IRS Notice 703 2017 free printable template

Show details

Department of the Treasury

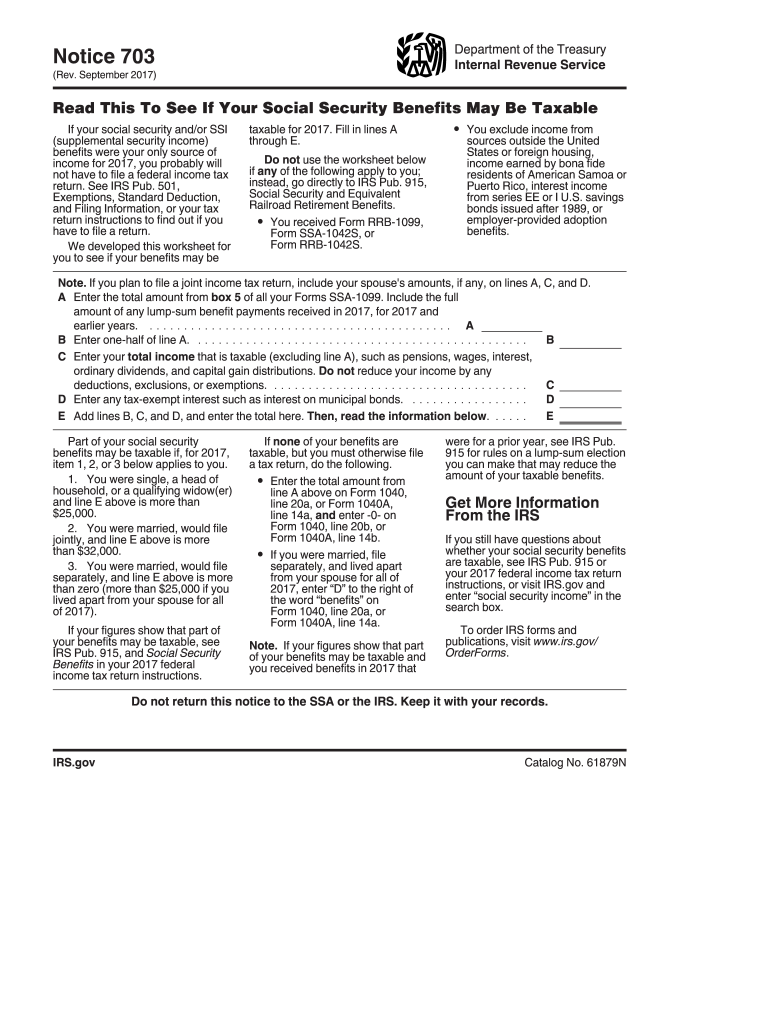

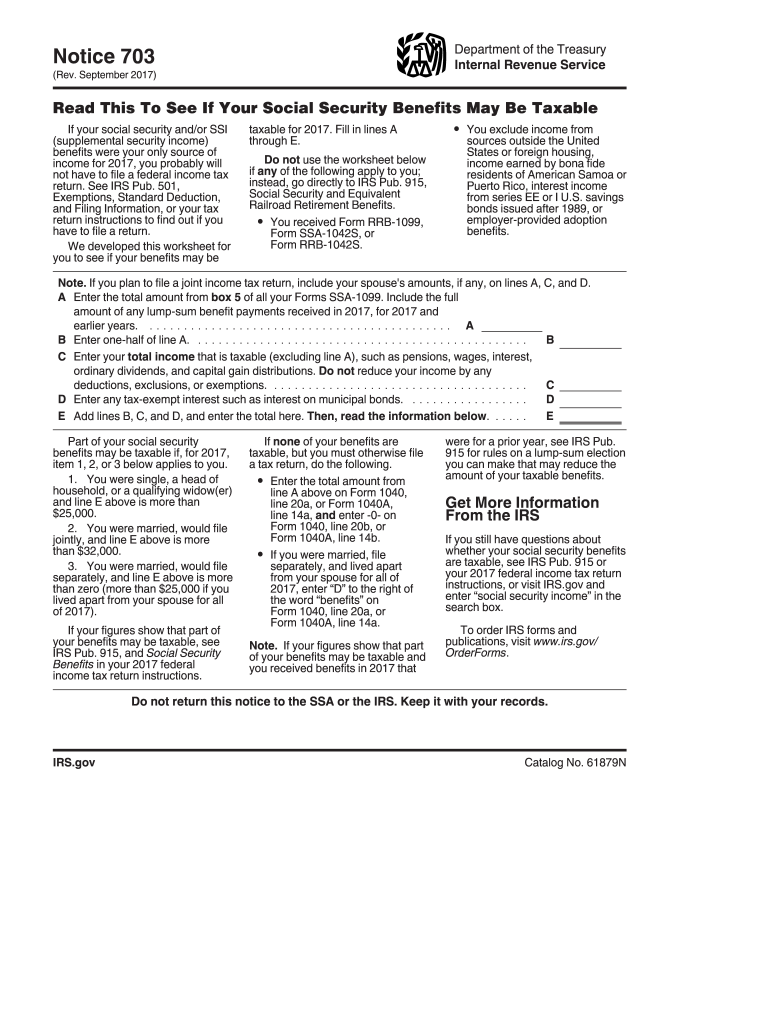

Internal Revenue ServiceNotice 703(Rev. September 2017)Read This To See If Your Social Security Benefits May Be Taxable

If your social security and/or SSI

(supplemental

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Notice 703

Edit your IRS Notice 703 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Notice 703 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS Notice 703 online

To use our professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS Notice 703. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Notice 703 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Notice 703

How to fill out IRS Notice 703

01

Obtain a copy of IRS Notice 703 from the IRS website or your tax professional.

02

Read the entire notice carefully to understand the purpose and instructions.

03

Fill out the top section with your personal information, including your name, address, and social security number.

04

Provide any requested information related to your tax situation or specific issues stated in the notice.

05

Attach any required supporting documents that the notice requests.

06

Review your responses for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed notice to the IRS using the address specified in the notice.

Who needs IRS Notice 703?

01

Individuals or entities who have received IRS Notice 703 regarding unpaid taxes, underreporting of income, or other tax-related problems.

02

Taxpayers who need to provide additional information to resolve issues identified by the IRS.

Fill

form

: Try Risk Free

People Also Ask about

Is my Social Security taxable worksheet?

None of your social security benefits are taxable. Enter -0- on Form 1040, line 5b.

What is a Notice 703 from the IRS?

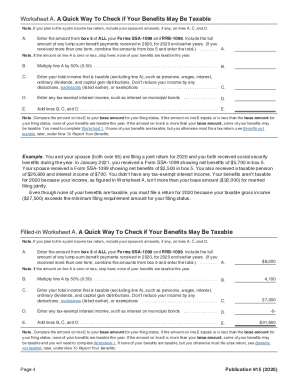

A worksheet (IRS Notice 703) is included for determining whether any portion of your Social Security benefits received is subject to income tax.

At what age is railroad retirement no longer taxed?

60/30 annuity payments before the employee or spouse is age 62: All benefits paid to an employee before age 62 are considered NSSEB and are fully taxable and reported on Form RRB-1099-R (or Form RRB-1042S for nonresident aliens).

How do I calculate my taxable Social Security benefits?

