IRS Notice 703 2015 free printable template

Show details

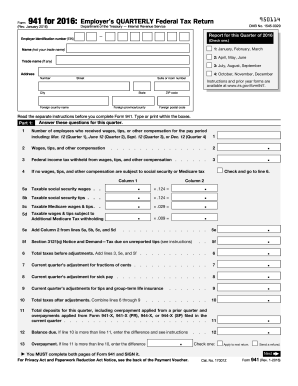

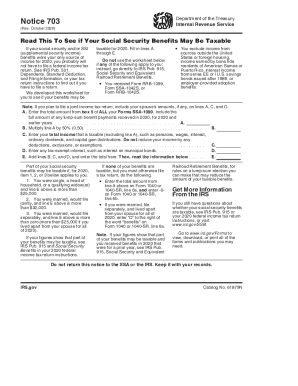

Department of the Treasury Internal Revenue Service Notice 703 Rev. September 2015 Read This To See If Your Social Security Benefits May Be Taxable If your social security and/or SSI supplemental security income benefits were your only source of income for 2015 you probably will not have to file a federal income tax return. See IRS Pub. 501 Exemptions Standard Deduction and Filing Information or your tax return instructions to find out if you have to file a return* We developed this worksheet...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Notice 703

Edit your IRS Notice 703 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Notice 703 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS Notice 703 online

Follow the guidelines below to use a professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IRS Notice 703. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Notice 703 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Notice 703

How to fill out IRS Notice 703

01

Obtain a copy of IRS Notice 703 from the IRS website or your tax professional.

02

Read the notice carefully to understand its purpose and the information required.

03

Fill out the date at the top of the notice.

04

Provide your name, address, and taxpayer identification number in the designated fields.

05

Refer to the instructions on the notice for specific information to include in your response.

06

If you're responding to a request, include any supporting documentation as specified.

07

Sign and date the notice at the bottom.

08

Make a copy for your records before mailing the notice to the IRS.

Who needs IRS Notice 703?

01

Individuals or businesses that have received IRS Notice 703 regarding a specific tax matter.

02

Taxpayers who need to provide additional information or clarification to the IRS.

03

Anyone who has been contacted by the IRS and is required to respond to the notice.

Fill

form

: Try Risk Free

People Also Ask about

What is the IRS form for figuring taxable Social Security benefits?

You report the taxable portion of your social security benefits on line 6b of Form 1040 or Form 1040-SR. Your benefits may be taxable if the total of (1) one-half of your benefits, plus (2) all of your other income, including tax-exempt interest, is greater than the base amount for your filing status.

Is Social Security based on last 5 years or best 5 years?

We base your retirement benefit on your highest 35 years of earnings and the age you start receiving benefits.

Will I get Social Security if I only worked 5 years?

Although you need at least 10 years of work (40 credits) to qualify for Social Security retirement benefits, we base the amount of your benefit on your highest 35 years of earnings.

What is the Social Security 5 year rule?

You must have worked and paid Social Security taxes in five of the last 10 years. • If you also get a pension from a job where you didn't pay Social Security taxes (e.g., a civil service or teacher's pension), your Social Security benefit might be reduced.

What is a Notice 703 from the IRS?

A worksheet (IRS Notice 703) is included for determining whether any portion of your Social Security benefits received is subject to income tax.

Do you pay taxes on Social Security disability?

California does not tax social security income from the United States, including survivor's benefits and disability benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IRS Notice 703 directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign IRS Notice 703 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I sign the IRS Notice 703 electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your IRS Notice 703 in seconds.

Can I create an electronic signature for signing my IRS Notice 703 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your IRS Notice 703 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is IRS Notice 703?

IRS Notice 703 is a notice issued by the Internal Revenue Service to inform taxpayers about the payment of certain tax credits that may affect their tax obligations.

Who is required to file IRS Notice 703?

Taxpayers who receive notice regarding tax credits or refunds that they need to report are required to file IRS Notice 703.

How to fill out IRS Notice 703?

To fill out IRS Notice 703, taxpayers should provide their personal information, the relevant tax year, details regarding the tax credits received, and any additional required documentation as specified on the notice.

What is the purpose of IRS Notice 703?

The purpose of IRS Notice 703 is to notify taxpayers about their eligibility for certain tax credits and to ensure accurate reporting of these credits on their tax returns.

What information must be reported on IRS Notice 703?

Information that must be reported on IRS Notice 703 includes taxpayer identification details, the specific tax credits being claimed, and any relevant financial data that supports the claim for those credits.

Fill out your IRS Notice 703 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Notice 703 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.