to $431,9003 more rows • 5 Dec 2022

What is the tax rate for income 2022?

There are seven tax brackets for most ordinary income for the 2022 tax year: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent.”

What is lump sum Social Security worksheet?

The SSA Lump-Sum Payment Worksheet will help you determine if the lump-sum election is beneficial for the taxpayer, but there is no need to complete the worksheet if the taxpayer has no taxable Social Security benefits.

What is computation of income tax?

The process of determining the different sources of Income is called 'Computation of Income'. While computing income, the different incomes are finally grouped as “Gross Total Income”. After computing income, the tax is computed based on the income tax rate applicable and the various income tax deductions allowable.

What is the tax computation sheet?

Tax computation means the working sheets, statements, schedules, calculations and other supporting documents forming the basis upon which an income tax return is made that are required to be submitted together with the return or maintained by the person making the return.

What is the line 5 worksheet?

The program: The calculation of the additional child tax credit is dependent on the amount of your 'earned income' and the number of qualifying children you have.

What are NZ tax brackets 2022?

There are five PAYE tax brackets for the 2021-2022 tax year: 10.50%, 17.50%, 30%, 33% and 39%. Your tax bracket depends on your total taxable income.

What is the tax computation worksheet?

The second worksheet is called the “Tax Computation Worksheet.” It can be found in the instructions for 1040 Line 16. This second worksheet is used twice in the Qualified Dividends and Capital Gain Tax Worksheet to help taxpayers calculate the amount of income tax owed.

Is lump sum considered income?

If you take monthly income, your payments are subject to ordinary income tax. If you take a lump sum in cash, it's immediately taxable, and you'll be subject to 20 percent federal (and potentially state) mandatory tax withholding.

What is the tax table for 2022?

2022 Tax Rates and Brackets Tax RateTaxable Income (Single)Taxable Income (Married Filing Jointly)12%$10,276 to $41,775$20,551 to $83,55022%$41,776 to $89,075$83,551 to $178,15024%$89,076 to $170,050$178,151 to $340,10032%$170,051 to $215,950$340,101 to $431,9003 more rows • Dec 5, 2022

What tax bracket will I be in 2022?

2022 federal income tax brackets Tax rateTaxable income bracketTaxes owed10%$0 to $10,275.10% of taxable income.12%$10,276 to $41,775.$1,027.50 plus 12% of the amount over $10,275.22%$41,776 to $89,075.$4,807.50 plus 22% of the amount over $41,775.24%$89,076 to $170,050.$15,213.50 plus 24% of the amount over $89,075.3 more rows • Oct 20, 2022

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my IRS Notice 703 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your IRS Notice 703 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I edit IRS Notice 703 straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing IRS Notice 703 right away.

Can I edit IRS Notice 703 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign IRS Notice 703 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is IRS Notice 703?

IRS Notice 703 is a notification from the Internal Revenue Service that provides guidance to taxpayers regarding circumstances that may require corrective actions or additional information related to their tax filings.

Who is required to file IRS Notice 703?

Typically, individuals or entities that have received the notice and are directed by the IRS to provide specific information are required to file IRS Notice 703.

How to fill out IRS Notice 703?

To fill out IRS Notice 703, the taxpayer must carefully read the instructions provided in the notice, supply all required information accurately, and submit the form according to the IRS guidelines.

What is the purpose of IRS Notice 703?

The purpose of IRS Notice 703 is to inform taxpayers of discrepancies or issues related to their tax returns, and to assist them in correcting these errors to ensure compliance with tax laws.

What information must be reported on IRS Notice 703?

The information that must be reported on IRS Notice 703 includes identification details of the taxpayer, specific tax year in question, and any relevant documentation or explanations required to resolve the IRS's inquiries.

Fill out your IRS Notice 703 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Notice 703 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.