Each January, you will receive a Social Security Benefit Statement (Form SSA-1099) showing the amount of benefits you received in the previous year. You can use this Benefit Statement when you complete your federal income tax return to find out if your benefits are subject to tax.

Why did I get a notice of deficiency?

If you get a statutory notice of deficiency, you have 90 days to file a petition with the U.S. Tax Court to appeal taxes the IRS thinks you owe. You would receive this letter if you didn't respond to a previous letter allowing you 30 days to appeal within the IRS, or if your appeal was unsuccessful.

What notices are the IRS sending out?

Most IRS letters and notices are about federal tax returns or tax accounts. Each notice deals with a specific issue and includes any steps the taxpayer needs to take. A notice may reference changes to a taxpayer's account, taxes owed, a payment request or a specific issue on a tax return.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS Notice 703 to be eSigned by others?

Once your IRS Notice 703 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I edit IRS Notice 703 on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing IRS Notice 703 right away.

How can I fill out IRS Notice 703 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your IRS Notice 703 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is IRS Notice 703?

IRS Notice 703 is a notification provided by the Internal Revenue Service that outlines certain tax obligations or requirements that taxpayers need to be aware of.

Who is required to file IRS Notice 703?

Typically, any taxpayer who has received the notice and is affected by the requirements outlined in it is required to respond or take action as specified.

How to fill out IRS Notice 703?

To fill out IRS Notice 703, taxpayers should carefully read the instructions included with the notice, provide the requested information accurately, and submit the form by the prescribed deadline.

What is the purpose of IRS Notice 703?

The purpose of IRS Notice 703 is to inform taxpayers about important tax-related issues, deadlines, or actions that need to be taken to comply with IRS regulations.

What information must be reported on IRS Notice 703?

The information that must be reported on IRS Notice 703 typically includes personal identification details, specific tax-related data as requested by the IRS, and any other relevant documentation as instructed.

Fill out your IRS Notice 703 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Notice 703 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.